Explore Forex in Organic Food Trade

The significance of Forex in Organic Food Trade has grown remarkably, becoming a pivotal element in today’s global economy. Grasping the intricacies of Forex is essential for navigating the complexities of the ever-evolving organic food market.

The Influence of Forex in the Organic Food Sector

Forex, or foreign currency exchange, is instrumental in shaping the economic landscape of the organic food industry. It plays a critical role in setting prices for organic goods in international markets, thereby affecting their trade and accessibility globally. Fluctuations in currency exchange rates can significantly impact the cost and logistics of exporting or importing organic products, influencing the strategies and decisions of producers, retailers, and consumers. For businesses in this sector, understanding and managing Forex-related risks and opportunities is vital for maintaining profitability and competitive edge.

Global Evolution of the Organic Food Market

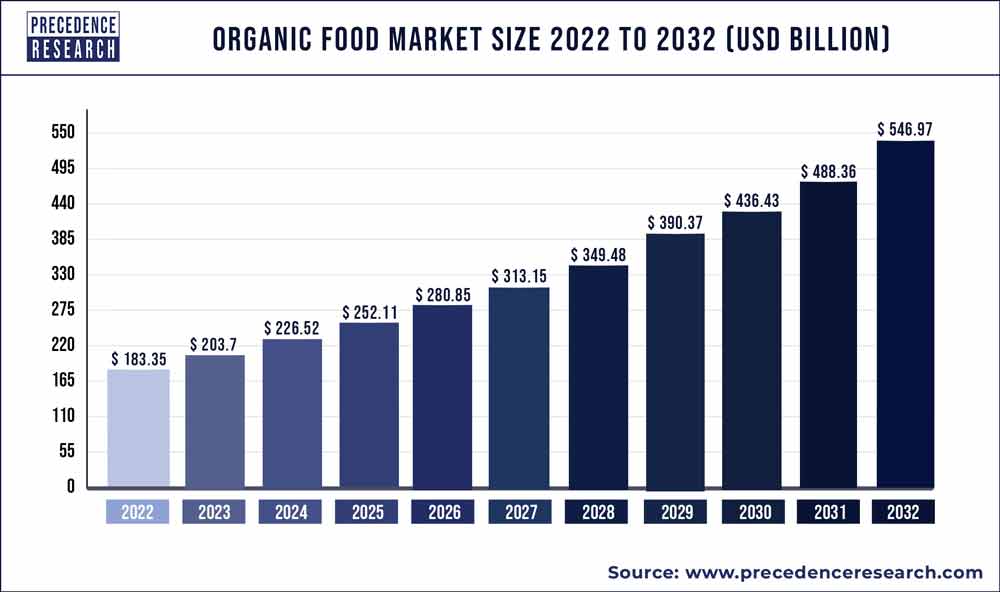

The organic food market has experienced significant growth globally, driven by changing consumer preferences and a growing consciousness about health and environmental sustainability. This shift towards healthier and eco-friendly food choices has led to increased consumer spending on organic products. The rise in demand has, in turn, transformed agricultural practices, encouraging more farmers to adopt organic methods and increasing the number of businesses involved in the organic food supply chain.

Impact of the Growing Organic Food Market on Forex

The expanding organic food market profoundly influences Forex markets, affecting international trade balances and economic policies. Major organic food-producing nations are increasingly influential in global trade, and the heightened demand for organic products attracts foreign investments in organic agriculture. This influence of the organic market extends to the formulation of international trade agreements and economic alliances, as nations strategize to optimize their trade benefits in this sector.

Forex’s Role in International Organic Food Trade

Forex is a crucial factor in international trade, especially within the organic food industry. It affects various aspects, from production costs to the pricing tactics of exporters and importers. The fluctuating nature of Forex markets presents both risks and opportunities. For example, a devalued currency might boost an exporting country’s competitiveness in the global market, while a strong currency could pose challenges for exporters but advantages for importers. It’s crucial for industry players to understand these dynamics, as adept Forex management can lead to better market positioning and enhanced profitability.

In sum, the role of Forex in the organic food trade is a fundamental aspect of this industry’s global dynamics. It not only determines the economic feasibility of organic products and companies but also influences broader international trade patterns and economic policies. As the global organic food market continues its growth trajectory, the integration and impact of Forex will remain a key element in its ongoing development and success.

The Influence of the Organic Food Sector on Forex Markets

Organic Food Trade Patterns and Their Forex Market Impact

Organic food trade patterns are integral to the dynamics of Forex markets, significantly influencing currency values and shaping the structure of international trade deals. The flow of organic goods across borders doesn’t just involve physical products; it also carries substantial weight in Forex fluctuations, affecting the strength and stability of currencies.

Dissecting Trade Dynamics in the Organic Food Industry

In the organic food sector, trade dynamics are heavily swayed by the output and trade policies of the world’s leading organic producers. These countries’ activities in the organic market have a direct bearing on Forex market trends. For instance, an upsurge in organic exports from a particular country can bolster its currency, reflecting increased foreign demand. Conversely, a downturn in production or restrictive trade policies could weaken the currency, thereby impacting the Forex market.

The Role of Agricultural Policies in Forex and Organic Trade

National and international agricultural policies are key determinants in Forex within the Organic Food Trade. These policies, which govern trade regulations, subsidies, and tariffs, play a pivotal role in shaping the organic food market’s interaction with Forex markets. Supportive policies can enhance a country’s competitiveness in the global organic market, potentially fortifying its currency. In contrast, policies that impede organic trade can have a detrimental effect on a country’s Forex standing.

The Interplay Between Currency Fluctuations and Organic Food Pricing

There exists a delicate balance between currency fluctuations and the pricing of organic foods in the global market. A weakening currency might make a country’s organic exports more appealing and price-competitive internationally, leading to increased sales but possibly lower revenue returns in the home currency. On the other hand, a stronger currency could escalate export prices, possibly curtailing demand but increasing revenue when converted back to the local currency. This intricate relationship is a critical consideration for those operating in the organic food market, as it necessitates strategic management to capitalize on Forex movements.

In summary, the relationship between the organic food industry and Forex markets is intricate and influential, encompassing aspects such as trade patterns, agricultural policies, and the effects of currency movements on pricing. For those engaged in the organic food sector, a deep understanding of these interactions is vital for navigating the complexities of international trade and for making the most of the opportunities presented by the Forex markets. As the organic food industry grows, its impact on the Forex landscape is expected to become increasingly significant, underscoring the importance of this area for businesses and policy makers.

Economic Influence of Key Organic Food Producers on Forex Markets

The Role of Leading Organic Food Producers in Shaping Forex Dynamics

Prominent organic food-producing countries significantly impact the Forex markets, primarily through their agricultural exports and related economic policies. These nations, by virtue of their substantial organic food production, hold a substantial sway over the nuances of Forex trading.

Global Leaders in Organic Food Production and Their Forex Influence

Countries at the forefront of organic food production, such as the United States, Germany, France, and China, play a crucial role in influencing Forex markets. Their dominance in the organic sector not only bolsters their domestic economies but also has a pronounced effect on global Forex trends. The strength of their currencies is often linked to the success and export volumes of their organic food sectors. For example, increased organic exports can strengthen a nation’s currency, affecting its Forex market stance and international trade balance.

Interaction Between Forex Markets and Top Organic Food Exporters

The relationship between the world’s top organic food exporters and Forex markets is a key indicator of wider economic patterns. These nations’ organic trade activities directly influence their currency values and shape international trade dynamics. An upswing in organic food exports from these countries can lead to a stronger currency, indicating a robust trade position and potentially altering their overall Forex strategy.

Case Studies on Organic Trade’s Impact on National Economies

Analyzing specific examples from leading organic food-producing countries provides insight into the direct connection between organic trade and national economic health. A nation that boosts its organic food exports can experience a significant inflow of foreign currency, strengthening its economic position and currency valuation. In contrast, challenges such as reduced organic production or policy shifts can weaken a country’s currency, highlighting the direct link between organic trade and Forex market fluctuations.

In conclusion, the role of major organic food-producing countries in the global Forex markets is significant and multifaceted. Their organic food trade activities and economic policies directly affect their national economies and play a critical role in shaping global Forex market trends. As the organic food sector continues to expand, its influence on the economies of leading producing countries and the global Forex landscape will likely become increasingly significant, warranting ongoing observation and analysis.

Strategizing Forex in the Organic Food Market

Crafting Forex Strategies for Organic Food Exporters

Navigating the intricacies of international trade demands that exporters in the organic food sector develop and implement comprehensive Forex strategies. These strategies are crucial not only for profit maximization but also for maintaining consistent operations in a market sensitive to currency value changes.

Key Forex Strategies for Organic Food Exporters

Organic food exporters should employ a variety of Forex strategies to effectively manage the challenges posed by fluctuating currency markets. These strategies encompass a range of activities, from actively hedging against currency risks to meticulously tracking global currency trends and understanding the macroeconomic factors affecting Forex. This strategic approach allows exporters to make well-informed decisions regarding product pricing, timing for market entry, and managing the risks associated with currency exchange.

Implementing Forex Risk Management in Organic Food Exports

Robust risk management is essential for mitigating the effects of Forex volatility on organic food exports. This involves a thorough assessment of potential Forex risks and strategizing to minimize their impact. Tools such as forward contracts, options, and futures can be utilized as hedges against potential adverse currency movements. Moreover, diversification of currency exposure and periodic reassessment of Forex strategies are vital in responding effectively to changing market conditions.

Utilizing Currency Exchange Tools and Techniques for Effective Trading

For traders within the organic food market, leveraging a suite of currency exchange tools and analytical techniques is imperative for successful Forex engagement. These include advanced Forex market analysis platforms, efficient currency conversion tools, and access to up-to-date currency data. Employing methods like technical, fundamental, and sentiment analysis helps traders in making informed currency trading decisions. Keeping abreast of international economic developments, policy shifts, and market sentiment is also critical in understanding and predicting Forex movements.

In the organic food market, adept Forex strategy implementation is crucial. These strategies go beyond risk management; they are essential for leveraging global market opportunities. As the organic food sector continues its expansion and further integrates into the global economic fabric, the significance of skilled Forex management escalates, becoming an indispensable element for exporters and traders in this vibrant industry.

This discussion highlights the importance of strategic Forex management in the organic food market. It underscores the need for organic food exporters and traders to adopt a range of risk management tactics and utilize various tools and techniques to navigate the complexities and capitalize on the opportunities within the Forex in Organic Food Trade.

Forecasting the Intersection of Forex and Organic Food Trade

Trends Reshaping Organic Food and Forex Markets

As we look toward the future, the convergence of Forex and the organic food trade is marked by significant emerging trends, which are reshaping the contours of international commerce. These developments, stemming from both the organic food sector and Forex markets, are integrally linked and set to redefine the global economic landscape.

Key Emerging Trends in Organic Food and Forex Markets

The organic food market has been witnessing a shift in consumer preferences, increasingly leaning towards health-conscious and eco-friendly choices. This change is catalyzing new opportunities and challenges in the organic sector, consequently influencing the Forex markets. The growing demand for organic products is altering trade policies, affecting currency valuation, and prompting shifts in investment strategies at an international level.

Evolving Global Organic Food Market Trends

There’s a notable expansion and evolution within the global organic food market. This encompasses broader adoption of organic farming techniques, a widening array of organic products, and the entry of new market participants. These shifts are transforming supply chain dynamics and prompting economic policy adjustments in countries leading in organic food production. As a result, the economic stability and currency strength of these nations are becoming increasingly linked to the organic food sector’s performance.

Anticipating Forex Responses to Organic Market Changes

Predicting the response of Forex markets to shifts in the organic food industry is gaining importance. The global expansion of the organic sector can impact currency demand and trade balances, leading to fluctuations in Forex markets. For example, a surge in exports from a key organic food-producing country could strengthen its national currency. Conversely, regulatory changes impacting organic farming could exert a negative influence on currency values. Traders and investors are thus encouraged to closely monitor trends and policy developments in the organic market to devise Forex strategies that are both resilient and adaptable.

Looking ahead, the relationship between Forex markets and the global organic food industry is entering an era of dynamic integration and transformation. Emerging trends are providing insights into future market directions, suggesting a more interconnected relationship between these two sectors. For stakeholders in both fields, staying informed and responsive to these trends will be essential in navigating the future landscape of global trade. Adapting to these evolving dynamics will be key to developing strategies that are robust, proactive, and in sync with the changing global economic framework.

Conclusion

In summary, the intricate and evolving relationship between Forex markets and the international organic food industry encompasses multiple dimensions. Throughout this guide, we have delved into the various facets of this interaction, highlighting the critical need to comprehend these intricate dynamics. The interconnected nature of these sectors underscores the importance of a nuanced understanding of how global economic forces interplay with the burgeoning organic food market.

Click here to read our latest article on Cracking Down on Wildlife Trafficking Cryptocurrencies

FAQs

- How does Forex influence the international organic food market? In the global organic food market, Forex significantly impacts product pricing and international market competitiveness, affecting how organic goods are traded and priced in different countries.

- What effect do organic food trading patterns have on Forex? Organic food sector’s trading patterns shape Forex by changing currency values and influencing the formulation of international trade policies, especially in economies heavily involved in organic trade.

- Can you highlight some key trends in organic food markets affecting Forex? Notable trends include growing consumer demand for organics, an increase in organic farming methods, and a wider range of organic products, all influencing Forex market trends.

- How are organic food prices affected by currency value changes? Fluctuations in currency values can alter the global competitiveness of organic food exports, impacting international demand and the pricing strategies of exporting countries.

- What Forex strategies are vital for organic food market exporters? Organic food exporters should engage in risk hedging, stay informed about global currency trends, and understand how economic indicators affect Forex to effectively navigate international trade.

- Why is managing Forex risk crucial for organic food exporters? Managing Forex risk is key for organic food exporters to counteract the unpredictability of currency markets, ensuring financial stability and consistent profitability in international transactions.

- What are effective tools and methods for Forex and organic food market trading? For effective trading, utilizing tools like Forex analytical software, currency conversion technologies, and applying analytical methods such as technical, fundamental, and sentiment analysis are recommended.

- Which leading organic food producers influence Forex, and how? Major organic food producers like the USA, Germany, France, and China impact Forex significantly. Their organic food trade activities can affect their national currency’s strength and global Forex trends.

- How does forecasting Forex movements aid organic food traders? By predicting Forex shifts in relation to the organic food market, traders and exporters can develop strategies that are adaptable and robust, allowing them to navigate market fluctuations effectively.

- What does the future hold for Forex and the organic food industry globally? The future suggests an increasing interlinkage between the Forex and global organic food markets, driven by consumer trends, policy changes, and international trade developments. This evolving relationship underscores the need for a comprehensive understanding of both areas for strategic planning and market success.