Setting the Stage on The Impact of Ocean Conservation on Forex

The global forex market, renowned for its sensitivity to a myriad of factors, ranging from economic indicators to political upheavals, harbors an often-neglected influencer in the form of ocean conservation policies. This comprehensive guide embarks on an exploration of the profound effects of global ocean conservation policies on the forex market, shining a spotlight on their constructive impact on currency exchange rates. Central to this analysis are the prominent roles played by Marine Protected Areas, Ocean Pollution Policies, Blue Economy Initiatives, and Carbon Pricing within these policies, all of which collectively shape forex trends.

Ocean conservation policies constitute a pivotal response to the pressing environmental challenges that beset our planet. In an era where governments and international entities increasingly grasp the significance of sustainable practices, these policies have evolved into a spectrum of initiatives. Among these are the establishment of sanctuaries known as Marine Protected Areas and the enactment of regulations aimed at combatting the scourge of ocean pollution. These collective endeavors signify a commitment to environmental stewardship and the preservation of our oceans’ vitality.

Understanding Global Ocean Conservation Policies

To grasp the intricate relationship between ocean conservation policies and their influence on the forex market, it is imperative to gain a comprehensive understanding of these policies’ nature and objectives. These global ocean conservation policies represent multifaceted and holistic approaches aimed at addressing the urgent environmental challenges confronting our planet. They are not only designed to safeguard marine ecosystems but also to contribute significantly to the overarching goal of fostering a sustainable future for our oceans and the communities that rely on them.

Marine Protected Areas (MPAs): Guardians of Ocean Biodiversity

Marine Protected Areas, commonly abbreviated as MPAs, stand out as iconic symbols of ocean conservation endeavors. These meticulously chosen oceanic regions are subjected to rigorous management with the primary objective of safeguarding marine ecosystems and preserving biodiversity. Within the boundaries of MPAs, human activities are subjected to stringent regulations, encompassing various restrictions from controlling fishing practices to regulating industrial activities.

The profound significance of MPAs lies in their capacity to serve as sanctuaries for marine life. By creating safe havens where marine species can thrive without the constant threat of overexploitation or habitat degradation, MPAs play a pivotal role in maintaining the vitality and equilibrium of our oceans. Their conservation endeavors radiate far beyond their defined boundaries, benefiting adjacent marine areas and ecosystems.

In the context of the forex market, the establishment of Marine Protected Areas serves as a concrete manifestation of a nation’s or region’s commitment to responsible environmental stewardship. The creation of these protected areas conveys a powerful message to global investors and trading partners, signifying a resolute dedication to long-term sustainability. This can bolster investor confidence in the local economy.

Investors perceive nations that prioritize conservation as stable and forward-thinking, and this favorable perception can attract heightened foreign investments. Consequently, the local currency may experience appreciation as a direct consequence of the government’s proactive stance on environmental preservation.

Furthermore, the restrictions imposed within MPAs can elicit shifts in the supply and demand dynamics of commodities linked to activities prohibited or regulated within these protected zones. For instance, reduced fishing activity within an MPA can induce alterations in the availability of seafood products, influencing their market prices and, subsequently, impacting currency exchange rates.

In essence, Marine Protected Areas not only contribute significantly to the preservation of oceanic health but also wield a tangible and positive influence on the forex market by fostering economic stability and molding commodity markets.

Ocean Pollution Policies: Shields Against Environmental Degradation

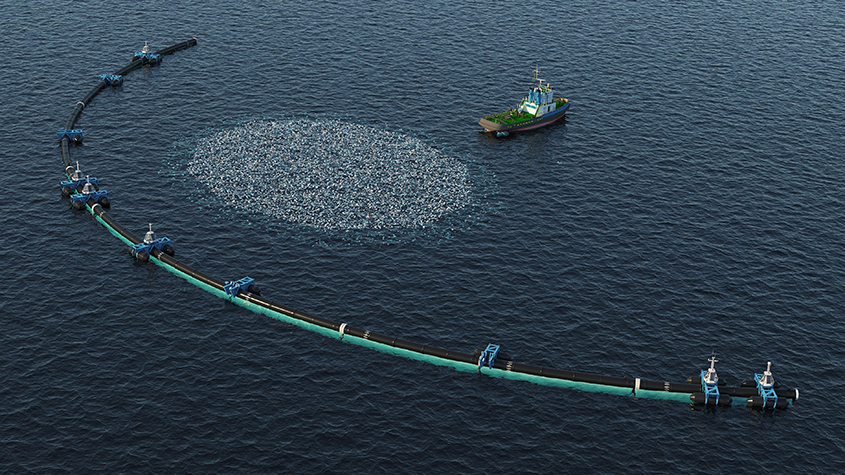

In stark contrast to the proactive conservation offered by MPAs, Ocean Pollution Policies represent a critical line of defense in the battle against environmental degradation. These policies encompass an extensive spectrum of regulations meticulously tailored to curb and alleviate the contamination of our oceans by an array of pollutants.

Pollutants, such as plastics, chemicals, and oil spills, pose formidable threats to marine life and ecosystems. Ocean Pollution Policies are meticulously crafted to confront these hazards head-on by imposing stringent controls on industries and activities responsible for marine pollution.

The principal objective of Ocean Pollution Policies is to mitigate environmental harm and champion sustainable practices in industries that interact with the ocean. These policies establish benchmarks for waste management, emission reduction, and cleanup protocols to minimize the adverse consequences of pollution.

From the vantage point of the forex market, Ocean Pollution Policies wield substantial influence, particularly in sectors that significantly contribute to ocean pollution. When governments or international entities enact more stringent regulations, businesses operating within these domains may encounter amplified compliance costs. These elevated costs can impinge upon the profitability of these enterprises, subsequently influencing the performance of their respective currencies.

Investors and traders vigilantly monitor the developments and implementation of Ocean Pollution Policies because they can serve as early indicators of potential risks or opportunities within industries susceptible to regulatory shifts concerning ocean pollution. The anticipation of more stringent regulations can prompt trading decisions that, in turn, impact currency valuations, especially in nations heavily reliant on industries with substantial environmental footprints.

In summary, gaining an in-depth understanding of global ocean conservation policies is essential for deciphering their ramifications on the forex market. Marine Protected Areas and Ocean Pollution Policies epitomize proactive and defensive measures, respectively, in the pursuit of environmental sustainability. Both play pivotal roles in shaping the economic and market dynamics of coastal and island economies, and their influence transcends the realm of ocean conservation to reverberate within the global arena of currency exchange rates.

The Influence of Marine Protected Areas on Forex Markets

Understanding how Marine Protected Areas (MPAs) affect the forex market reveals a multifaceted connection with profound consequences. This intricate relationship can be dissected into two pivotal aspects: the manifestation of commitment to sustainable environmental practices and the intricate interplay of supply and demand dynamics for commodities within the protected areas. Together, these elements create a dynamic that significantly impacts currency exchange rates.

A Commitment to Sustainability: Bolstering Confidence and Attracting Investments

The establishment of MPAs symbolizes a nation or region’s unwavering commitment to responsible environmental stewardship. This commitment extends beyond ecological conservation; it resonates within the global financial markets. When a country designates and actively preserves an MPA, it sends a resounding message of long-term sustainability to the international community.

From an investor’s standpoint, this dedication to sustainability fosters confidence in the local economy. Investors perceive nations prioritizing the protection of their natural resources and marine ecosystems as dependable and forward-thinking partners. The act of setting aside marine areas for preservation signifies a willingness to prioritize environmental well-being over immediate financial gains. This positive perception can attract increased foreign investments.

These foreign investments, especially in industries aligned with sustainable practices, often follow the declaration of commitment to environmental conservation. As capital flows into the local economy, it stimulates growth and development, thereby enhancing economic stability. This, in turn, exerts a favorable influence on the local currency’s value, causing it to appreciate in the forex market when compared to other currencies.

Restrictions and Commodity Dynamics: Currency Exchange Rate Fluctuations

Beyond the symbolic value and investor sentiments, the restrictions enforced within MPAs exert a more direct and tangible influence on the forex market. MPAs typically come with rigorous regulations governing specific economic activities within their boundaries, including activities like fishing and mining.

These regulations have the potential to disrupt the traditional supply-demand dynamics of commodities associated with these activities. For instance, reduced or restricted fishing within an MPA can lead to a decrease in the supply of seafood products. As the availability of these products diminishes, market forces come into play, propelling their prices upwards.

The repercussions of these price fluctuations within commodity markets transcend the confines of the industries operating within MPAs, reaching out to impact currency exchange rates. Forex traders vigilantly monitor these developments as they assess the potential economic implications of the restrictions imposed within MPAs.

When the supply of specific commodities linked to these restricted activities is curtailed within a nation or region, it can disrupt trade balances, influencing the overall economic performance of the country. These imbalances can manifest as currency exchange rate fluctuations in the forex market.

For example, in a scenario where a nation heavily relies on revenue generated from fisheries and an MPA restricts fishing activities, the country may witness a reduction in seafood exports. This reduced export income can negatively affect the nation’s trade balance, potentially resulting in the depreciation of its currency.

Conversely, restrictions within MPAs can also present opportunities for specific industries and commodities aligned with sustainable practices. In regions where sustainable aquaculture is promoted as an alternative to conventional fishing, there may be an increase in the supply of farmed seafood products. This can positively influence the trade balance and currency exchange rates.

In summary, the impact of Marine Protected Areas on the forex market is intricate and multi-dimensional. It encompasses not only the symbolism of environmental commitment but also the palpable consequences of regulations on economic activities within these protected zones. These consequences extend their influence to commodity markets, trade balances, and ultimately, currency exchange rates, shaping the dynamic relationship between MPAs and the forex market.

Ocean Pollution Policies and Their Impact on Forex Market Trends

The intricate interplay between Ocean Pollution Policies and the trends witnessed within the forex market is a subject of paramount importance, particularly when considering industries that shoulder significant responsibility for ocean pollution. The connection between these policies and the currency exchange rates becomes particularly evident when we delve into the implications of more stringent regulations, compliance costs, the keen oversight of investors, and the consequential shifts in trading decisions.

Direct Influence on Forex Market Trends

Ocean Pollution Policies serve as a guiding compass, steering the course of forex market trends, particularly in sectors that cast a substantial shadow on ocean pollution. When governments and international entities introduce more rigorous regulations with the aim of curbing pollution, industries intertwined with these policies reach a critical juncture.

The reverberations of such regulations resonate deeply within these industries, touching upon their financial structure. Adherence to these stringent policies often necessitates the implementation of additional measures and technologies, which, in turn, can translate into elevated operating costs. These augmented costs represent a double-edged sword; while they reflect a commitment to environmental preservation, they can also impact the profitability of businesses operating within these sectors.

Compliance Costs and Currency Performance

The crux of the matter lies in the potential of these compliance costs to cast their shadow upon currency exchange rates. As enterprises grapple with the financial consequences of adhering to more stringent regulations, their profitability may be jeopardized. Diminished profitability, in turn, can have repercussions on the performance of their respective currencies within the forex market.

For instance, when companies entrenched in pollution-intensive industries experience a decline in profitability owing to the compliance costs linked with Ocean Pollution Policies, investors might perceive these enterprises as less financially appealing. This perception can lead to a decrease in investor confidence and, subsequently, a depreciation of the local currency.

Investor Vigilance and Trading Decisions

In this intricate web of interactions, investors emerge as pivotal actors in shaping forex market trends. They meticulously observe developments related to Ocean Pollution Policies, recognizing their potential to signal both risks and opportunities within industries susceptible to regulatory shifts associated with ocean pollution.

Investor vigilance is particularly acute when the prospect of more stringent regulations looms large. These regulatory shifts have the potential to profoundly alter the economic landscape for industries subject to these policies. Consequently, investors adopt a proactive stance in assessing the potential repercussions on these industries and their financial outlook.

This vigilance and scrutiny ultimately translate into trading decisions that resonate throughout the forex market. Investors, cognizant of the potential ramifications of Ocean Pollution Policies on the fiscal well-being of specific industries, may recalibrate their trading strategies and portfolios accordingly.

For instance, in anticipation of more rigorous regulations, investors may choose to divest from stocks or assets connected to pollution-intensive industries, seeking safer investment alternatives. This shift away from certain sectors can lead to a reduced demand for the corresponding currencies linked to these industries, thereby affecting their exchange rates.

Conversely, industries aligned with sustainability and environmentally responsible practices may witness a surge in investor interest. These sectors, anticipated to thrive under stricter environmental regulations, can experience heightened demand for their assets, bolstering the performance of the currencies associated with these sectors.

In summary, the intricate relationship between Ocean Pollution Policies and forex market trends unfolds as a dynamic and multi-faceted phenomenon. These policies wield direct influence over industries deeply entrenched in ocean pollution, setting the stage for substantial shifts in compliance costs, profitability, and ultimately, currency performance.

Blue Economy Initiatives: Driving Forex Market Dynamics

Blue Economy Initiatives are emerging as a potent force with the potential to significantly shape forex market dynamics. These initiatives are gaining global momentum as nations increasingly acknowledge the economic opportunities offered by ocean-related industries. Rooted in sustainability, they encompass sectors like fisheries, shipping, and tourism, all while striving for a harmonious balance between economic expansion and responsible environmental stewardship.

The Ascent of Blue Economy Initiatives

Blue Economy Initiatives represent a transformative shift in the way countries perceive and harness the boundless potential of their oceanic resources. These initiatives transcend the conventional paradigm of resource extraction and exploitation, embracing principles of sustainability and prudent management. The ocean, once primarily seen as a source of raw materials, is now recognized as a wellspring of economic possibilities that can be harnessed without jeopardizing its long-term health.

These initiatives encompass a diverse spectrum of practices, including the adoption of sustainable fishing methods, the implementation of eco-friendly shipping practices, and the promotion of responsible coastal and marine tourism. At their core, Blue Economy Initiatives advocate for equilibrium, where economic progress goes hand in hand with the preservation of marine ecosystems and the welfare of coastal communities.

Influence on Forex Market Trends

The promotion and adoption of Blue Economy Initiatives hold the potential to exert a positive influence on the forex market, particularly within coastal and island economies. This influence stems from several pivotal factors that mold the dynamics of currency exchange rates.

- Economic Stability and Attraction of Investors: Perceptions of economic stability and growth prospects profoundly impact forex market trends. Blue Economy Initiatives, with their emphasis on sustainable practices, serve as markers of a nation’s unwavering commitment to long-term economic stability. Investors are naturally drawn to countries that prioritize sustainability, viewing them as having reduced risk associated with environmental degradation. As a consequence, nations actively championing Blue Economy Initiatives can draw increased foreign investments. These investments infuse capital into the local economy, fuel growth, and enhance overall economic stability. From an investor’s standpoint, such nations become more appealing destinations for capital deployment, thereby positively affecting the performance of their currencies in the forex market.

- Fiscal Health and Currency Performance: The fiscal well-being of a nation is intimately tied to the performance of its currency. Blue Economy Initiatives, by fostering sustainable economic practices, contribute to enhanced fiscal health. Sustainable fisheries, responsible tourism, and eco-friendly shipping practices can lead to stable revenue streams and reduced reliance on volatile sectors. A nation endowed with a robust Blue Economy is better equipped to weather economic fluctuations and external shocks, bolstering investor confidence. Strong fiscal foundations translate into a more favorable perception of the nation’s currency in the forex market. Consequently, the currency may experience appreciation when compared to currencies of nations with less sustainable economic practices.

- Balancing Growth and Environmental Responsibility: Blue Economy Initiatives exemplify the delicate equilibrium between economic growth and environmental responsibility. This equilibrium resonates positively with international stakeholders and trading partners, reflecting a nation’s commitment to prudent resource management and sustainability. These values hold increasing significance in the global arena. Trading partners, when assessing the economic viability of engaging with nations that champion Blue Economy Initiatives, often perceive them as dependable and forward-thinking counterparts. This perception can lead to strengthened trade relationships, potentially bolstering the demand for the nation’s currency.

In summary, the rise of Blue Economy Initiatives as drivers of forex market dynamics mirrors the evolving landscape of sustainable economic practices. These initiatives epitomize the synergy between economic expansion and environmental stewardship, resonating positively within coastal and island economies.

Carbon Pricing’s Impact on Forex Markets: A Comprehensive Exploration

Carbon Pricing stands at the core of numerous ocean conservation policies, with a particular focus on addressing climate change and emissions reduction. This policy tool involves the strategic imposition of a financial cost on carbon emissions, designed to incentivize businesses and industries to proactively reduce their carbon footprint.

Carbon Pricing in the Context of Ocean Conservation Policies

Carbon Pricing plays a pivotal role in the broader context of ocean conservation policies, reaching beyond the boundaries of land-based concerns to encompass the profound influence of emissions on ocean health and coastal ecosystems. By introducing a tangible financial dimension to carbon emissions, governments and international bodies aim to trigger a transformative shift towards environmentally sustainable practices, thereby addressing the intricate challenges posed by climate change and its impact on oceans.

The Multifaceted Influence of Carbon Pricing on Forex Markets

The implications of Carbon Pricing on the forex market are intricate and multidimensional, reflecting the complexities inherent in a globally interconnected economy.

- Escalating Costs and Currency Devaluation: One facet of Carbon Pricing involves the potential escalation of operational costs, notably affecting companies entrenched in carbon-intensive industries. As these enterprises grapple with the financial implications of adhering to carbon reduction targets and pricing mechanisms, their profit margins may come under pressure. This reduction in profitability can directly impact the performance of the local currency. For instance, in industries where carbon emissions are deeply intertwined with production processes, the introduction of carbon pricing mechanisms can translate into augmented expenses. These additional costs have the potential to erode profit margins, potentially leading to decreased investor confidence and subsequent currency devaluation within the forex market.

- A Reputation as an Environmental Steward and Attraction of Foreign Investments: Conversely, the commitment to Carbon Pricing can bestow upon a nation a valuable reputation as a responsible custodian of the environment. This reputation extends beyond domestic policy and resonates on the international stage. Nations that actively pursue carbon reduction initiatives often emerge as leaders in sustainable practices. This global recognition can result in a more favorable image within the international community, ultimately attracting foreign investments. Investors increasingly seek opportunities in nations that demonstrate a dedicated commitment to environmental stewardship, viewing them as stable and forward-thinking partners. This influx of foreign investments can exert a tangible influence on the currency’s performance in the forex market, potentially leading to currency appreciation.

In conclusion, the influence of Carbon Pricing on forex markets underscores the intricate interplay between environmental policy, industrial economics, and international finance. As nations adopt and implement carbon pricing mechanisms, they embark on a journey characterized by both challenges and opportunities within their domestic industries and global interactions.

Carbon Pricing, while potentially driving up operational costs for carbon-intensive industries, also holds the promise of cultivating a reputation as responsible environmental stewards. This reputation, in turn, can significantly influence the attraction of foreign investments and the currency’s performance in the forex market.

Analyzing Forex Market Data: Unveiling the Impact of Ocean Conservation Policies

A comprehensive grasp of how ocean conservation policies affect the forex market hinges on the meticulous analysis of relevant data. Forex market analysts stand as vigilant sentinels, closely tracking an array of economic indicators, policy proclamations, and industry developments to assess their potential reverberations on currency exchange rates.

Data Analysis as the Cornerstone

Data analysis occupies a pivotal role in the quest for understanding the multifaceted impact of ocean conservation policies on the forex market. Analysts deploy a wide spectrum of tools and methodologies, meticulously dissecting the intricate tapestry of interactions between policy decisions and the dynamics of currencies.

Economic Indicators as the Vanguard

At the forefront of forex market analysis lie economic indicators, encompassing an array of metrics, from GDP growth and inflation rates to employment figures and trade balances. These metrics serve as the compass for analysts, guiding their assessments of policy developments and their repercussions on economic dimensions.

In the realm of ocean conservation policies, these economic indicators take on heightened significance. For instance, the creation of Marine Protected Areas (MPAs) can directly impact fisheries and tourism industries, leading to shifts in employment rates and trade balances. Through the analysis of these indicators, forex market participants gain insight into potential currency exchange rate fluctuations resulting from policy interventions.

Policy Announcements and the Market Pulse

Policy pronouncements wield unique influence over forex market sentiment. The dissemination of information pertaining to ocean conservation policies, whether related to emission reduction targets or sustainable fishing practices, possesses the potential to swiftly ignite market reactions. Analysts pore over these policy statements, assessing their clarity, objectives, and potential repercussions.

Market sentiment serves as a guiding force in forex trading decisions. Positive policy announcements, signaling unwavering dedication to environmental conservation, have the power to bolster investor confidence and strengthen the local currency. Conversely, policy ambiguity or negative signals can instill caution among investors, possibly leading to currency depreciation.

Industry Developments and Sectoral Insights

Industry dynamics within the purview of ocean conservation policies yield invaluable insights for forex analysts. The performance of sectors such as fisheries, shipping, and renewable energy is intricately linked to policy initiatives. Analysts embark on sectoral analysis, closely monitoring data and trends specific to these industries.

For example, the transition toward sustainable fishing practices in accordance with conservation policies can impact the supply and demand dynamics of seafood products. These industry transformations resonate within the forex market, leaving their imprint on currency exchange rates. Analysts proficient in sectoral analysis are well-equipped to anticipate currency movements intertwined with these industry shifts.

Empowering Investors and Traders

The forex market thrives on information as investors and traders navigate its complexities. These market participants rely on diligently analyzed data to make astute decisions. By remaining attuned to ocean conservation policy developments and their potential ramifications, market actors can strategically position themselves.

For investors, a comprehensive grasp of how conservation policies intersect with economic indicators and industry nuances allows for informed portfolio diversification. Traders, meanwhile, leverage data-driven insights to craft effective trading strategies, capitalizing on market fluctuations triggered by policy-related announcements.

In summation, data analysis stands as the linchpin in unraveling the intricate interplay between ocean conservation policies and the forex market. Analysts diligently scrutinize economic indicators, policy declarations, and industry dynamics to decode their impact on currency exchange rates. Armed with this knowledge, investors and traders navigate the forex landscape with confidence, utilizing data-driven insights to make informed decisions in a world where policy shifts and market dynamics intertwine in a delicate dance of influence.

Economic Consequences and Strategic Policy Guidance

The interplay between ocean conservation policies and the forex market underscores a complex relationship between environmental preservation and economic repercussions. These policies, while poised to foster economic growth, sustainability, and global prestige, carry the weight of challenges and potential short-term currency fluctuations.

Inevitable Economic Ramifications

The sway of ocean conservation policies over economic realms is undeniable, wielding both constructive and intricate consequences that echo through economies and currency markets.

- Fostering Economic Growth: Primarily, ocean conservation policies hold the potential to ignite economic growth. These policies frequently pivot towards sustainable practices, nurturing sectors such as renewable energy, eco-tourism, and responsible fisheries. The expansion of these industries breathes fresh life into national economies, propelling job creation and revenue generation. As economic indicators ascend, investor confidence often follows suit, uplifting the performance of the local currency in the forex market. Sustainable economic growth establishes nations as alluring investment destinations, fostering a robust currency reflective of a thriving economic landscape.

- Propelling Sustainability: Ocean conservation policies champion sustainability, guiding nations towards prudent resource management and ecologically aware practices. While these policies may pose transient challenges to specific industries, their long-term advantages are immeasurable. The safeguarding of marine ecosystems and coastal environments guarantees the enduring availability of resources vital to economies. The perception of a nation as a responsible custodian of its natural wealth reverberates positively with investors and trade partners. This perception kindles demand for the nation’s currency, further fortifying its position in the forex market.

- Hurdles and Short-Term Currency Dynamics: Yet, it is crucial to acknowledge the hurdles posed by ocean conservation policies. Industries deeply intertwined with practices slated for transformation, such as carbon-intensive sectors or unsustainable fishing methods, may encounter escalated costs and momentary disruptions. These hurdles can sway currency exchange rates, precipitating fluctuations. Investors and forex market stakeholders vigilantly observe these short-term undulations, recognizing them as part of the broader narrative of policy-induced transformation. Maneuvering through these fluctuations necessitates vigilance and adaptability, as currency values adapt to evolving economic terrains.

Policy Guidance: Paving the Way Forward

As nations grapple with the intricate task of harmonizing economic advancement and environmental protection, the formulation of robust policy recommendations takes center stage. Strategies geared towards mitigating adverse consequences on industries while optimizing the advantages of ocean conservation policies demand meticulous deliberation.

- Support for Industry Transition: Policies can be designed to underpin industries during their transition towards sustainability. Incentives, subsidies, and training initiatives can facilitate the adoption of eco-friendly practices, mitigating the economic ripples associated with change.

- Diversification and Innovation: Promoting diversification and innovation within sectors susceptible to policy impacts can enhance their resilience. Governments can foster research and development ventures to encourage sustainable alternatives, ensuring industries maintain competitiveness in an evolving landscape.

- International Synergy: Ocean conservation transcends borders, necessitating international cooperation. Nations can collaborate to align policies, curtailing trade imbalances and enhancing economic stability. Such cooperation can breed investor trust and bolster currencies within the forex market.

- Vision for the Long-Term: Lastly, the cultivation of comprehensive, long-term visions that fuse economic expansion with sustainability is imperative. Policies that harmonize economic objectives with environmental stewardship set the stage for enduring prosperity and currency resilience.

In summation, the economic ramifications of ocean conservation policies on the forex market are palpable, encompassing growth, sustainability, challenges, and fluctuations. The craft of effective policy recommendations serves as the guiding star, steering nations as they navigate this intricate terrain. By adroitly balancing economic progress and environmental safeguarding, nations can plot a course towards a future where both objectives coexist harmoniously, nurturing economic vibrancy and a robust forex market.

Conclusion

In summary, the intricate interplay between ocean conservation policies, encompassing initiatives like Marine Protected Areas and Ocean Pollution Policies, and the forex market represents a multifaceted phenomenon. These policies wield the power to sway investor sentiment, steer industry dynamics, and influence economic stability, particularly within coastal and island economies. Furthermore, the promotion of Blue Economy Initiatives and the implementation of Carbon Pricing mechanisms stand as pivotal forces, sculpting the contours of forex trends.

As we chart our course ahead, it becomes increasingly evident that environmental conservation and economic well-being are intricately intertwined. Navigating the realm of ocean conservation policies with foresight and strategic acumen enables nations to cultivate positive reactions within the forex market while concurrently safeguarding the invaluable ecosystems of our oceans.

Click here to read our latest article on Forex in Organic

FAQs

- What defines ocean conservation policies, and why are they crucial for the forex market’s dynamics? Ocean conservation policies encompass initiatives such as Marine Protected Areas and Ocean Pollution Policies, aiming to protect marine ecosystems. They hold significance for the forex market as they can shape investor sentiment and the economic landscape in coastal regions.

- How do the establishment of Marine Protected Areas impact currency exchange rates? The creation of Marine Protected Areas signifies a nation’s commitment to sustainable practices, instilling confidence among investors and attracting foreign investments. This often results in the appreciation of the local currency.

- Can stricter Ocean Pollution Policies lead to shifts in forex market trends? Yes, stringent Ocean Pollution Policies can impose additional compliance costs on industries, potentially affecting their profitability and, subsequently, the performance of their respective currencies.

- What characterizes Blue Economy Initiatives, and how do they relate to the forex market’s dynamics? Blue Economy Initiatives focus on sustainable practices in ocean-related industries. They can enhance the economic stability of coastal regions, drawing investments and influencing currency performance.

- What role does Carbon Pricing play, and why does it matter in the context of the forex market? Carbon Pricing involves assigning a financial value to carbon emissions, incentivizing businesses to reduce their carbon footprint. It affects the forex market by impacting compliance costs for carbon-intensive sectors and attracting foreign investments.

- Are there instances of short-term currency fluctuations tied to ocean conservation policies? Yes, industries undergoing transformation due to policy changes may experience short-term currency fluctuations while adapting to new regulatory frameworks.

- How can investors and traders navigate forex market movements shaped by these policies effectively? Staying well-informed about policy developments, industry shifts, and economic indicators is essential for making informed trading decisions in this context.

- What significance does market sentiment hold in the forex market’s reactions to conservation policies? Positive policy signals can boost investor confidence, strengthening the local currency, while negative signals may trigger caution among investors, potentially leading to currency depreciation.

- Are there international collaborations related to ocean conservation policies that influence forex market trends? Yes, international cooperation on these policies can help reduce trade imbalances and enhance economic stability, impacting forex markets.

- How can nations strike a balance between fostering economic growth and preserving the environment within the framework of these policies? Effective policy recommendations can provide support for industries transitioning toward sustainability, encourage diversification and innovation, foster international synergy, and align economic objectives with responsible environmental stewardship.