Introduction

In the intricate tapestry of New Zealand’s economic landscape, the Reserve Bank of New Zealand (RBNZ) stands as a formidable linchpin, its influence reverberating through the corridors of monetary policy and financial stability. This comprehensive guide endeavors to unravel the layers of the RBNZ’s pivotal role, casting a spotlight on its profound significance in steering the nation’s economic course. At the heart of its mandate lies the dual commitment to maintaining price stability and nurturing sustainable economic growth, making the RBNZ not just a central institution but a strategic architect of New Zealand’s financial prosperity.

As the custodian of economic stability, the RBNZ’s strategies become the threads weaving through the fabric of the nation’s financial well-being. In this exploration, we delve into the nuanced mechanisms employed by the RBNZ to achieve and sustain stability and growth, dissecting its historical journey, ownership dynamics, governance structure, and the arsenal of tools deployed in executing its mandate. This journey serves not only as a retrospective of the RBNZ’s pivotal contributions but as a forward-looking guide to understanding its enduring role in shaping the economic destiny of New Zealand.

Join us as we navigate through the corridors of the RBNZ’s influence, where every policy decision and strategic move echoes beyond the charts and graphs, impacting the lives of individuals, the trajectory of businesses, and the overall resilience of the New Zealand economy.

History of the Reserve Bank of New Zealand

In the crucible of economic turmoil following the Great Depression, the Reserve Bank of New Zealand (RBNZ) emerged as a beacon of stability. Founded in 1934, its inception was a response to the pressing need for a financial anchor in the tumultuous seas of economic uncertainty. As the global landscape grappled with unprecedented challenges, the RBNZ was entrusted with a broad mandate encompassing the issuance of currency, banking system regulation, and the pivotal setting of interest rates.

The pages of history turned, and the RBNZ, like the resilient silver fern emblematic of New Zealand, weathered the storms of economic upheavals. Its journey mirrored the transformative phases of the nation it served, navigating through the trials of World War II, global economic shifts, and the complexities of a changing geopolitical landscape.

However, the defining moment came in 1989 with the enactment of the Reserve Bank of New Zealand Act. This legislative milestone marked a significant evolution in the RBNZ’s mandate, aligning its focus with a paramount objective—price stability. The emphasis on maintaining stable prices signaled a strategic pivot, reflecting a commitment to fostering an economic environment free from the specter of inflationary volatility.

This historical trajectory is more than a chronicle of events; it is a testament to the RBNZ’s resilience and adaptability. It underscores the institution’s ability to evolve with the changing tides of economic paradigms and its unwavering dedication to fulfilling its crucial role in New Zealand’s economic stability and growth. The RBNZ, forged in the crucible of economic history, stands not just as a guardian of monetary policy but as a dynamic force shaping the contours of New Zealand’s economic destiny.

Current Shareholders

Within the unique economic landscape of New Zealand, the Reserve Bank of New Zealand (RBNZ) stands as a distinctive entity in terms of ownership. Unlike traditional models, the RBNZ is not subject to the ebb and flow of private shareholders but instead finds itself firmly tethered to the national interest. The entire apparatus of the bank is encapsulated within the auspices of the New Zealand government, creating a singular paradigm of ownership.

At the helm of this distinctive paradigm is the Minister of Finance, assuming an unparalleled role as the sole shareholder of the RBNZ. This strategic alignment transcends the conventional dynamics of profit-driven institutions. Instead, it establishes a profound connection between the fate of the bank and the overarching national interest.

This singular ownership model is not a mere formality; it is a deliberate and calculated choice that underscores the RBNZ’s commitment to a broader set of objectives beyond the pursuit of profits. The symbiotic relationship between the RBNZ and the government is exemplified by the direct channeling of profits back to the state’s coffers. This financial interdependence is a testament to the RBNZ’s allegiance to the economic well-being of New Zealand, prioritizing national objectives over the accumulation of private gains.

In an era where financial institutions often grapple with the delicate balance between public responsibilities and private profit motives, the RBNZ’s ownership structure emerges as a beacon of a different ethos. It stands not just as a monetary authority but as a custodian of national economic interests, navigating the intricate dance between financial stability, economic growth, and the broader prosperity of New Zealand.

Appointment of the Board and Governor

In the intricate governance architecture of the Reserve Bank of New Zealand (RBNZ), the appointment of the board and the Governor takes center stage, embodying a meticulous process designed for strategic effectiveness.

The governance paradigm is carefully crafted, with the Minister of Finance wielding the authority to appoint the board members. This ensemble of directors becomes the custodian of the RBNZ’s overarching mandate, ensuring that the bank operates in alignment with its prescribed objectives. The strategic appointment of individuals to the board becomes a key determinant in the symphony of economic governance orchestrated by the RBNZ.

At the heart of this governance structure is the Governor, a figure appointed for a term of five years, with the prospect of reappointment. This tenure provides a delicate balance—long enough to foster stability and continuity, yet with the flexibility to adapt to the dynamic economic landscape. The Governor assumes a pivotal role in the implementation of monetary policy, becoming the linchpin in the day-to-day operations of the RBNZ.

This strategic assembly of governance, with a board overseeing operations and a Governor steering the ship, is not a mere bureaucratic formality. It is a deliberate orchestration designed to ensure a harmonious execution of the RBNZ’s mandate. Each board member brings a unique set of skills and expertise, contributing to the nuanced decision-making essential for economic stability and growth.

The appointment process becomes a beacon of continuity and strategic acumen, reflecting the commitment of the RBNZ to navigate the complex currents of economic governance. In this intricate dance of appointments and strategic oversight, the RBNZ crafts a governance structure that is not just a regulatory necessity but a linchpin in the seamless execution of its mandate.

Mandate and Tools for Execution

Woven into the constitutional fabric of New Zealand, the mandate of the Reserve Bank of New Zealand (RBNZ) is akin to a guiding compass, directing its efforts toward the twin objectives of maintaining price stability and propelling sustainable economic growth.

At the helm of the RBNZ’s strategic toolkit stands the Official Cash Rate (OCR), a versatile instrument akin to the conductor’s baton in an economic symphony. This interest rate isn’t just a numerical entity but a dynamic force that resonates through the financial corridors. By intricately influencing borrowing costs, the OCR becomes a linchpin in shaping spending patterns, ultimately steering the trajectory of inflation. It’s a delicate dance, a strategic maneuver that requires precision and foresight.

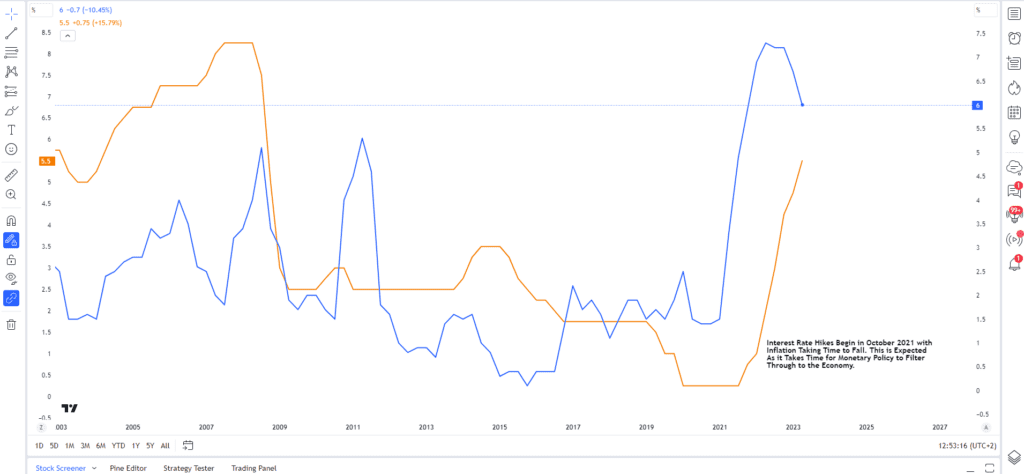

The RBNZ’s ability to navigate the economic landscape is showcased in its adept handling of interest rate hikes. Adjusting the OCR isn’t a mere technicality; it’s a strategic decision that influences economic cycles. The delicate balance between fostering growth and ensuring stable prices is a testament to the RBNZ’s strategic prowess. As depicted in the historical view of interest rate hikes and their impact on inflation, the RBNZ’s decisions aren’t isolated events but threads woven into the intricate fabric of economic evolution. The lagging effect, influenced by external factors, adds layers of complexity to this economic symphony, where cause and effect play out over time.

Yet, the RBNZ’s toolkit extends beyond interest rate adjustments. Open market operations become a nuanced brushstroke, influencing the money supply and sculpting the landscape of interest rates. This strategic deployment is not a mere auxiliary; it’s a deliberate move in the intricate chess game of financial stability.

Regulatory tools, another dimension of the RBNZ’s arsenal, add a layer of robustness to its strategic framework. From setting capital requirements for banks to vigilantly monitoring financial system liquidity, these tools aren’t just safeguards—they are proactive measures ensuring the resilience and stability of New Zealand’s financial landscape.

In this strategic symphony, the mandate and tools for execution are not static elements but dynamic forces responding to the ever-shifting cadence of the global and domestic economic landscape. The RBNZ’s resilience, adaptability, and commitment to New Zealand’s economic prosperity shine through its strategic choices, making it a guardian of economic equilibrium.

Illustrative Chart: Interest Rate Hikes and Inflation

Embarking on a journey through time, the illustrative chart becomes a visual chronicle, unraveling the intricate dance between interest rate hikes and inflation under the stewardship of the Reserve Bank of New Zealand (RBNZ).

In the historical tableau presented, each data point is a chapter, a testament to the RBNZ’s strategic decisions and their profound impact on the economic landscape. Interest rate hikes, depicted as pivotal moments, are not mere numerical adjustments but strategic maneuvers in the symphony of economic governance.

The chart is more than a visual aid; it’s a narrative tool, revealing the lagging effect inherent in the RBNZ’s decisions. The echoes of interest rate adjustments reverberate through time, influenced by external factors that add layers of complexity to the economic symphony. This lag becomes a crucial dimension, a nuanced interplay where cause and effect unfold over the canvas of months and years.

The correlation between interest rate hikes and inflation is not a linear equation; it’s a dynamic relationship shaped by the ebb and flow of economic forces. The RBNZ, in wielding interest rates as a strategic tool, navigates this complex terrain with a keen awareness of the temporal intricacies. The chart becomes a storytelling medium, illustrating not just the decisions but the consequences, the ripples that extend through the fabric of New Zealand’s economic evolution.

As viewers delve into the visual narrative, they witness the impact of interest rate hikes not as isolated events but as integral components of the broader economic symphony. It’s a tapestry where the RBNZ’s decisions, akin to musical notes, contribute to the harmonious progression of the nation’s economic melody. The illustrative chart encapsulates not just data points but a dynamic story—a story where the RBNZ, through its strategic choices, conducts the economic symphony of New Zealand.

Conclusion

As we conclude this comprehensive guide, the RBNZ emerges as a stalwart guardian of New Zealand’s economic equilibrium. Its strategic tools, from the OCR to regulatory finesse, resonate through the markets and banks. Recognizing the RBNZ’s continued importance is not just a reflection on its past achievements but an acknowledgment of its pivotal role in shaping the future economic landscape of New Zealand.

Click here to read our latest article on Understanding Moving Averages for Forex Trading

FAQs

- What is the primary focus of the Reserve Bank of New Zealand (RBNZ)? The RBNZ’s primary focus is to maintain price stability and promote sustainable economic growth in New Zealand.

- What pivotal role does the Official Cash Rate (OCR) play in the RBNZ’s toolkit? The OCR is a crucial instrument that influences borrowing costs, spending patterns, and inflation, allowing the RBNZ to navigate economic dynamics.

- How has the RBNZ evolved since its establishment in 1934? Originally founded in response to the Great Depression, the RBNZ has adapted over the years, with a significant shift in its mandate highlighted by the Reserve Bank of New Zealand Act in 1989.

- Who are the shareholders of the Reserve Bank of New Zealand? The RBNZ stands uniquely as a wholly-owned entity by the New Zealand government, with the Minister of Finance serving as the sole shareholder.

- How does the RBNZ balance financial stability with its mandate? The RBNZ employs regulatory tools, including setting capital requirements for banks and monitoring financial system liquidity, to ensure a delicate balance between stability and growth.

- What is the significance of the governance structure of the RBNZ? Governance, overseen by a board appointed by the Minister of Finance, ensures effective execution of the RBNZ’s mandate, with the Governor playing a central role in implementing monetary policy.

- Can you elaborate on the impact of interest rate hikes on inflation, as illustrated by the RBNZ’s historical chart? The historical chart reveals a nuanced relationship, showcasing the lagging effect of interest rate hikes on inflation, influenced by external factors, adding complexity to the economic symphony.

- How does the RBNZ contribute to New Zealand’s economic resilience? Through its mandate and strategic tools, such as the OCR, open market operations, and regulatory measures, the RBNZ actively shapes economic resilience, ensuring stability and growth.

- What sets the RBNZ’s ownership model apart from other central banks? The RBNZ’s singular ownership by the government, with profits directed back to the state, distinguishes it, emphasizing a commitment to national objectives over profit accumulation.

- How does the RBNZ navigate the complexities of the economic landscape? The RBNZ, with its diverse toolkit and strategic decisions, navigates economic complexities, balancing the need for growth with the imperative of maintaining stable prices, ensuring a dynamic and resilient economic landscape.

Click here to learn more about New Zealand’s Reserve Bank