Introduction to Forex Trading Order Types

The realm of Forex trading is not just dynamic and complex, but also incredibly rewarding for those who master its intricacies. At the heart of these intricacies are the Forex Trading Order Types, whose strategic application can be a game-changer in navigating the Forex markets. Understanding and effectively utilizing these order types is not just a matter of trade execution, but a core aspect of a robust trading strategy, leading to markedly improved performance and enhanced risk management.

In this comprehensive guide, we dive deeper into the world of advanced Forex Trading Order Types. We explore the nuances of OCO Order Strategies, which are pivotal for traders looking to balance potential profits against losses. These strategies offer a dual approach, where setting up one order automatically negates the other, thus providing a safety net in volatile market conditions.

Simultaneously, we delve into Trailing Stop Order Techniques. This technique is a favorite among Forex traders due to its dynamic nature. Unlike standard stop-loss orders, trailing stops move in accordance with market prices, offering a flexible approach to protect gains. This adaptability makes Trailing Stop Order Techniques an essential tool for traders who aim to maximize their profits while minimizing losses.

Another crucial aspect covered in this guide is the Forex Iceberg Order Tactics. This order type is especially relevant for traders dealing with large volumes, enabling them to hide the full size of their order. By doing so, Forex Iceberg Order Tactics help in maintaining market stability and preventing significant price slippage, which is an important consideration in the overall Risk Management in Forex Orders.

All these order types, when understood and applied correctly, can profoundly impact your Forex trading journey. They not only offer various mechanisms to manage trades but also embody advanced techniques for Risk Management in Forex Orders. This guide aims to provide a detailed understanding of these order types, helping you to incorporate them into your trading strategies for improved decision-making and enhanced trading performance.

Whether you are a beginner or an experienced trader, gaining a comprehensive understanding of these Forex Trading Order Types and their strategic applications will empower you to navigate the Forex market with greater confidence and efficiency. Stay tuned as we delve into each of these order types, unraveling their complexities and teaching you how to leverage them for your trading success.

One Cancels the Other (OCO) Orders

OCO Order Strategies stand as a cornerstone in the diverse array of Forex Trading Order Types. These strategies involve setting up a pair of orders where the execution of one automatically leads to the cancellation of the other. This unique characteristic of OCO Order Strategies makes them a vital tool in a trader’s arsenal, especially in managing the unpredictable swings of the Forex market.

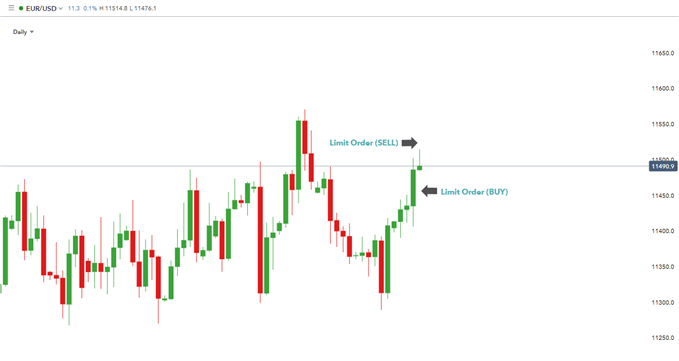

The beauty of OCO Order Strategies lies in their simplicity and effectiveness. For instance, a trader might place a buy order above the current market price and a sell order below it. If the market rises and the buy order is executed, the sell order is immediately canceled, thus locking in the potential for profit while eliminating the risk on the downside. Conversely, if the market falls and the sell order is executed, the buy order is canceled. This mechanism not only helps in capitalizing on market movements but also serves as a critical component of Risk Management in Forex Orders.

Moreover, OCO Order Strategies are versatile and can be tailored to fit various trading scenarios. They are particularly useful in markets that exhibit high volatility, where rapid price changes can occur. By employing these strategies, traders can set predefined entry and exit points, thereby reducing the need for constant market monitoring and making their trading process more efficient and less stressful.

The application of OCO Order Strategies also allows traders to plan their trades more strategically. By having both a profit target and a stop-loss order set up as an OCO, traders can define their risk-to-reward ratio in advance. This pre-planning of potential outcomes is a critical aspect of disciplined trading and forms the backbone of effective Risk Management in Forex Orders.

In essence, OCO Order Strategies offer a blend of flexibility, control, and strategic foresight, making them an indispensable tool in Forex Trading Order Types. Whether you’re looking to capitalize on market breakouts or safeguard against sudden price reversals, understanding and utilizing OCO Order Strategies can significantly enhance your trading performance, decision-making, and overall approach to managing risks in the volatile Forex market.

Iceberg Orders

Forex Iceberg Order Tactics hold a pivotal position in the spectrum of Forex Trading Order Types, especially for traders who deal with substantial volumes. The concept of an iceberg order, named for the way only a small part of an iceberg is visible above water, involves dividing a large order into multiple smaller orders. These smaller portions are then executed individually, keeping the bulk of the order hidden from the public market. This tactic is crucial for maintaining market equilibrium and avoiding substantial price movements that can occur if a large order is known to market participants.

The strategic use of Forex Iceberg Order Tactics is particularly beneficial in maintaining anonymity and reducing market impact. When a large order is placed in its entirety, it can signal market participants, potentially leading to adverse price movements. For example, a significant sell order might cause other traders to sell, driving the price down before the original order is fully executed. Iceberg orders mitigate this risk by revealing only a small portion of the total order, thereby preventing price slippage and ensuring a more favorable execution price.

Moreover, Forex Iceberg Order Tactics are not just about concealment but also about strategic execution. By breaking down a large order into smaller ones, traders can adapt to changing market conditions. They can modify the remaining hidden orders based on the market’s reaction to the executed portions, providing a dynamic approach to executing large volume trades. This flexibility is a key component of effective Risk Management in Forex Orders, as it allows traders to react to market movements in real-time while minimizing their market footprint.

Another significant aspect of using Forex Iceberg Order Tactics is in promoting a more level playing field in the Forex market. Since large orders can influence market prices significantly, their concealment through iceberg orders helps in maintaining a more stable and predictable market environment. This stability is beneficial not only for the traders placing the orders but also for the overall health of the Forex market.

In summary, Forex Iceberg Order Tactics are an essential tool in the arsenal of Forex Trading Order Types. They provide large volume traders with the means to execute significant orders without disrupting market prices, thus maintaining price stability and market integrity. As part of a comprehensive approach to Risk Management in Forex Orders, understanding and effectively utilizing iceberg orders can be a significant advantage, enabling traders to execute large trades efficiently and discreetly.

Trailing Stop Orders

Trailing Stop Order Techniques are an indispensable element in the arsenal of Forex Trading Order Types, offering traders a unique and dynamic method for safeguarding their profits. Unlike traditional stop-loss orders, which remain fixed once set, trailing stop orders are designed to move in line with favorable market movements, thereby offering a more flexible approach to risk management.

The key advantage of Trailing Stop Order Techniques lies in their ability to automatically adjust with the changing market prices. For instance, in a long position, if the market price rises, the trailing stop moves up proportionally, but if the market price falls, the stop loss doesn’t move. This mechanism ensures that traders can lock in profits while simultaneously limiting their downside risk. It’s particularly valuable in the Forex market, known for its volatility and rapid price movements.

Implementing Trailing Stop Order Techniques allows traders to adopt a ‘set and forget’ strategy. Once a trailing stop is set, it autonomously adjusts to price changes, relieving traders from the need to constantly monitor market movements and manually adjust their stop losses. This hands-off approach is not only convenient but also helps in mitigating emotional decision-making, a common pitfall in trading.

Moreover, Trailing Stop Order Techniques are flexible and can be tailored to fit individual trading styles and risk tolerance levels. Traders can set the trailing stop distance according to their specific needs, whether they prefer tight control over their trades or more room for the trade to develop. This customization is a crucial aspect of effective Risk Management in Forex Orders, as it allows traders to protect their capital while giving their trades enough space to mature.

In essence, Trailing Stop Order Techniques provide a balance between securing profits and allowing enough room for market fluctuations, without the constant need for manual adjustments. They are an essential tool for any Forex trader looking to maximize gains while minimizing losses. As part of a comprehensive Forex trading strategy, understanding and effectively utilizing trailing stop orders can significantly contribute to enhanced trading performance and more robust Risk Management in Forex Orders.

Comparative Analysis

When delving into the intricate world of Forex Trading Order Types, understanding the distinct characteristics and benefits of OCO Order Strategies, Forex Iceberg Order Tactics, and Trailing Stop Order Techniques becomes essential. Each of these order types brings a unique edge to trading strategies, and their effectiveness is often contingent on the specific trading situation and the trader’s risk tolerance.

OCO Order Strategies are particularly useful in scenarios where a trader anticipates significant price movement but is uncertain about the direction. By placing two orders – one above and one below the current market price – the trader can capitalize on whichever direction the market moves. This strategy is ideal for traders looking to harness market volatility without having to make a definitive call on the direction. It exemplifies proactive Risk Management in Forex Orders by limiting potential losses and securing profits once a certain price level is hit.

Forex Iceberg Order Tactics, on the other hand, are tailor-made for large volume traders who wish to mask their market activity. By breaking a large order into smaller, concealed chunks, these tactics prevent substantial market impact that can occur with large orders. This approach is beneficial in maintaining price stability and is a key strategy for traders who want to avoid influencing the market with their large orders. Forex Iceberg Order Tactics are an integral part of Risk Management in Forex Orders, particularly for institutional traders or individuals dealing with significant sums.

Trailing Stop Order Techniques offer a dynamic and automated way of securing profits while limiting losses. These orders are particularly useful in trending markets where the price moves favorably for an extended period. The ability of the trailing stop order to adjust according to the market conditions provides a blend of flexibility and security, making it a popular choice among traders who prefer a set-and-forget approach to Risk Management in Forex Orders.

In summary, while OCO Order Strategies are best suited for situations with high uncertainty and potential for significant market movements, Forex Iceberg Order Tactics are ideal for large volume trades requiring discretion. Trailing Stop Order Techniques, meanwhile, are more suited for trending markets where they can lock in profits while still allowing room for price growth. Understanding the specific contexts and applications of these Forex Trading Order Types is crucial in tailoring them to individual trading styles and risk profiles, thereby enhancing overall Risk Management in Forex Orders. This comparative analysis underscores the importance of selecting the right order type based on the market environment and individual trading objectives.

Advanced Strategies and Tips

The integration and combination of different Forex Trading Order Types can elevate a trader’s strategy from basic to advanced, providing a more nuanced and effective approach to navigating the Forex market. By blending OCO Order Strategies, Forex Iceberg Order Tactics, and Trailing Stop Order Techniques, traders can create a sophisticated and multi-layered trading strategy.

For example, combining OCO Order Strategies with Forex Iceberg Order Tactics can be particularly effective in managing large positions in a volatile market. A trader might use an OCO order to set a profit target and a stop-loss for a position while simultaneously breaking down the orders into smaller chunks using iceberg tactics. This combination allows for capitalizing on price movements in either direction while maintaining discretion and minimizing market impact. Such a strategy is not only about setting optimal entry and exit points but also about managing market visibility, which is crucial for large volume trades.

Incorporating Trailing Stop Order Techniques into this mix adds another dimension to the strategy. Trailing stops can be used to automatically adjust the stop-loss levels as the market moves favorably, securing profits while still allowing for the potential upside. This is especially useful in trending markets where it enables traders to ‘ride the wave’ of market movements without constantly having to adjust their stop-loss levels manually. The automation aspect of Trailing Stop Order Techniques is a significant boon for Risk Management in Forex Orders, ensuring that protective measures are always in sync with current market dynamics.

Furthermore, advanced traders can utilize these combined strategies to diversify their trading approaches across different currency pairs and market conditions. For instance, while OCO orders and iceberg tactics may be more suitable for major currency pairs in a highly liquid market, trailing stops might be more effective in less volatile, trending markets.

In essence, the key to leveraging these advanced strategies lies in understanding the strengths and applications of each Forex Trading Order Type and knowing how to combine them effectively. Such a comprehensive approach not only enhances the potential for profit but also fortifies Risk Management in Forex Orders. By mastering these advanced strategies and tips, traders can navigate the Forex market with greater confidence and sophistication, adapting to its dynamics with a well-rounded and versatile trading strategy.

Conclusion

Forex Trading Order Types are the cornerstone of effective trading strategies. OCO Order Strategies, Trailing Stop Order Techniques, and Forex Iceberg Order Tactics each play a critical role in Risk Management in Forex Orders. By mastering these order types, traders can enhance their Forex strategy for improved performance.

Click here to read our latest article on Dynamic Fractal Trading Strategies

FAQs

- What are Forex Trading Order Types? Forex Trading Order Types are instructions that traders give to their brokers to buy or sell currencies at specific prices or under certain conditions. These include OCO (One Cancels the Other) orders, trailing stop orders, and iceberg orders, each serving different strategic purposes in trading.

- How do OCO Order Strategies work in Forex trading? OCO Order Strategies involve setting two orders simultaneously – a stop order and a limit order. When one of these orders is executed due to market movements, the other order is automatically canceled. This strategy is used to manage risk and capitalize on market volatility.

- What are the benefits of using Trailing Stop Order Techniques? Trailing Stop Order Techniques allow traders to automatically adjust their stop-loss orders in response to favorable market movements. This ensures that profits are secured while limiting losses, making it an essential tool for Risk Management in Forex Orders.

- Can Forex Iceberg Order Tactics be used by individual traders? Yes, Forex Iceberg Order Tactics can be utilized by individual traders, especially those dealing with large order sizes. These tactics involve splitting a large order into smaller, hidden portions to minimize market impact and maintain price stability.

- How do Forex Iceberg Order Tactics contribute to Risk Management in Forex Orders? Forex Iceberg Order Tactics help in managing risk by concealing the total order size, preventing significant market impact, and avoiding price slippage. This is particularly beneficial for large volume traders who wish to execute orders without influencing the market price unduly.

- What is the best way to use Trailing Stop Order Techniques for beginners? For beginners, it is advisable to start with a wider trailing stop to allow some room for market fluctuations and gain a feel for how trailing stops can protect profits while minimizing losses. As they gain experience, traders can adjust the stop parameters to suit their trading style and risk tolerance.

- Are OCO Order Strategies suitable for all market conditions? OCO Order Strategies are particularly effective in volatile or uncertain market conditions where the direction of the market movement is unclear. They offer a balanced approach to capturing gains in either direction while limiting potential losses.

- How can combining different Forex Trading Order Types enhance trading strategies? Combining different Forex Trading Order Types, such as using OCO orders with iceberg tactics, can create more nuanced strategies. This blend allows traders to capitalize on market movements, manage large orders discretely, and automate risk management, leading to potentially improved trading performance.

- What is the primary advantage of using Forex Iceberg Order Tactics? The primary advantage of using Forex Iceberg Order Tactics lies in their ability to break a large order into smaller segments, thus avoiding significant market impact and maintaining price stability while executing large volume trades.

- Can Trailing Stop Order Techniques be used in conjunction with OCO orders? Yes, Trailing Stop Order Techniques can be used in conjunction with OCO orders. For example, after an OCO order is triggered and one part of it is executed, a trailing stop can be placed on the open position to manage the trade dynamically as the market progresses.

Click here to learn more about Forex Trading Order Types