Introduction to Fractal Trading Strategies

Fractal Trading Strategies stand tall as the bedrock of success in deciphering the intricate landscape of Forex trading. These strategies, deeply rooted in the concept of fractals, unveil a potent framework that empowers traders to dissect price movements with unparalleled precision. At the core of this methodology lies the ability to not merely comprehend the current market state but to foresee potential shifts, seizing opportunities presented by Trend Reversals and Breakouts.

In the realm of Forex, where volatility reigns supreme, Fractal Trading Strategies serve as a beacon guiding traders through the labyrinth of price fluctuations. Understanding these strategies, akin to unraveling Price Patterns in Currency Trading, equips traders with a sophisticated toolset, enabling them to discern patterns within chaos. This comprehension is pivotal, akin to deciphering Market Fractals and honing the skill of trend identification.

The essence of Fractal Trading Strategies lies in their capability to offer traders a refined lens, a specialized viewpoint that transcends the surface-level movements. By delving into the minutiae of fractals, traders can glean insights that transcend the ordinary, enabling them to gauge market sentiment, anticipate shifts in momentum, and strategically position themselves ahead of the curve.

Crucially, the concept of fractals underpins the methodology used in analyzing Trend Reversals and Breakouts. It acts as a compass in navigating the Forex landscape, allowing traders to identify pivotal points where trends morph, providing early indications of potential reversals. These Fractal Analysis in Forex not only provides insights but also empowers traders with actionable intelligence, the kind that can transform a good trade into a great one.

Fractal Trading Strategies aren’t just about decoding market movements; they signify a mindset, a perspective that embraces the inherent rhythm of the market. These strategies offer traders a unique vantage point, akin to recognizing Market Fractals and trend identification, allowing them to read between the lines of price charts and discover opportunities that might otherwise remain obscured.

Understanding Fractals in Forex Trading

Fractals, these intricate repetitive geometric formations, embody the heartbeat of market movements within the realm of Forex trading. Often likened to the Price Patterns in Currency Trading, these patterns etch themselves across charts, revealing a narrative of the market’s ebb and flow.

At its core, comprehending these fractals is akin to deciphering the enigmatic language of the market. They manifest as clusters of five successive candlesticks, showcasing the high or low points within a price movement. These Price Patterns in Currency Trading, when recognized and dissected, act as the cornerstone for traders seeking to navigate the market’s intricate web.

However, the true significance of fractals extends beyond their visual representation on charts. Their relevance transcends mere geometry, delving into the realm of Market Fractals and Trend Identification. Here lies the crux for traders—unraveling the deeper implications embedded within these formations.

In the dynamic world of Forex trading, understanding the implications of fractals is a vital edge. Market Fractals encapsulate these formations, capturing the essence of repetitive market behavior—cycles that echo across various timeframes, offering windows into potential shifts in trends. This comprehension acts as a guide, a compass aiding traders in deciphering the underlying sentiment and probable trajectories of the market.

Trend Identification, an art mastered through fractal analysis, forms the backbone of strategic decision-making for traders. By discerning the subtleties within these fractal formations, traders can forecast potential trend shifts, anticipate reversals, and ascertain the viability of breakouts. The ability to discern these patterns, often interwoven within the fabric of charts, empowers traders to read between the lines of market movements.

In essence, the journey through Understanding Fractals in Forex Trading is not merely about recognizing shapes on a chart. It’s about embracing a deeper understanding, akin to deciphering the hidden language of the market. This understanding paves the way for traders to cultivate insights, enabling them to forecast potential market movements and position themselves strategically.

As we delve deeper into the realm of fractals, exploring their multifaceted nature and unraveling their significance in Market Fractals and Trend Identification, we equip ourselves with the tools to navigate the labyrinth of Forex trading with precision and finesse.

Identifying Trend Reversals with Fractals

Fractals, those intriguing and recurring patterns etched within the fabric of market charts, serve as an indispensable ally for traders in identifying potential shifts within market trends. Their significance goes beyond mere patterns; they act as beacons, illuminating probable turning points that signal the onset of Trend Reversals.

The strategic prowess of Fractal Analysis in Forex lies in its ability to decipher the evolving market landscape. It’s not merely about observing fractals but understanding their narrative—the story they unfurl within the dynamic realm of the Forex market. This comprehension becomes a guiding principle for traders seeking to navigate the labyrinth of market dynamics.

The identification and validation of Trend Reversals are hallmarks of successful trading strategies, and fractals stand at the forefront of this pursuit. These formations often manifest as a series of five candlesticks, highlighting potential peaks or troughs within a price movement. It is within these formations that traders unearth actionable insights, offering a glimpse into the underlying sentiment of the market.

Traders adept in Fractal Analysis harness these formations to their advantage. The confirmation of a potential reversal involves a meticulous evaluation, not just relying on the presence of a fractal pattern but employing supporting indicators to validate the shift in trend. This amalgamation of fractals with other technical tools elevates the precision of identifying Trend Reversals, empowering traders to make informed decisions.

Furthermore, fractals aren’t merely singular occurrences; they resonate across multiple timeframes, offering a comprehensive view of market dynamics. This multifaceted nature of fractals grants traders the ability to corroborate potential reversals across varying timeframes, strengthening the conviction behind identified trends.

In essence, the art of Identifying Trend Reversals with Fractals isn’t confined to recognizing patterns on a chart. It’s about interpreting these formations as cues, decoding the underlying shifts in market sentiment, and validating these insights through meticulous analysis. It’s a synergy between fractal formations, confirmation indicators, and a comprehensive understanding of Market Fractals and Trend Identification.

As traders traverse through the realm of fractals, honing their skills in identifying potential reversals and understanding the nuances of Trend Reversals with Fractals, they equip themselves with a potent tool that can decipher the ever-evolving language of the market.

Strategies for Breakouts Using Fractals

Breakout trading stands as a cornerstone in the repertoire of Forex strategies, offering traders lucrative opportunities stemming from significant price movements. Within this landscape, fractals emerge as indispensable instruments, serving as the compass guiding traders to identify potential breakout points and navigate the ever-evolving terrain of the market.

Fractals, akin to intricate puzzle pieces scattered across charts, hold the key to unlocking breakout opportunities. These formations, characterized by clusters of five candlesticks, often mark pivotal highs and lows, providing traders with critical insights into potential breakout zones. They act as signposts, signaling areas where market dynamics are poised to breach established boundaries.

The art of utilizing Fractals in Breakout Strategies transcends mere recognition of these formations. It’s about formulating effective strategies that align seamlessly with Market Fractals and Trend Identification, strategically positioning traders to capitalize on impending breakouts.

Traders adept in Fractal Analysis deploy a multifaceted approach to breakout trading. They scrutinize fractals not in isolation but in conjunction with other indicators, corroborating these patterns with supporting signals to validate breakout potential. This synthesis between fractals and supplementary technical tools elevates the accuracy of identifying breakout points, enabling traders to enter positions with greater conviction.

Moreover, fractals extend their influence across multiple timeframes, presenting a panoramic view of potential breakout scenarios. This comprehensive perspective empowers traders to gauge breakout opportunities across varying time horizons, augmenting the depth of analysis and fortifying trading decisions.

The strategic fusion of Fractals with Breakout Trading isn’t merely about pinpointing entry and exit points; it’s a meticulous orchestration. It’s about interpreting these formations as precursors to potential breakouts, understanding their role within Market Fractals and Trend Identification, and employing strategies that harness their predictive power.

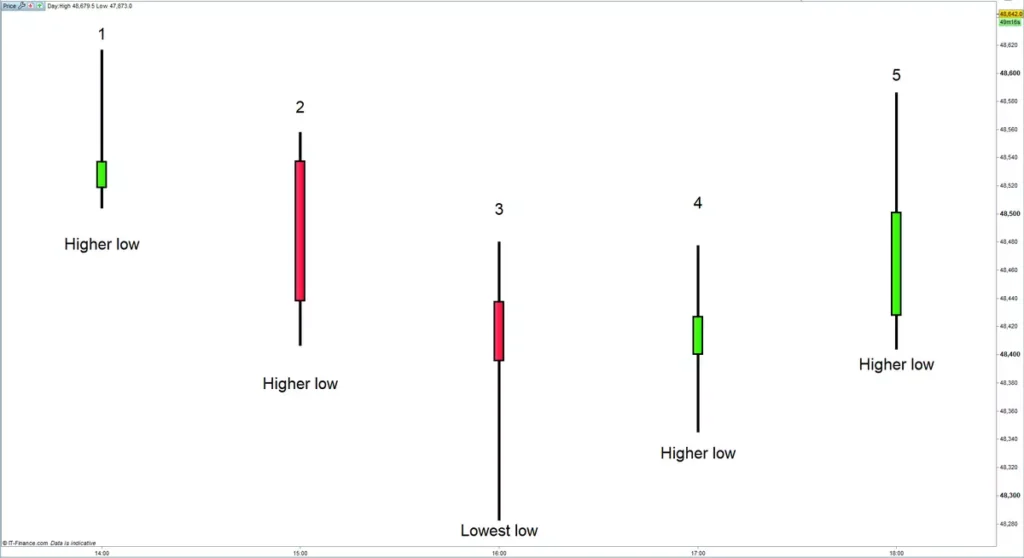

In technical analysis, a fractal represents a distinctive five-bar or candle trend reversal pattern. When considering a bullish fractal reversal pattern:

- The third candle within this sequence of five would demonstrate the lowest low.

- The first two candles in the pattern would exhibit higher lows compared to the middle candle.

- The final two candles in the series would showcase higher lows than the middle candle.

- The visual illustration below exemplifies the structure of a bullish fractal pattern.

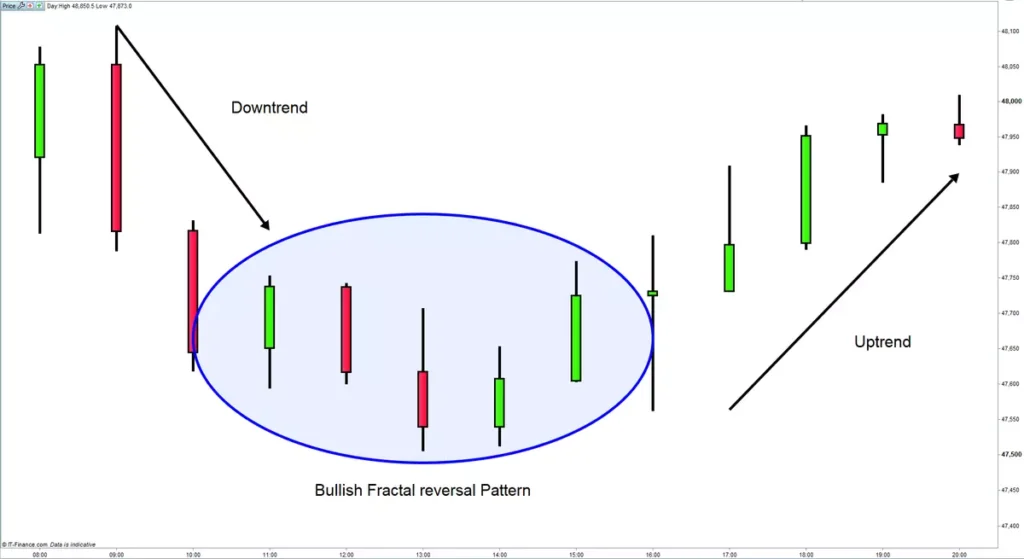

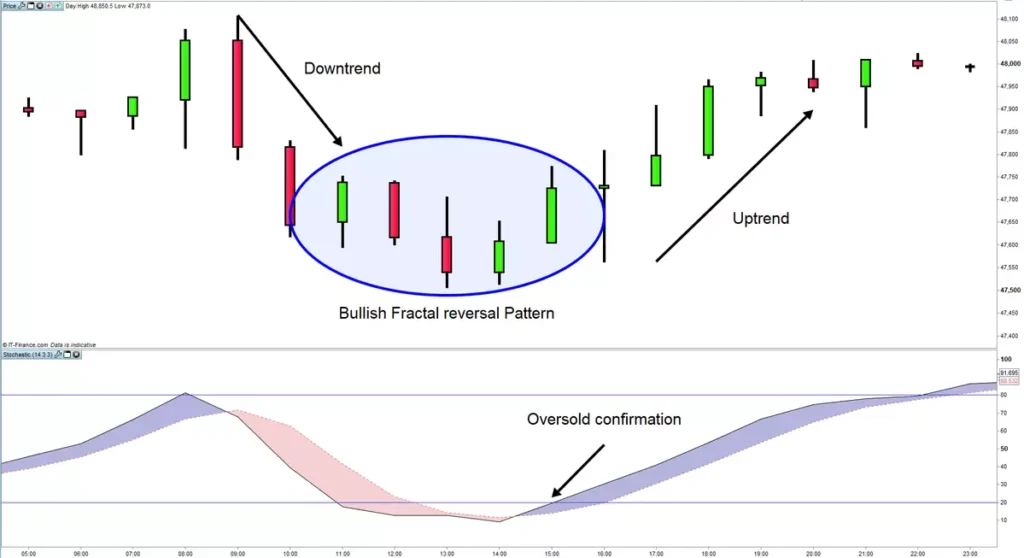

A bullish fractal reversal pattern suggests a potential conclusion to a short-term downtrend and the initiation of an upward trend. Traders may interpret this pattern as a signal to enter a long position or to consider exiting an existing short position.

Many traders opt to combine fractal signals with oscillators like the stochastic or relative strength index (RSI) to confirm a bullish buy signal. Consequently, a fractal buy signal gains more credibility when it coincides with an oversold signal.

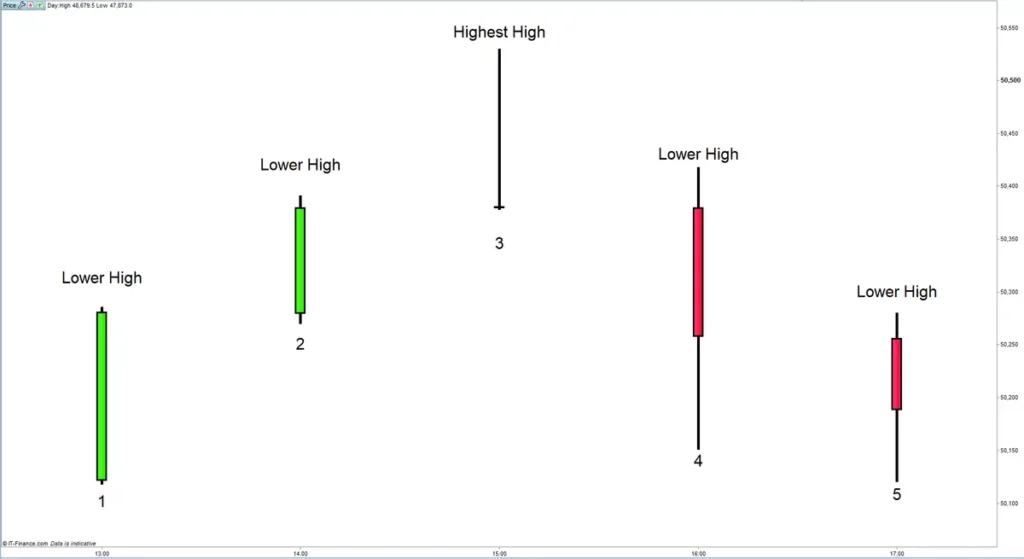

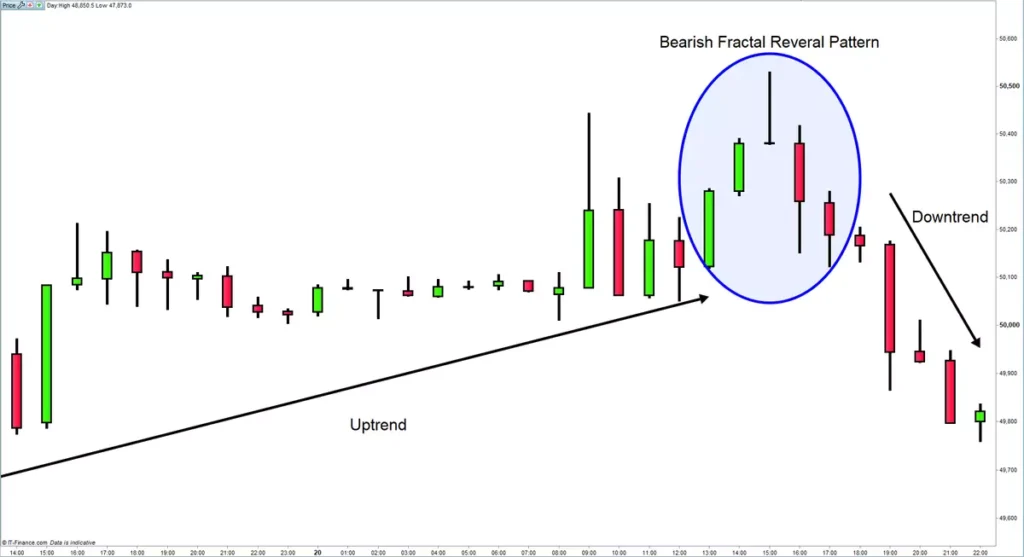

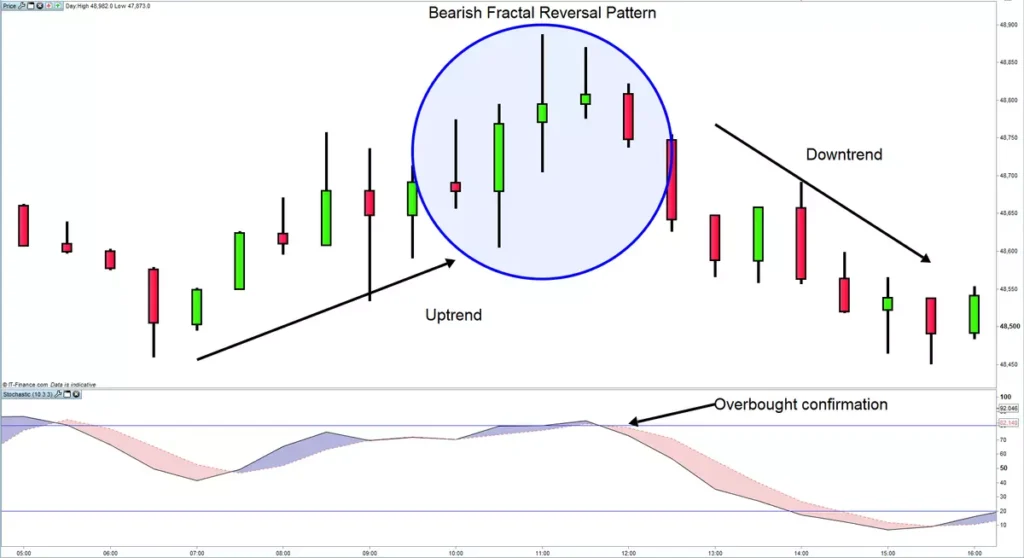

Now, examining the bearish fractal reversal pattern:

- The third candle within the sequence of five would register the highest high.

- The first two candles in this pattern would display lower highs compared to the middle candle.

- The final two candles in the sequence would demonstrate lower highs than the middle candle.

- The visual graph below presents an illustration of a bearish fractal pattern.

A bearish fractal reversal pattern implies a potential end to a short-term uptrend and a potential initiation of a downtrend. Traders might interpret this pattern as a signal to enter a short position or to contemplate exiting an existing long position.

Traders frequently integrate fractal signals with oscillators like the stochastic or RSI to confirm a bearish sell signal. Consequently, a fractal sell signal holds more weight when it aligns with an overbought signal.

In essence, the essence of Strategies for Breakouts Using Fractals lies in the amalgamation of technical analysis and a comprehensive understanding of market dynamics. It’s a symbiotic relationship between fractal formations, breakout strategies, and a profound comprehension of Price Patterns in Currency Trading that empowers traders to navigate the volatile terrain of breakouts with acumen and precision.

As traders venture into the realm of breakout trading, honing their strategies by aligning with Fractal Analysis in Forex and understanding the intricate interplay of Market Fractals and Trend Identification, they equip themselves with a strategic edge that can transform breakout opportunities into profitable ventures.

Practical Application of Fractals in Forex Trading

The practical application of Fractal Trading Strategies unveils its true potency when traversing the dynamic terrain of the Forex market. Real-life examples and case studies serve as guiding beacons, illuminating the path for traders seeking to harness the power embedded within fractals and their application in real-world trading scenarios.

In delving into these practical applications, traders are presented with a treasure trove of insights. These examples aren’t mere theoretical concepts but tangible instances where Fractal Analysis in Forex translates into actionable strategies. They portray instances where fractals have served as precursors to significant market movements, illustrating their role as predictive indicators.

Real-life scenarios often depict how fractals prelude Trend Reversals or mark breakout points, providing concrete evidence of their efficacy. They showcase instances where a keen understanding of Market Fractals and Trend Identification has allowed traders to position themselves strategically, capitalizing on market shifts that might otherwise remain obscured.

Moreover, case studies offer a deep dive into the nuances of Fractal Trading Strategies, unveiling the anatomy of successful trades while dissecting the pitfalls of failed attempts. Understanding these applications becomes a pivotal aspect of a trader’s journey, serving as a learning curve that refines their approach and strengthens their trading arsenal.

By studying these practical applications, traders gain a nuanced perspective. They comprehend the intricacies of identifying and leveraging fractals, learning to interpret these formations beyond their geometric patterns. These insights aid in the development of a discerning eye—a critical skill for traders navigating the volatile waters of Forex trading.

Furthermore, these real-life instances serve as cautionary tales, highlighting common pitfalls that traders encounter when applying Fractal Trading Strategies. By analyzing these pitfalls, traders gain a deeper understanding of potential traps, fortifying their strategies and adopting measures to sidestep similar pitfalls in their trading journeys.

The essence of the Practical Application of Fractals in Forex Trading lies not just in perceiving these examples as success stories but as learning opportunities. They serve as building blocks in a trader’s journey, refining their approach, honing their skills in Fractal Analysis, and fortifying their trading strategies against potential pitfalls.

As traders immerse themselves in these practical applications, absorbing the lessons embedded within real-life examples and case studies, they arm themselves with insights that go beyond theory—a profound understanding that can transform theoretical knowledge into actionable, profitable trades.

Advanced Tips and Best Practices

Delving into the intricacies of Fractal Analysis in Forex unveils a realm of advanced tips and best practices that elevate a trader’s proficiency in deciphering market movements. These insights transcend the basics, offering a nuanced understanding that transforms Fractal Trading Strategies into a sophisticated art form.

Combining Fractals with other technical indicators stands as a pivotal strategy in amplifying the accuracy of market analysis. While fractals provide a window into potential trend shifts, their synergy with oscillators, moving averages, or Fibonacci retracement levels further corroborates these insights. This amalgamation strengthens the conviction behind identified trends and reinforces trading decisions with complementary signals.

Moreover, adapting strategies to varying market conditions becomes imperative in ensuring adaptability and resilience in the face of market flux. Fractal Analysis isn’t a one-size-fits-all solution; it demands flexibility. In trending markets, traders might lean on fractals to identify and ride prolonged trends. Conversely, during volatile or ranging markets, fractals could aid in pinpointing pivotal reversal points or consolidation zones, enabling traders to navigate choppy waters with dexterity.

Understanding the intricacies of combining Fractals with other technical indicators isn’t merely about layering indicators on a chart. It’s about comprehending the interplay between these tools, identifying instances where they converge or diverge, and interpreting these alignments or divergences as cues for informed trading decisions.

Furthermore, embracing the adaptive nature of strategies tailored to varying market conditions requires a holistic approach. It involves continuously refining one’s skill in Market Fractals and Trend Identification, fostering an intuitive understanding of how fractals interact within different market environments.

An additional facet of advanced practice involves risk management strategies. While fractals offer predictive insights, prudent risk management forms the backbone of successful trading. Setting stop-loss orders based on fractal-based analysis, employing proper position sizing, and aligning risk-reward ratios with identified trends are crucial components of a robust risk management plan.

In essence, delving into Advanced Tips and Best Practices in Fractal Analysis in Forex isn’t just about delving deeper; it’s about refining one’s craft. It’s about honing the ability to fuse fractals with other technical tools, adapting strategies to diverse market conditions, and employing prudent risk management—an integration that transforms theoretical knowledge into practical wisdom.

As traders immerse themselves in these advanced tips and best practices, mastering the art of combining Fractals with other technical indicators and adapting strategies to varying market conditions, they cultivate a nuanced skill set—an expertise that can navigate the ever-evolving landscape of Forex trading with finesse.

Conclusion

Summarizing the significance of Fractal Trading Strategies, this section encourages traders to integrate these strategies into their trading arsenal. Emphasizing continuous practice and refinement, it underlines the transformative potential of mastering Fractal Analysis in Forex for sustainable trading success.

Click here to read our latest article on Forex Momentum Trading Strategies

FAQs

- What are Fractal Trading Strategies in Forex? Fractal Trading Strategies are methods employed by traders to analyze market movements using repetitive geometric patterns (fractals) visible on price charts. These strategies help identify potential trend reversals and breakout points.

- How do fractals assist in identifying trend reversals? Fractals highlight potential highs and lows in price movements, providing early indications of trend reversals. By recognizing clusters of five candlesticks, traders can anticipate shifts in market sentiment.

- What role do fractals play in breakout trading? Fractals act as essential tools for breakout trading by identifying potential breakout points. They mark critical highs and lows, offering insights into areas where market dynamics may breach established boundaries.

- Can fractals be used in conjunction with other technical indicators? Yes, combining fractals with other indicators like moving averages, oscillators, or Fibonacci retracement levels strengthens analysis. This fusion enhances the reliability of identified trends and reinforces trading decisions.

- How important is adapting strategies to varying market conditions in Fractal Trading? Adapting strategies to diverse market conditions is crucial. Fractal strategies might differ in trending, volatile, or ranging markets. Flexibility ensures traders can navigate different market environments effectively.

- What practical applications do fractals have in Forex trading? Practical applications of fractals are seen in real-life examples and case studies, showcasing their role in identifying trend reversals, breakout points, and validating trading strategies.

- Are there common pitfalls traders should avoid when using Fractal Trading Strategies? Yes, common pitfalls include relying solely on fractals without confirmation indicators, misinterpreting fractal signals, or neglecting risk management. Understanding these pitfalls helps refine trading approaches.

- How can traders refine their Fractal Analysis in Forex? Traders can refine their analysis by studying advanced tips, such as combining fractals with other indicators, adapting strategies to different market conditions, and implementing sound risk management practices.

- What risk management techniques complement Fractal Trading Strategies? Risk management techniques include setting stop-loss orders based on fractal analysis, employing proper position sizing aligned with identified trends, and maintaining favorable risk-reward ratios.

- What’s the significance of Market Fractals and Trend Identification in Fractal Trading? Market Fractals and Trend Identification are crucial components of Fractal Trading Strategies. Understanding these concepts provides traders with actionable insights into market dynamics and potential trade opportunities.

Click here to learn more about Fractal Trading Strategies