Retail sales serve as a crucial economic gauge, offering insights into a nation’s financial well-being. This comprehensive guide delves into the understanding retail sales, highlighting its importance as an economic indicator. We explore its interconnectedness with consumer spending, inflation, monetary policies, and trade balances, illuminating its impact across diverse financial markets.

Introduction

Retail sales encompass the total merchandise sales to end consumers, spanning physical stores, online platforms, and various distribution channels. It holds a pivotal role in a country’s Gross Domestic Product (GDP), mirroring the spending patterns of its populace. The Retail Sales Index (RSI) is a widely-used economic metric tracking retail sales changes over time.

Monitoring retail sales carries immense significance for policymakers, investors, businesses, and consumers. It provides valuable insights into a nation’s economic well-being, offering clues about consumer confidence, economic growth, and potential shifts in the business landscape.

Components of Retail Sales

The composition of retail sales is intricate and varies across countries, reflecting unique economic landscapes, consumer preferences, and cultural influences. To illustrate this complexity, we’ll delve into the components of retail sales, focusing on the United States as an example.

In the United States, retail sales encompass a diverse range of goods and services distributed through numerous channels, from traditional brick-and-mortar stores to the expansive world of e-commerce. The American consumer market boasts diversity, with purchases spanning daily necessities to luxury items. Here are key components of U.S. retail sales:

- Groceries: Essential items like food, beverages, and household products form a substantial segment of retail sales, with grocery stores and supermarkets as major contributors.

- Apparel and Fashion: Clothing, footwear, and accessories reflect consumer trends and preferences, sold through department stores, boutiques, and online retailers.

- Electronics and Technology: Rapid technological advancements drive demand for gadgets like smartphones and laptops, available in electronics stores and online marketplaces.

- Automobiles: Auto dealerships significantly impact retail sales, encompassing new and used vehicle sales, alongside services like maintenance and repair.

- Home Furnishings: Retail sales extend to home improvement and décor, including furniture, appliances, and renovation materials.

- Entertainment and Leisure: Expenditure on leisure activities like movies, sports gear, and recreational equipment contributes to retail sales, served by various outlets and online platforms.

- Health and Wellness: Consumer spending on health-related products such as pharmaceuticals, vitamins, fitness equipment, and wellness services forms an integral part of retail sales.

It’s important to note that not all retail sales categories are equally susceptible to economic fluctuations. While sectors like automobiles and electronics are more volatile due to economic conditions and consumer sentiment, others, like groceries and essential items, exhibit greater stability.

To refine insights into consumer spending habits and derive meaningful economic data, economists often use the concept of Core Retail Sales. This metric excludes highly volatile categories like automobiles, gasoline, building materials, and food services. By eliminating these variables, economists obtain a more stable view of retail spending trends, facilitating better-informed policymaking and investment decisions based on enduring consumer behavior patterns rather than short-term sectoral fluctuations.

Core retail sales typically omit the following categories:

- Automobiles: Car sales are prone to significant fluctuations due to factors like economic conditions, interest rates, and consumer sentiment.

- Gasoline: Rapid changes in gas prices can affect fuel-related spending.

- Building Materials: The construction sector’s sensitivity to economic cycles leads to fluctuations in building material sales.

- Food Services: Dining out spending can be influenced by disposable income and cultural trends.

By excluding these categories from analysis, economists gain a clearer view of fundamental consumer spending trends. This approach provides a more stable and insightful assessment of the economy, offering a valuable resource for policymakers and investors to base decisions on enduring consumer behavior patterns rather than short-term sector-specific fluctuations.

How Is Consumer Spending Linked to Retail Sales?

The nexus between consumer spending and retail sales constitutes a fundamental element of any nation’s economic landscape. Consumer spending acts as the driving force behind economic growth, job generation, and overall prosperity. Unraveling the intricate connection between these two facets is essential for grasping the dynamics of economic well-being.

Consumer spending, the financial outlays by individuals and households on a wide spectrum of goods and services, sets in motion a chain of events that reverberate through the economy. This process operates as follows:

- Stimulating Multiple Sectors: Consumer spending exhibits a multiplier effect. When individuals make purchases, it generates heightened demand across various sectors. This not only benefits retailers but also extends to manufacturers, suppliers, and service providers. For instance, buying a new refrigerator not only aids the appliance store but also the appliance manufacturer, the logistics companies facilitating delivery, and potentially even the energy sector due to increased electricity consumption.

- Job Creation: Rising product and service demand often necessitate business expansion to meet this surge in requirements. This expansion frequently translates into the creation of jobs. These new employment opportunities bolster individual income, further promoting consumer spending.

- Enhanced Production: To accommodate the mounting demand, businesses must amplify their production of goods or delivery of services. This upsurge in production catalyzes economic growth and contributes to a nation’s Gross Domestic Product (GDP), a pivotal indicator of economic robustness.

- Foreign Investment and Economic Advancement: A nation’s active consumer spending resonates positively on the global stage. Foreign investors tend to favor countries demonstrating robust consumer demand, as it signals economic stability and growth prospects. This can attract foreign investment, further propelling economic expansion.

Retail sales occupy a central role in this economic synergy by serving as a leading gauge of consumer sentiment and economic vitality. Their significance stems from the following factors:

- Instantaneous Reflection of Consumer Activity: Retail sales data swiftly reflects consumer behavior. Transactions are promptly recorded and reported, rendering retail sales data a reliable, up-to-the-minute indicator of consumer activity.

- Mirror of Consumer Confidence: Elevated retail sales often mirror growing consumer confidence. When individuals perceive financial security and trust in economic stability, they tend to spend more. Conversely, a dip in retail sales can signify waning confidence and potential economic challenges.

- Predictive Utility: Economists and policymakers closely monitor retail sales figures to foresee economic shifts. For instance, a sudden decline in retail sales may foreshadow a broader economic downturn, prompting proactive measures.

In summary, consumer spending and retail sales are intricately interwoven, constituting the backbone of economic activity within any nation. As consumers open their wallets, they catalyze a cascade of heightened demand, job creation, and economic expansion. The vigor of an economy often finds reflection in the strength of its retail sales, rendering this metric indispensable for both policymakers and investors endeavoring to fathom and navigate the economic landscape. Ultimately, as consumer confidence and spending surge, the entire economy reaps the benefits, enhancing the potential for extended growth and prosperity.

How Retail Sales Are Measured

The measurement and analysis of retail sales represent a multifaceted process that entails monitoring consumer purchases across diverse retail channels and product categories. This measurement holds immense importance in assessing a nation’s economic health and trends. To gain a deeper insight into the measurement of retail sales, it is crucial to consider the various components involved in this intricate process.

Diverse Retailers

Retail sales encompass an extensive range of products and services, transacted through numerous retail channels. These channels span traditional physical stores to the rapidly expanding e-commerce domain, catering to distinct consumer requirements. Retailers can be broadly classified into different sectors, each representing a unique facet of the retail market. These sectors encompass:

- Grocery and Food Retailers: Encompassing supermarkets, convenience stores, and specialty food shops, this category covers essential purchases such as groceries, beverages, and fresh produce.

- Apparel and Fashion Retailers: This category includes clothing stores, footwear outlets, and boutiques, serving consumers’ fashion and clothing needs.

- Electronics and Technology Retailers: Both physical electronics stores and online platforms offer consumer electronics, gadgets, and tech accessories.

- Automobile Dealerships: Devoted to the sale of new and used vehicles, along with related services like maintenance and repair.

- Home Furnishing and Home Improvement Stores: Encompassing furniture stores, home decor shops, and outlets selling materials for home improvement projects.

- Entertainment and Leisure Retailers: These include movie theaters, video game stores, sporting goods retailers, and others meeting consumers’ recreational and entertainment needs.

- Health and Wellness Retailers: Pharmacies, fitness equipment stores, wellness centers, and similar establishments offer products and services related to health and well-being.

Weighted Categories in Retail Sales Index

To accurately represent the significance of these diverse sectors within the broader economy, economists and statisticians employ a Retail Sales Index (RSI). The RSI categorizes retail sales into weighted segments, with each segment reflecting its proportion of total retail sales. The assignment of weight to each category is determined by its economic importance.

For instance, sectors like automobiles and electronics, which often involve substantial transactions, receive higher weightings in the index due to their potential to significantly impact the economy. Conversely, categories like groceries, representing more stable and essential consumer spending, also receive weightings but may exhibit a lower volatility index.

Evolving Categories Reflecting Market Dynamics

The composition of these weighted categories within the retail sales index is subject to change over time. This evolution mirrors shifting consumer preferences, technological advancements, and market dynamics. A notable example of this evolution is the recent ascent of e-commerce.

As online retailers have gained prominence and reshaped the retail landscape, the weightings within the retail sales index have adjusted. E-commerce has witnessed substantial growth, resulting in an augmented weight in the index. This transformation underscores the evolving shopping patterns of consumers and underscores the significance of digital commerce in contemporary retail.

Interpreting Retail Sales Data

A comprehensive grasp of the composition of these weighted categories is imperative for accurately interpreting retail sales data and identifying emerging trends in consumer behavior. When analyzing retail sales figures, economists and market analysts closely monitor changes in category weightings and the performance of individual sectors. This analysis aids in discerning alterations in consumer preferences, economic trends, and potential areas of economic expansion or contraction.

Measuring retail sales entails the monitoring of consumer purchases across a broad spectrum of retail sectors, each serving distinct consumer needs. These sectors are classified into weighted segments within the retail sales index, reflecting their economic importance. The dynamic nature of these categories underscores the ever-evolving retail landscape and its ramifications for the broader economy. A precise interpretation of retail sales data necessitates a keen understanding of these categories and their evolving dynamics, offering invaluable insights into consumer behavior and economic trends.

Understanding Retail Sales and Their Dance with Inflation

When it comes to evaluating an economy’s well-being, retail sales figures undoubtedly play a pivotal role. They offer a direct window into consumer spending behaviors, granting us insights into trends, preferences, and economic vitality. However, lurking beneath these numbers is a crucial economic element that must never be underestimated: inflation.

The Intricate Role of Inflation

Inflation, the gradual uptick in the general price level of goods and services over time, quietly reshapes the economic landscape. It nibbles away at a nation’s currency’s purchasing power, meaning that as prices ascend, each unit of money fetches fewer goods and services. Understanding how inflation intertwines with retail sales data is paramount for gaining a precise and genuine understanding of a country’s economic stance.

The Unadorned Retail Sales Data

In their raw form, retail sales figures remain untouched by the specter of inflation. In simpler terms, when you observe a surge in retail sales, it doesn’t necessarily imply heightened consumer purchasing power. In essence, the uptick in the total expenditure on goods and services might be merely a consequence of rising prices rather than a genuine uptick in consumer demand or economic growth.

The Peril of Overlooking Inflation

Neglecting inflation when dissecting retail sales data can cast a distorted lens on economic growth and consumer well-being. Consider this straightforward illustration:

Imagine a year where retail sales have soared by 5%. At first glance, this might seem indicative of robust economic growth and heightened consumer activity. However, if the inflation rate for that same year also stood at 5%, it means that consumers were essentially buying the same quantity of goods and services as the previous year, but at inflated prices. In reality, their purchasing power remained unchanged, despite the apparent surge in retail sales.

Cracking the Code of Purchasing Power

Purchasing power stands as a pivotal concept in the realm of economics. It signifies the tangible value of money and the capacity of consumers to acquire goods and services. To accurately gauge the impact of retail sales, it becomes imperative to assess whether consumers are gaining or relinquishing their purchasing power.

In an environment characterized by soaring inflation, even when retail sales exhibit growth, individuals might encounter increasing challenges in maintaining their accustomed standard of living. Their money doesn’t stretch as far as it once did, and they might need to allocate a more substantial portion of their income to cover the escalating costs of essentials like housing, healthcare, and sustenance.

The Imperative of Factoring in Inflation

For a holistic and precise comprehension of a nation’s economic status, adjusting retail sales data for inflation is non-negotiable. This adjustment, commonly referred to as “real” retail sales, encompasses alterations in both the nominal value of sales (the actual dollars spent) and the purchasing power held by those dollars.

By taking inflation into account, analysts can dissect whether retail sales growth is spurred by heightened consumer demand, escalating prices, or a combination of both. This nuanced approach bestows a more accurate evaluation of economic circumstances and the well-being of consumers.

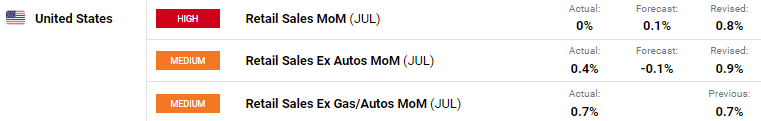

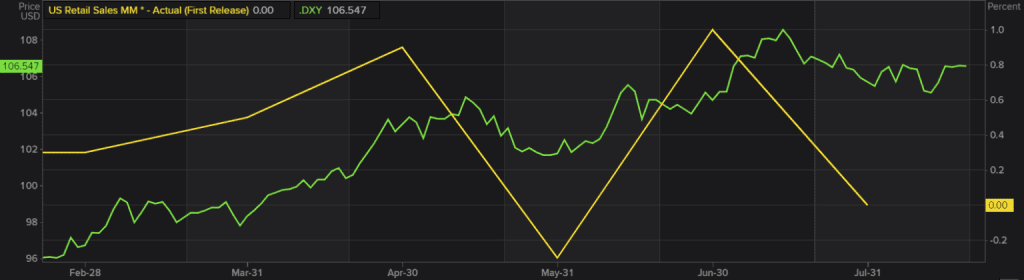

Souce: DFX

While retail sales data furnishes invaluable insights into consumer spending behaviors and economic dynamism, it should eternally be scrutinized in tandem with a profound understanding of inflation’s sway. Neglecting the influence of rising prices on retail sales can lead to erroneous conclusions about economic expansion and consumer welfare. To authentically assess an economy’s state and its populace’s welfare, pondering consumers’ genuine purchasing power in conjunction with unprocessed retail sales figures is indispensable. Only then can policymakers, economists, and investors craft judicious strategies aligned with the veritable economic panorama.

Trading Retail Sales in the Equity Markets: Harnessing Economic Indicators

In the realm of equity markets, where investors seek to make well-informed decisions to optimize their returns, comprehending the interplay between retail sales and stock performance holds immense value. Retail sales, revered as a leading economic indicator, offer crucial insights into the potential future trajectory of specific sectors and companies, particularly those intricately linked to consumer spending. Let’s explore how retail sales impact equity markets and why this understanding stands as a precious asset for stock investors.

Tracing Historical Connections

Over the course of history, discernible correlations have emerged between retail sales data and stock market performance, especially within sectors deeply intertwined with consumer spending. The automotive industry serves as an illustrative example of this relationship.

Consider prominent automakers like Ford and General Motors. Their fortunes are intricately tied to consumer demand for automobiles. When retail sales of cars surge and display upward momentum, these companies typically witness heightened profits and often, an appreciable rise in their stock prices. The logic is straightforward: robust retail sales signal a confident consumer base, more inclined to invest in new vehicles, thereby benefiting automakers.

Source: DFX

A Direct Influence on Stock Prices

The influence of retail sales on stock prices within the automotive sector is notably straightforward. When consumers display confidence and an inclination to spend, automakers can move more vehicles, bolstering their revenue and profitability. This, in turn, can propel stock prices higher, as investors perceive these companies as more valuable and lucrative. The positive correlation between retail sales and stock performance in these sectors is a firmly established phenomenon.

A Cautionary Indicator of Potential Headwinds

Conversely, a dip in retail sales can serve as a cautionary indicator for companies operating within consumer-centric sectors. When retail sales of cars and other consumer goods decline, it can signify impending challenges for businesses reliant on consumer expenditure. In such scenarios, investors might adopt a cautious stance, contributing to a slump in stock prices for these enterprises.

An Enlightened Investment Approach

Comprehending the nexus between retail sales and equity markets stands as a pivotal instrument for stock investors. It empowers them to make judicious decisions when assessing investments in specific sectors or individual companies. Here are several pivotal ways in which this knowledge can be applied:

- Sector Allocation: Investors can strategically distribute their investments by favoring sectors poised to gain from robust retail sales. During periods of vigorous consumer spending, allocating a portion of the portfolio to consumer discretionary or retail-associated sectors could prove to be a prudent move.

- Stock Selection: When handpicking individual stocks, investors can evaluate a company’s sensitivity to retail sales. Businesses heavily reliant on consumer spending should undergo closer scrutiny, with their financial well-being considered alongside retail sales trends.

- Risk Management: Recognizing the potential repercussions of dwindling retail sales on stock prices allows investors to employ risk management strategies. Diversification and stop-loss orders, for instance, can shield investments from potential downturns.

- Market Timing: Investors might incorporate retail sales data into their market timing strategy. Robust retail sales could be interpreted as a signal to enter the market or amplify exposure to sectors closely linked to consumers, while a drop in retail sales might warrant a more cautious approach.

The symbiotic relationship between retail sales and equity markets stands as an invaluable asset for stock investors. It serves as a compass for investment decisions, informs portfolio allocation tactics, and acts as an early warning system when economic challenges loom on the horizon. By harnessing this knowledge, investors can navigate the dynamic universe of equity markets with heightened confidence and a more profound understanding of the driving forces behind stock performance within consumer-oriented sectors.

Forex Markets and the Currency Effects of Economic Indicators

The dynamic foreign exchange (Forex) market is where currencies from around the globe are bought and sold by traders and investors. Within this intricate realm, economic indicators hold a central role in shaping currency values. Retail sales data, a pivotal economic indicator, wields significant influence over the Forex markets. Grasping how retail sales figures can sway currency valuations and impact central bank decisions is paramount for Forex participants.

Market Volatility and Retail Sales

The unveiling of retail sales figures has the potential to spark market volatility within the Forex arena. Market players meticulously analyze this economic data because it furnishes invaluable insights into a nation’s economic well-being and consumer sentiment. Upon the release of retail sales data, it can induce swift price movements in currency pairs.

Consider a scenario where a country reports robust retail sales data. This signals a robust economic performance and consumer confidence, portraying a thriving domestic market. Consequently, foreign investors may flock to invest in this economically sound nation, driving up the value of its home currency.

In contrast, lackluster retail sales figures can erode a nation’s currency strength. If consumers are not spending as anticipated, it implies potential economic hurdles, motivating investors to seek more promising investment avenues elsewhere. Consequently, the currency may depreciate as foreign capital flows out of the nation.

The Role of Central Banks

The impact of retail sales data on Forex markets extends beyond immediate market reactions. Central banks, such as the U.S. Federal Reserve, scrutinize retail sales figures when formulating monetary policy decisions.

- Interest Rate Determination: Robust retail sales figures can directly influence a central bank’s interest rate policies. If retail sales indicate vigorous economic growth, central banks may opt for interest rate hikes. These rate hikes are implemented to temper the economy and counteract potential inflation stemming from increased consumer spending.

- Stimulative Rate Cuts: Conversely, when retail sales figures are weak, central banks may opt for interest rate reductions to stimulate economic growth. Lower interest rates can make borrowing cheaper, thus encouraging consumer spending and reinvigorating economic activity.

- Currency Impact: These interest rate decisions, influenced by retail sales data among other factors, can wield a substantial impact on a nation’s currency value. Higher interest rates are apt to attract foreign investment, fostering currency appreciation, while lower rates may lead to depreciation.

Forex Trading Strategies

For Forex traders, grasping the interplay between retail sales data, central bank actions, and currency values is vital for crafting effective trading strategies. Here are some ways traders can harness this knowledge:

- Event Trading: Traders often engage in event trading, positioning themselves ahead of key economic indicator releases, such as retail sales data. They anticipate market reactions and aim to capitalize on price fluctuations immediately following the data’s release.

- Fundamental Analysis: Retail sales data serves as a fundamental analysis tool, aiding in the assessment of overall economic health. Traders who incorporate fundamental analysis consider economic indicators like retail sales in their decision-making process.

- Central Bank Monitoring: Forex traders closely monitor central bank meetings and announcements. Understanding how central banks interpret retail sales data and the subsequent policy decisions can offer insights into currency trends.

In conclusion, retail sales data stands as a potent catalyst for volatility in the Forex markets. Forex traders and investors closely track the release of this economic indicator, as it offers valuable glimpses into consumer sentiment and economic well-being. The repercussions of retail sales on currency values reach into central bank decisions, where interest rates are adjusted in response to economic conditions unveiled by this data. A comprehensive comprehension of these dynamics is indispensable for those navigating the intricate and ever-evolving realm of Forex trading.

How to Utilize Retail Sales Data Across Diverse Financial Markets

Retail sales data is an adaptable and invaluable macroeconomic metric that transcends the boundaries of various financial markets. Whether you’re an equity investor, a Forex trader, a participant in commodities, or engaged in the fixed income arena, mastering the art of utilizing retail sales data can provide you with a competitive edge in your financial pursuits. Let’s delve into the multifaceted applications of this data across distinct market types, empowering you to craft astute trading strategies and investment decisions.

Insights for the Stock Market

In the stock market, retail sales data serves as a potent tool for investors seeking to identify sectors and companies poised to benefit from heightened consumer spending. Here’s how investors can harness this data:

- Sector Analysis: Scrutinizing retail sales trends provides insights into sectors experiencing increased consumer activity. This knowledge guides investment decisions, aiding in resource allocation to sectors with robust growth potential. For example, a surge in retail sales within the technology sector may suggest investment opportunities in tech-related stocks.

- Stock Selection: Going further, investors can pinpoint individual companies within prospering sectors based on robust retail sales data. For instance, an uptick in retail sales of home improvement products may steer investors toward specialized companies in this sector.

- Spotting Trends: Retail sales data unveils emerging trends in consumer behavior, be it related to e-commerce, sustainable products, or digital entertainment. These trends offer investment opportunities aligned with evolving consumer preferences.

Strategies for the Forex Market

In the Forex market, traders can harness the potency of retail sales data to execute well-informed currency trades. Here’s how:

- Currency Analysis: Retail sales data provides critical insights into a nation’s economic performance and consumer sentiment. Traders employ this information to evaluate the relative strength of various currencies. Strong retail sales, for instance, may indicate a robust economy, prompting traders to take bullish positions on the currency.

- Event Trading: Forex traders frequently engage in event trading, positioning themselves ahead of retail sales data releases. Anticipating market reactions empowers traders to capitalize on immediate price fluctuations post-data announcement.

- Central Bank Influence: Understanding how central banks interpret retail sales data and how it influences their policy decisions is imperative for Forex traders. Interest rate adjustments, influenced by economic conditions illuminated by retail sales figures, significantly impact currency values.

Insights for the Commodity Market

Commodity traders can leverage retail sales data to assess demand for specific goods. Here’s how:

- Demand Assessment: Retail sales data offers invaluable insights into consumer demand for various products. For instance, robust retail sales of electronic devices may signify heightened demand for metals used in their production, such as copper or rare earth metals.

- Price Movements: As consumer demand directly impacts certain commodities, retail sales data can influence commodity prices. Commodity traders incorporate retail sales data into their analysis when predicting price movements.

Considerations for the Fixed Income Market

In the fixed income market, retail sales data can provide insights into potential interest rate movements. Here’s how it can be applied:

- Interest Rate Expectations: Strong retail sales data may lead central banks to consider interest rate hikes as a preventive measure against potential inflation. Fixed income investors use this data to anticipate fluctuations in interest rates, which can impact bond prices and yields.

- Bond Strategy: Bond investors adapt their strategies based on retail sales data. For instance, in anticipation of rising interest rates, investors may opt for shorter-duration bonds to mitigate interest rate risk.

Retail sales data stands as a versatile economic indicator, offering invaluable insights across an array of financial markets. By grasping how to interpret and apply this data in equities, Forex, commodities, and fixed income, traders and investors equip themselves to make informed decisions and strategically position in their respective markets. Whether you seek investment prospects, currency trades, or commodity insights, retail sales data stands as a potent addition to your financial toolkit.

Conclusion

In summary, gaining a holistic perspective on a nation’s economic well-being necessitates a grasp of retail sales, a pivotal economic gauge mirroring consumer spending patterns and economic robustness. Vigilantly tracking retail sales and acknowledging their repercussions on inflation, monetary policy, and trade balance empowers investors and traders to craft well-informed choices spanning diverse financial markets. Retail sales data stands as a versatile asset enriching market analysis strategies, allowing individuals to navigate the intricate realm of finance with enhanced assurance.

Click here to read our latest article on How Psychology Empowers Forex Currency Trading Success

FAQs

- What are Retail Sales? Retail sales refer to the total value of goods and services sold to consumers in a given period, typically by businesses in the retail sector.

- Why are Retail Sales Important? Retail sales are crucial because they provide insights into consumer spending behavior, which drives economic activity and influences various sectors.

- How are Retail Sales Measured? Retail sales are measured using data collected from a wide range of retailers and are often categorized into weighted segments based on their economic significance.

- What is the Significance of Core Retail Sales? Core Retail Sales exclude volatile categories like automobiles and gasoline, offering a more stable view of consumer spending trends.

- How Do Retail Sales Affect the Stock Market? Retail sales can impact the stock market, particularly in sectors influenced by consumer spending, such as the automotive industry.

- What’s the Connection Between Retail Sales and Forex Markets? Retail sales data can influence currency values in the Forex market, as strong or weak sales indicate economic health and consumer sentiment.

- How Does Retail Sales Data Affect Commodity Prices? Retail sales data can help assess demand for specific goods, which, in turn, can affect commodity prices, especially for raw materials.

- What Role Does Retail Sales Data Play in Fixed Income Investments? Retail sales data can provide insights into potential interest rate movements, impacting bond prices and yields.

- Is Retail Sales Data Adjusted for Inflation? No, retail sales data is typically not adjusted for inflation, so it’s essential to consider inflation’s impact on consumer purchasing power.

- How Can I Use Retail Sales Data in My Investment Strategy? Investors and traders can use retail sales data to identify trends, sectors, and companies poised for growth or potential challenges in various markets.

Click here to learn more about about Retail Sales