Introduction

The Forex realm mirrors a massive, ever-shifting sea, where market tides alter with each news announcement. In this fluctuating setting, “trading the news before the release” stands out as a stable lighthouse for those in the trading arena. Even though it may not ignite the rush associated with trading post-release, its essence is rooted in its systematic and deliberate methodology.

Choosing to act prior to significant news announcements lets traders explore a lesser-known market segment. This span, marked by growing expectations and speculative moods, is rich with nuanced indicators. These fine-tuned market changes provide discerning traders with unparalleled perspectives.

Trading before a news release is not merely about immediate gains. It’s a strategic effort to grasp the market’s deeper movements, predict forthcoming trends, and adjust one’s position proactively. Here, traders aren’t just responding to market shifts; they’re mapping out their path, transforming potential challenges into actionable insights.

Forex Landscape Insights into Trading Before a News Release

Steering through the Forex market is like navigating a vessel across turbulent seas, particularly in the whirlwind of news announcements. The ripples of unpredictability generated by such releases can overwhelm even the most seasoned traders if caught off-guard. Yet, in the calm preceding these turbulences—when focusing on trading before the news release—a universe of hidden opportunities emerges.

This calm, often overlooked due to impending news, is a goldmine for the observant. Trading before the news release provides a distinct perspective, a fleeting chance to discern, evaluate, and decide without the intense market reactions. Perfect timing, coupled with a thought-out strategy, can shape one’s trajectory in line with predicted market changes.

But to harness this pre-release period’s magic, one needs more than just awaiting the news. It’s about feeling the market’s heartbeat, capturing emergent patterns, and noting nuanced shifts in trader emotions. Metrics and tools become indispensable, offering hard data to guide intuition.

The 10-day SMA (simple moving average) is often a go-to for many on this journey. Though straightforward, it provides profound insights into market momentum and possible trend trajectories. By analyzing the SMA and similar tools, traders can form a more vivid market picture. This comprehension aids in the design of strategies that are forward-thinking, ensuring that they ride the waves of success amidst market tempests.

Strategies for Trading Before a News Release

Venturing into Forex without a roadmap is akin to entering treacherous waters unguided. Given that news releases can be potential game-changers, understanding how to operate during the preceding tranquility is paramount. Here are two primary strategies for traders during the pre-release phase:

Pre-Release Trend Following Strategy

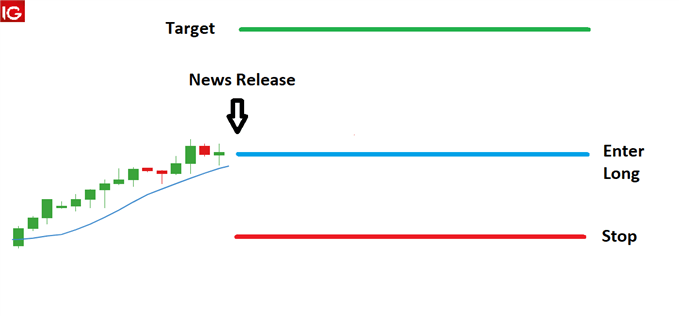

“Go with the flow until it’s time to row,” echoes the wisdom of trading circles. The pre-release trend following strategy embodies this principle. Rather than forecasting the next market shift, it underscores the importance of moving with the ongoing momentum, capitalizing on it before disruptive news alters the course.

The 10-day SMA is central to this strategy, providing insights into the market’s rhythm. By comparing prices with the 10-day SMA, traders can decipher prevailing market sentiments. If prices hover above the SMA, it hints at a bullish outlook, suggesting an upward trend. Conversely, prices below the SMA hint at a bearish atmosphere. Equipped with this intel, traders can position their trades in harmony with the market direction, hoping the forthcoming news aligns with or doesn’t drastically alter the current flow.

Of course, unexpected news can cause waves. To mitigate this, protective measures, like stop-loss orders, are crucial, serving as safety nets in volatile conditions.

Pre-Release Calm Strategy

Contrasting with the trend-riding approach is the pre-release calm strategy. It’s about seeking those moments of stillness in the Forex ocean right before significant announcements, such as the US non-farm payrolls, disrupt the equilibrium.

This strategy emphasizes capitalizing on the subdued atmosphere and reduced trade volume. A sharp eye is required to pinpoint essential support and resistance levels, guiding potential entry and exit strategies.

In essence, while the trend following strategy is about flowing with currents, the calm strategy is about anchoring securely, observing, and acting when assured of the environment. Each approach offers traders distinct ways to leverage the pre-release period, readying them for any Forex surprises.

Deciphering Market Patterns: Trading Before a News Release

Forex resembles a vast sea with news announcements as the driving winds. For traders, discerning when to act is essential. Here, the art of trading before the news release shines as a guidepost, leading traders away from potential upheavals.

Opting to trade in the hours leading up to major news is like a chess master contemplating moves ahead of a critical match. This window is free from the sudden shifts, granting traders the clarity to strategize. Such moments, preceding the release, empower traders to shape their trade landscape, readying them for probable market evolutions.

The Forex domain during these quieter times offers a plethora of opportunities. The pre-release calm strategy, especially before events like the US non-farm payrolls, gives traders a unique perspective to tap into these patterns. Whereas, for those leaning towards riding market momentum, the pre-release trend following strategy becomes their playbook.

Yet, in every trade endeavor, unpredictability looms. Market undercurrents or whispers of impending announcements can introduce unexpected shifts. The key is to remain vigilant, having multiple strategies at hand. As traders chart their path in Forex, the goal is not merely to sail but to become adept navigators.

Conclusion

Trading before a news release is a craft refined through comprehension, patience, and continuous evolution. By tapping into tools like the 10-day SMA and strategies such as the pre-release calm and trend-following approaches, traders can harness the predictability and potential that this specific trading window offers. However, as with all trading methodologies, it is crucial to remain vigilant, adaptable, and always prioritize risk management. In the dynamic world of trading, success often hinges on the ability to merge solid strategy with timely responsiveness. Embracing these principles while trading before news events can lead to more informed decisions and, ultimately, better outcomes in the market.

Click here to read our latest article on Common Mistakes to Avoid When Using Forex Trading Bots

FAQs

- Why is it beneficial to trade prior to the news release? Trading before the news release presents an opportunity for traders to assess and align their strategies in a less volatile scenario. This approach offers traders the advantage of predicting possible market trajectories based on prevailing trends and feelings.

- How does the 10-day SMA contribute to trading strategies before a news event? The 10-day SMA serves as a reliable metric for determining short-term market movements. When market prices are above the SMA, it generally points to an upward trend, and when below, it indicates a potential decline. This tool guides traders in making educated choices ahead of a news announcement.

- Is it wise to solely depend on the pre-release trend following strategy for successful trades? While the pre-release trend following strategy holds significant potential, it’s not advisable to exclusively lean on a single tactic. For best results, traders should diversify their methodologies and remain flexible to market shifts.

- How does the pre-release calm strategy differentiate from the trend-following one? The pre-release calm strategy is geared towards capitalizing on short-lived market ranges in the peaceful intervals leading up to a news event, especially pivotal ones like the US non-farm payrolls. On the other hand, the trend-following approach focuses on leveraging the momentum of existing market trends.

- In trading before the news release, how vital is it to manage risks? It’s of paramount importance. Even though trading prior to the news release can provide a more structured environment, there’s always the chance of unforeseen variables adding unpredictability. Therefore, leveraging risk management tools, such as stop-loss orders, becomes crucial.

- Are there particular economic occurrences that are best suited for the pre-release calm strategy? Indeed, the subdued intervals preceding major declarations, like the US non-farm payrolls, are optimal moments for applying the pre-release calm strategy, primarily because of the reduced market turbulence during these times.

- Is it possible for sudden volatility to impact pre-release trading methodologies? Definitely. The relative predictability offered by trading before the news release doesn’t make it immune to unexpected shakeups, be it from unanticipated global happenings or market rumors. This highlights the importance of always being prepared with risk management.

- When trading prior to a news event, how often should I refer to the 10-day SMA? The 10-day SMA is an indispensable metric for analyzing short-term trends. For those considering pre-release trading, it’s beneficial to consult it consistently to obtain an accurate reading of market momentum.

- How does the pre-release trend following approach respond to news that resonates with market anticipations? If the news complements the market’s anticipations, the pre-release trend following strategy is typically advantageous, as the market’s direction often remains consistent, experiencing minimal disturbances.

- How should I choose between the pre-release calm strategy and the trend following approach? Your decision should be influenced by the present market climate and your risk tolerance. If the market showcases evident trends, the trend following technique might be suitable. In contrast, during more tranquil phases, especially ahead of significant disclosures like the US non-farm payrolls, the calm strategy could yield better outcomes. Always gauge the market dynamics and your affinity with each strategy before making a choice.

Click here to learn more about Trading the News Before the Release