Introduction to Rare Earth Economics

In the realm of global economics, few resources carry as much strategic significance as rare earth elements. These exceptional minerals play a vital role in the foundation of modern technology, fueling a wide spectrum of devices from smartphones to electric vehicles. This exploration of “Rare Earth Economics” aims to delve into the intricate supply dynamics of these indispensable minerals and their far-reaching effects on forex markets.

This all-encompassing guide will not only illuminate the importance of rare earth elements but also scrutinize the pivotal role played by China in the rare earth market, alongside the worldwide demand for these minerals. Furthermore, we will investigate the environmental consequences of rare earth mining and the extent of technological reliance on these elements, revealing the intricate and multifaceted nature of this critical subject.

Comprehending Rare Earth Elements

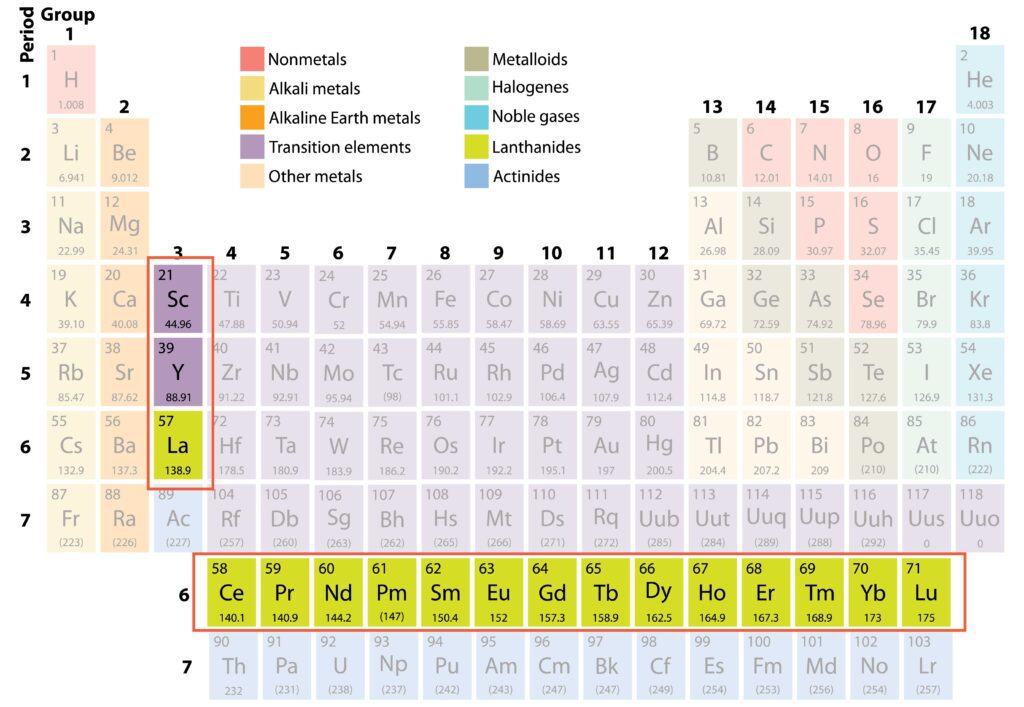

Rare earth elements, often referred to as “rare earths,” constitute a group of 17 chemically akin minerals, each possessing exceptional properties that are integral to contemporary industry. These minerals play a vital role in the creation of cutting-edge products and technologies that have become ubiquitous in our daily lives. With magnetic, luminescent, and conductive characteristics, rare earths are indispensable components in various technological applications.

Comprising 15 lanthanides along with scandium and yttrium, rare earth elements have permeated numerous devices and technologies. From the minuscule magnets within smartphone speakers to the robust magnets propelling wind turbines for renewable energy generation, rare earths are the unseen force behind countless innovations. Their luminescence enhances flat-panel display screens, while their conductivity facilitates the miniaturization of electronic components. Consequently, the demand for rare earths has surged, positioning them as the linchpin of modern technology.

Forex Market: A Comprehensive Overview

Concurrently, the foreign exchange (forex) market stands as the preeminent global financial market, facilitating the continuous exchange of currencies that reflects the relative strengths and weaknesses of nations’ economies. This dynamic marketplace is highly responsive to a plethora of factors, and its fluctuations wield profound influence over international trade, investments, and economic stability.

The forex market functions as a delicate ecosystem, subject to a wide array of variables. Economic indicators such as GDP growth, employment figures, and inflation rates carry immense weight. Geopolitical events, encompassing elections, trade negotiations, and diplomatic tensions, have the capacity to swiftly alter currency values. Additionally, commodities like rare earth elements exert a pivotal role in shaping the forex market’s intricacies.

Rare Earths’ Impact on Forex Markets

Rare earth elements, though often operating behind the scenes, represent indispensable commodities. The global supply of these elements is far from uniform, with China holding significant sway over production. This supply asymmetry can generate ripples in forex markets, particularly in nations reliant on rare earth imports for their high-tech industries. Sudden disruptions or alterations in supply can trigger currency valuation fluctuations, impacting trade balances and economic equilibrium.

As we embark on a deeper exploration of the complex relationship between rare earth elements and forex markets, it becomes evident that the significance of these minerals transcends the realms of mere scientific curiosity. Rare earth economics encompasses a multifaceted domain that permeates the core of our technological universe, resonating throughout the intricate fabric of global financial systems. Mastery of this interplay is imperative for policymakers, investors, and all individuals intrigued by the ever-evolving landscape of contemporary economics.

Rare Earth Elements Supply Dynamics

Understanding the complexities of rare earth elements supply is essential to grasp their impact on forex markets.

Global Distribution and Sources of Rare Earth Elements

Rare earth elements are not uniformly distributed across the world. China, in particular, holds a dominant position in rare earth production. Recognizing the geographical distribution of these elements is crucial for comprehending their implications on forex markets.

While China plays a significant role in rare earth production, other countries also contribute to the global supply. Awareness of these sources and their production capacities is vital. The distribution of rare earth deposits has strategic implications for nations involved in high-tech industries.

Major Rare Earth Producing Countries

Countries like the United States, Australia, and a select few others are major players in rare earth production, alongside China. The production levels in these nations have a substantial impact on the global supply chain. Changes in production, export policies, or trade dynamics within these countries can reverberate through the global supply and subsequently affect forex markets.

Diversifying rare earth production among these major players is a key consideration for those monitoring forex markets. Shifts in production patterns or strategic decisions by these nations can have ripple effects in the forex market, leading to currency valuation adjustments.

Technological Dependence on Rare Earth Elements

Modern technology relies heavily on rare earth elements. These minerals are integral to advanced electronics, renewable energy systems, and defense technologies. High-tech industries crucial to our contemporary world depend on the unique properties of rare earths for innovation and progress.

Disruptions or interruptions in the supply chain of rare earth elements can have profound consequences for these critical sectors. Such disruptions may arise from geopolitical tensions affecting access to rare earth resources or environmental regulations impacting mining operations. Scarcity or uncertainty in the supply of rare earths can result in production delays, increased costs, and fluctuations in forex rates.

In summary, comprehending the supply dynamics of rare earth elements is fundamental to understanding their impact on forex markets. The concentration of production, the roles of major producing countries, and the technological dependence on these elements all contribute to the intricate relationship between “Rare Earth Economics” and forex market dynamics. Staying well-informed about the supply aspects of rare earths is essential for investors, policymakers, and market participants navigating this complex landscape.

Impact on Forex Markets

To grasp the influence of “Rare Earth Economics” on forex markets, it’s imperative to dissect the intricate connection between these factors.

How Rare Earth Supply Influences Forex Markets

Rare earth supply dynamics are tightly interwoven with forex markets. The ebb and flow of rare earth supply can trigger fluctuations in currency valuations, particularly in countries heavily reliant on these minerals.

The rarity and strategic significance of rare earth elements mean that any disruptions or alterations in their supply chain can send ripples across the forex market. Nations heavily dependent on rare earth imports for their high-tech industries may experience shifts in currency values when faced with supply uncertainties. Given the forex market’s sensitivity to economic and geopolitical events, changes in rare earth supply can have swift and far-reaching effects.

Case Studies: Countries’ Forex Responses to Rare Earth Dynamics

Examining real-world instances offers invaluable insights into the intricate relationship between rare earth elements and currencies.

One noteworthy case study revolves around China’s rare earth export policies. China’s dominant position in rare earth production and export places it at the center of global supply. Any modifications in China’s export policies, whether driven by trade disputes or domestic considerations, can exert substantial impacts on forex markets worldwide. The examination of China’s rare earth export policies sheds light on the complex interplay between this critical resource and forex market dynamics.

Similarly, Japan’s response to rare earth supply challenges provides practical lessons in managing forex markets. Japan, a major consumer of rare earth elements, confronted supply disruptions in the past. These disruptions prompted strategic actions to secure rare earth resources and mitigate their impact on forex markets. The analysis of Japan’s strategies offers a real-world perspective on how nations navigate the intricacies of rare earth supply within the forex context.

In summary, comprehending the influence of rare earth supply on forex markets is indispensable for those intrigued by the convergence of commodities and currency valuations. The scarcity and strategic importance of rare earth elements render them a pivotal factor in the forex landscape, especially for countries heavily reliant on these minerals. Real-world case studies, exemplified by China and Japan, furnish invaluable insights into understanding the nuances of this relationship and its implications for effective forex market management.

Key Factors Influencing Rare Earth Supply

To gain a comprehensive understanding of the intricate interplay between “Rare Earth Economics” and its influence on forex markets, it’s crucial to dissect the pivotal factors that shape rare earth supply.

Mining Policies and Environmental Regulations

Mining policies and environmental regulations wield substantial influence over the production of rare earth elements. These regulatory frameworks not only impact the mining industry but also have far-reaching consequences for the availability of rare earths in the global market.

The imposition of stricter environmental regulations, designed to mitigate the ecological impact of rare earth mining, can potentially constrain the supply of these vital minerals. Mining operations that fail to adhere to stringent environmental standards may face closures or reduced production capacity. These limitations can disrupt the rare earth supply chain, leading to potential shortages and, consequently, reverberations in forex markets.

From a forex market perspective, fluctuations in rare earth supply due to mining policies and environmental regulations can manifest as changes in currency valuations. Nations heavily reliant on rare earth imports may experience currency fluctuations in response to supply disruptions, affecting their trade balances and overall economic stability. Forex participants, including traders and investors, must closely monitor these regulatory developments as they can significantly impact trading strategies and currency portfolios.

Technological Advancements in Rare Earth Extraction

Technological innovations play a pivotal role in shaping the rare earth supply landscape. Advances in extraction methods have the potential to substantially influence the availability of these critical minerals in the market.

Innovations in rare earth extraction technologies can lead to increased efficiency and reduced production costs, potentially bolstering the supply of rare earth elements. These advancements may also encompass more sustainable and environmentally friendly extraction processes, aligning with global efforts to minimize the ecological footprint of rare earth mining.

For forex markets, technological progress in rare earth extraction introduces an element of supply predictability. More efficient extraction methods can result in a more stable supply chain, potentially mitigating supply-related fluctuations in the forex market. Investors and traders may find greater confidence in the currency valuations of nations that adopt advanced extraction technologies, as these innovations can enhance supply security.

In summary, understanding the key factors that influence rare earth supply, including mining policies, environmental regulations, and technological advancements, is fundamental to comprehending the intricate relationship between rare earth elements and forex markets. These factors can introduce both volatility and stability into the rare earth supply chain, ultimately impacting currency valuations and trade dynamics on the global stage. Staying well-informed about developments in these areas is essential for individuals navigating the complex landscape of “Rare Earth Economics” within the forex market context.

The Significance of Major Consumers and Producers

To obtain a holistic understanding of the intricate connection between “Rare Earth Economics” and its impact on forex markets, it is essential to explore the roles played by major consumers and producers of rare earth elements.

China’s Dominance in the Rare Earth Market

China’s unmatched dominance in rare earth production bestows upon it a significant influence over global supply and pricing dynamics. This pivotal role necessitates a deeper analysis of its wide-ranging effects on forex markets.

China not only boasts abundant rare earth resources but also controls a substantial portion of the global production and export market. Its policies, production levels, and export decisions can trigger substantial shifts in the rare earth supply chain. Any alterations in China’s approach, whether driven by trade disputes, environmental considerations, or domestic priorities, can result in supply disruptions that resonate throughout forex markets on a global scale.

From a forex market perspective, China’s position as a rare earth powerhouse introduces an element of currency valuation sensitivity. Countries heavily reliant on rare earth imports from China may experience currency fluctuations in response to supply variations. These fluctuations can impact trade balances, economic stability, and trading strategies within the forex market.

Emerging Rare Earth Producers

The landscape of rare earth production is undergoing gradual transformation with the emergence of new players. These emerging producers are challenging the existing dynamics and introducing competitiveness into the rare earth market. Their growth potential and their subsequent influence on forex markets are topics of significant interest.

As these emerging producers expand their footprint in the rare earth market, they have the potential to diversify the supply chain. This diversification can enhance supply stability and reduce vulnerability to supply disruptions. Participants in the forex market should vigilantly monitor the growth trajectories of these emerging producers, as their actions can introduce new dimensions to the forex market’s rare earth sensitivity.

Major Consumer Nations and Their Forex Market Sensitivity

Nations that serve as major consumers of rare earths are not immune to forex market sensitivity. Understanding the intricate relationship between their currency values and supply fluctuations is crucial.

Countries heavily reliant on rare earth imports for their advanced industries may experience fluctuations in currency valuations in response to supply disruptions. These fluctuations can have direct ramifications for trade balances, economic stability, and the behavior of the forex market.

Mastering how the currencies of major consumer nations respond to changes in rare earth supply is imperative for participants in the forex market. This understanding empowers traders and investors to make well-informed decisions and formulate strategies that account for the potential impact of supply-induced currency fluctuations.

In summary, comprehending the roles assumed by major consumers and producers in the rare earth market is fundamental to unraveling the intricate relationship between rare earth elements and forex markets. China’s dominance, the emergence of new producers, and the forex market’s sensitivity to major consumer nations all contribute to the complex landscape of “Rare Earth Economics.” Staying well-informed about these aspects is paramount for effectively navigating the ever-evolving forex market within the context of rare earth dynamics.

Future Trends and Predictions

To obtain a holistic understanding of the intricate connection between “Rare Earth Economics” and its influence on forex markets, it is imperative to delve into the realm of future trends and predictions in this dynamic landscape.

Future Demand Projections for Rare Earth Elements

Future demand projections for rare earth elements provide invaluable insights into potential shifts in supply dynamics and their consequential impacts on forex market dynamics. Staying attuned to these projections is of paramount importance for market participants seeking to navigate this multifaceted terrain.

These projections offer a glimpse into the evolving demands of high-tech industries, renewable energy sectors, and defense technologies. As these industries continue to advance, their reliance on rare earths is expected to grow. Projections serve as a forward-looking lens, shedding light on the extent of this growth and its potential ramifications for supply chains.

From a forex market perspective, these demand projections introduce an element of foresight. Anticipating shifts in rare earth supply and demand enables investors and policymakers to brace for potential market dynamics. Currency valuations can be swayed by disruptions or surpluses in the supply of rare earths, and preparedness for such scenarios is pivotal in risk management and capitalizing on emerging opportunities.

Potential Impacts on Global Forex Markets

Envisioning potential scenarios for forex markets in the context of rare earth elements is an indispensable facet of proactive decision-making for both investors and policymakers. Being prepared for these transformations can help mitigate risks and harness opportunities in the perpetually evolving forex landscape.

As rare earth supply and demand dynamics undergo transformations, forex markets may witness fluctuations in currency valuations. Nations heavily reliant on rare earth imports may witness currency responses to fluctuations in supply and demand. These responses can reverberate through trade balances, economic stability, and the strategies adopted by participants in the forex market.

Furthermore, geopolitical factors can exert significant influence on rare earth dynamics and, consequently, forex markets. Trade disputes, export policies, and international collaborations can all shape the availability and pricing of rare earths, thereby affecting currency valuations.

In summation, delving into future trends and predictions within the realm of “Rare Earth Economics” is essential for those navigating the intricate relationship between rare earth elements and forex markets. Projections regarding the future demand for rare earths offer vital insight into potential shifts in supply and demand dynamics. Understanding the potential repercussions of these shifts on global forex markets is paramount for investors and policymakers, enabling them to make well-informed decisions, manage risks effectively, and seize opportunities within this ever-evolving and dynamic landscape.

Strategies for Investors and Policymakers

To gain a comprehensive understanding of the intricate interplay between “Rare Earth Economics” and its profound influence on forex markets, it is imperative to explore strategic approaches for both investors and policymakers in this dynamic landscape.

Investment Opportunities in Rare Earth and Forex Markets

Investors with an eye on capitalizing on rare earth economics and forex market fluctuations should consider a range of investment opportunities. Diversifying investment portfolios across these domains can be a prudent strategy to mitigate risks and harness potential rewards.

- Rare Earth Investments: Investors intrigued by rare earths can explore various investment avenues within the rare earth industry itself. This may encompass investments in rare earth mining enterprises, rare earth element ETFs (Exchange-Traded Funds), or even physical rare earth assets. Such investments are intricately linked to the dynamics of the rare earth market and can yield returns based on shifts in supply and demand.

- Forex Market Investments: Forex markets offer a dynamic platform for investors to engage in currency trading. Currency pairs from nations heavily reliant on rare earth imports or exports can be particularly intriguing. By closely monitoring currency fluctuations driven by rare earth supply-related factors, investors can make well-informed forex market decisions to potentially profit from these movements.

- Diversification: Diversifying investment portfolios across both rare earth assets and forex market instruments serves as a risk management strategy. This approach enables investors to benefit from potential gains in rare earth markets while simultaneously hedging against potential losses through currency trading.

Policy Recommendations for Sustainable Supply Chains

Policymakers wield a pivotal role in ensuring the sustainability of rare earth supply chains, which, in turn, reverberates through forex markets. Implementing well-balanced policies that address economic interests alongside environmental considerations can yield advantages for both rare earth industries and forex markets.

- Environmental Regulations: Policymakers can establish and rigorously enforce environmentally stringent regulations within the rare earth mining and processing sectors. These regulations serve to mitigate the ecological impact of rare earth activities, fostering responsible resource extraction. Environmental sustainability contributes to long-term supply stability, thereby mitigating supply-related forex market volatility.

- Investment in Research and Development: Governments can incentivize research and development endeavors in rare earth recycling and alternative technologies. This reduces dependence on primary rare earth mining and promotes a circular economy approach to these critical minerals. Such initiatives enhance supply chain resilience and diminish vulnerabilities in forex markets related to supply disruptions.

- Trade Policies: Policymakers can engage in diplomatic efforts to ensure equitable and open trade in rare earths. Avoiding trade disputes and fostering international cooperation can stabilize rare earth supply chains, resulting in more stable forex market conditions.

- Support for Emerging Producers: Governments can provide support to emerging rare earth producers, encouraging competition and diversification in the market. This helps reduce reliance on a single dominant producer, enhancing supply chain resilience and decreasing sensitivity in forex markets.

In summary, strategic approaches for investors and policymakers in the context of “Rare Earth Economics” and forex markets are multifaceted. Investors can explore various investment opportunities to capitalize on rare earth dynamics and forex market fluctuations, while diversification aids in risk management. Policymakers play a pivotal role in ensuring the sustainability of rare earth supply chains through well-balanced policies that consider economic and environmental factors. These strategies contribute to a more stable and sustainable convergence of rare earth elements and forex markets, benefiting both industries and global economic stability.

Summarizing the Global Impact of Rare Earth Elements on Forex Markets

To summarize, the intricate interplay between rare earth elements and forex markets emphasizes the importance of a thorough comprehension of “Rare Earth Economics.” From China’s unparalleled position in the rare earth market to the worldwide demand for these elements, the consequences are extensive. Additionally, the environmental ramifications of rare earth mining and the technological reliance on these elements contribute depth to the discourse. As the global landscape continues to evolve in the realm of advanced technology, rare earths will retain their status as a pivotal factor in the broader global economic landscape.

Click here to read our latest article on Electric Aviation

FAQs

- What are rare earth elements, and why do they hold significant economic importance? Rare earth elements encompass 17 chemically similar minerals, including lanthanides, scandium, and yttrium. They are vital to various high-tech industries due to their unique properties, such as magnetism and luminescence. Their significance lies in their indispensable role in the production of advanced technology products.

- What characterizes China’s association with rare earth elements? China stands as the dominant force in rare earth element production, supplying a substantial portion of the global market. This dominance grants China significant influence over supply dynamics and pricing, making it a central player in the rare earth market.

- How does China’s pivotal role in the rare earth market impact the world of forex trading? China’s decisions regarding rare earth exports, trade policies, and production levels can trigger supply disruptions that ripple through currency valuations, especially in nations heavily reliant on these minerals.

- What is the global demand for rare earth elements, and how does it reverberate through forex markets? The global demand for rare earth elements continues to surge, propelled by high-tech industries. Shifts in demand can lead to supply fluctuations, subsequently influencing forex market dynamics, particularly in countries with significant rare earth imports or exports.

- What environmental consequences are associated with rare earth mining? Rare earth mining can entail substantial environmental impacts, including soil and water pollution. Stringent environmental regulations have the potential to constrict supply, potentially impacting forex markets.

- What underpins the technological reliance on rare earth elements? Rare earth elements are indispensable for the production of advanced electronics, renewable energy systems, and defense technologies. Supply chain disruptions can reverberate through these industries and, in turn, affect forex rates.

- How do mining policies and environmental regulations shape the rare earth supply landscape? Rigorous mining policies and environmental regulations can curtail the supply of rare earth elements, potentially leading to supply interruptions with ramifications for forex market dynamics.

- What investment prospects are linked to rare earth economics and forex markets? Investors can explore opportunities within rare earth mining firms, ETFs, and forex trading to leverage rare earth dynamics and currency fluctuations.

- How can policymakers contribute to the establishment of sustainable rare earth supply chains? Policymakers can institute and enforce stringent environmental regulations, allocate resources to research and development for recycling and alternative technologies, and offer support to emerging rare earth producers. These actions are essential for ensuring sustainable supply chains and stable forex markets.

- What outlook awaits the realm of rare earth economics and forex markets? The future outlook encompasses demand projections for rare earths, which can inform investment and policy decisions. Anticipating potential impacts on global forex markets arising from shifts in rare earth supply and demand is paramount for investors and policymakers to proactively prepare for market transformations.