Introduction to Forex Market Gaps

Forex Market Gaps are intriguing phenomena that every trader should master to enhance their trading success. In this comprehensive guide, we will delve into the world of Forex Market Gaps, explore various types of gaps, and discuss effective trading strategies to capitalize on them. Whether you’re a seasoned trader or just starting, understanding and mastering Forex Market Gaps can elevate your trading game.

Types of Market Gaps

Understanding the various types of market gaps is essential for traders seeking to navigate the Forex market effectively. Each type of gap offers unique insights into market dynamics and potential trading opportunities. Here, we will delve into the four primary types of Forex Market Gaps:

1. Common Gap

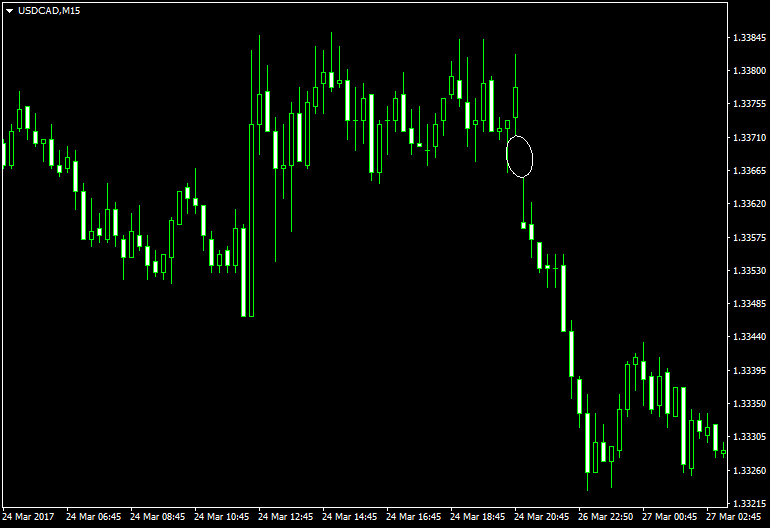

Common Gaps serve as a foundational element in the Forex market. These gaps occur when there is a noticeable price gap between the closing price of one candlestick and the opening price of the next. Common gaps are frequently observed during normal market conditions and often result from overnight trading.

Imagine a scenario where the Forex market closes at a certain price, and when it reopens, the opening price of the next candlestick is notably different. This disparity signifies a common gap. Traders often encounter common gaps when there is a difference in the supply and demand for a particular currency pair overnight.

2. Breakaway Gap

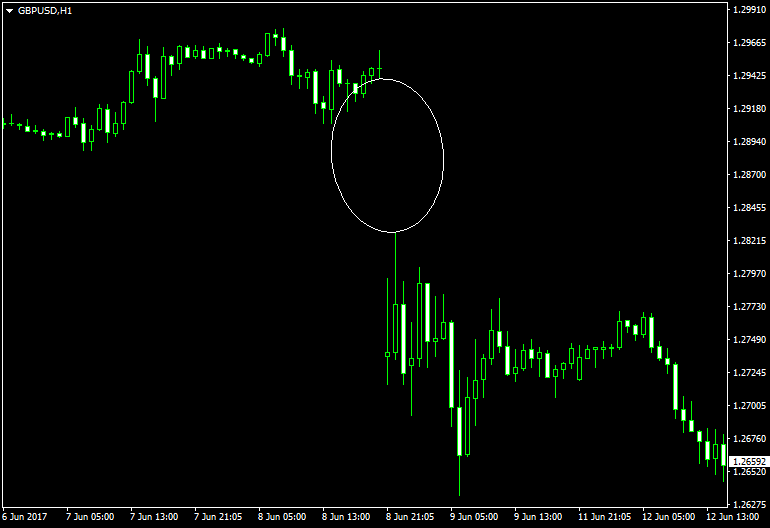

Breakaway Gaps are characterized by sudden and substantial price gaps that mark the initiation of a new trend. These gaps tend to be particularly exciting opportunities for traders, as they often signal significant shifts in market sentiment.

When a breakaway gap occurs, it suggests that market participants are embracing a new direction, either bullish or bearish. Traders interpret breakaway gaps as a strong indication that a trend is about to commence. As such, they frequently engage in positions that align with the gap’s direction, seeking to ride the trend’s momentum.

3. Runaway Gap

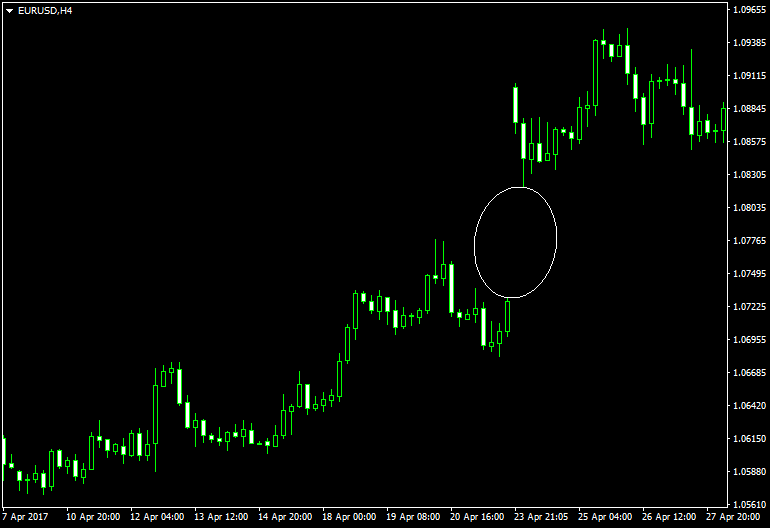

Also known as continuation gaps, Runaway Gaps appear within the context of an existing trend. Unlike breakaway gaps, runaway gaps signal that the current trend is likely to persist and continue its course.

Traders view runaway gaps as confirmations of the prevailing trend’s strength. These gaps suggest that the momentum behind the trend remains robust, and market participants continue to push prices in the same direction. Traders often consider runaway gaps as opportunities to join or reinforce existing positions in line with the ongoing trend.

4. Exhaustion Gap

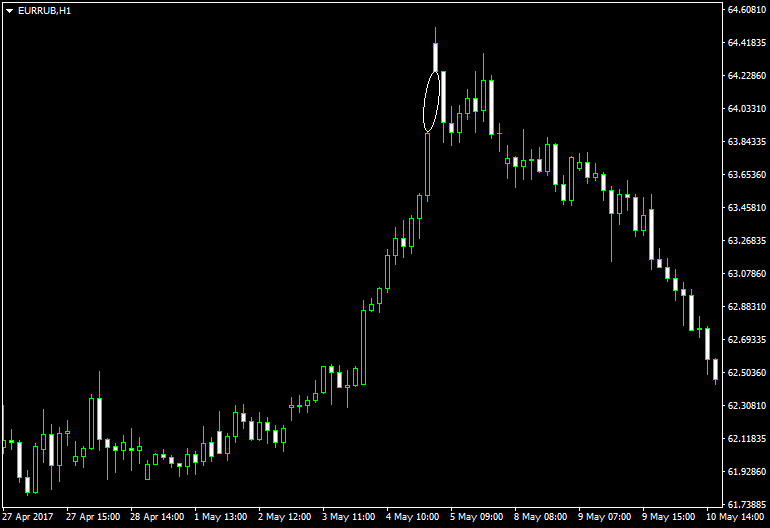

Exhaustion Gaps typically manifest near the conclusion of a strong trend. They serve as warning signs that the trend may be reaching its zenith and a reversal could be imminent. Recognizing an exhaustion gap is a valuable skill for traders seeking to anticipate trend reversals.

These gaps signify a final burst of buying or selling activity before the trend runs out of steam. Traders interpret exhaustion gaps as indications that market participants who were driving the trend are now closing their positions. Consequently, traders may prepare for potential trend reversals and adjust their strategies accordingly.

In conclusion, mastering the various types of Forex Market Gaps—common gaps, breakaway gaps, runaway gaps, and exhaustion gaps—enables traders to gain deeper insights into market dynamics and empowers them to make informed trading decisions. Each gap type offers distinct opportunities and challenges, making them essential elements in a trader’s toolkit.

Causes of Forex Market Gaps

Understanding the causes of market gaps is essential for any trader aiming for success in the Forex market. These gaps can significantly impact trading outcomes, and recognizing their origins is the first step towards effective gap trading. Here, we delve deeper into the key factors that can lead to Forex Market Gaps:

Weekend Gap Trading

Weekend gaps are among the most well-known and frequently observed types of gaps in the Forex market. These gaps occur during the weekend when the Forex market is closed for regular trading. The reason behind weekend gaps lies in the continuous flow of information, events, and news across the global financial landscape, even when the Forex market is at rest.

Consider this scenario: it’s Friday, and the market closes at a certain price. Over the weekend, significant global events or news emerge. These events could include economic data releases, geopolitical developments, or unexpected financial crises. The impact of such events can be substantial, leading to shifts in market sentiment.

When the Forex market reopens on Monday, it often does so at a price significantly different from Friday’s closing price. This disparity is the weekend gap. Traders who were not prepared for these gaps may find themselves facing positions that are far from where they expected.

News-Driven Gap Strategies

In the world of Forex trading, news-driven gap strategies are a fundamental component of a trader’s toolkit. News events, whether scheduled economic releases or unexpected developments, have the power to move markets and create substantial price gaps.

Traders who employ news-driven gap strategies meticulously follow economic calendars, which provide schedules of upcoming economic releases and events. These calendars serve as roadmaps for traders, helping them anticipate the impact of news events on currency pairs.

Effective news-driven gap strategies involve not only monitoring economic calendars but also understanding the nuances of market sentiment. Traders must gauge how market participants are likely to react to specific news releases. Will positive economic data boost a currency’s value, or will geopolitical tensions weigh it down? These are the questions traders must answer swiftly.

Reacting promptly to breaking news is crucial in this context. Successful traders are prepared to enter or exit positions rapidly when unexpected events trigger significant gaps. They are poised to capitalize on the initial market response or protect their positions from adverse moves.

In summary, mastering the causes of Forex Market Gaps involves recognizing the influence of weekend gaps driven by unfolding events during market closures and understanding the dynamics of news-driven gap strategies. Armed with this knowledge, traders can navigate the challenges posed by gaps and incorporate them into their trading strategies for greater success in the Forex market.

Gap Trading Techniques

Mastering gap trading techniques is a crucial aspect of achieving success in the Forex market. Traders who can effectively navigate and capitalize on market gaps gain a significant edge in their trading endeavors. Here are some effective gap trading strategies to consider:

1. Trading the Gap Fill

Trading the Gap Fill is a popular approach among gap traders. This strategy involves entering a trade with the expectation that the price will eventually return to fill the gap. Gap fills occur when the price retraces and reaches the level at which the gap initially occurred, effectively “filling” the gap.

To execute this strategy, traders often rely on technical analysis tools and concepts such as support and resistance levels. They look for key price levels where there is a high probability of the gap being filled. Once identified, traders enter positions with the goal of profiting from the price movement as it retraces to fill the gap.

2. Momentum Trading

Momentum trading is another gap trading technique employed by traders seeking to capitalize on the continuation of a gap. When a gap suggests a strong trend in a particular direction, momentum traders seize the opportunity to enter positions in alignment with the gap’s direction.

In this strategy, traders ride the momentum of the gap, allowing their positions to run in the direction of the gap until signs of a potential trend reversal become evident. Momentum traders often employ technical indicators and trend-following tools to confirm and support their trading decisions.

3. Gap Reversal Strategy

Gap reversal strategies are designed for traders who anticipate that the price will reverse its course after a gap has occurred. This approach involves closely monitoring the gap’s development and looking for signs of exhaustion or overextension in the gap’s direction.

Traders employing the gap reversal strategy may use technical indicators, candlestick patterns, or other analysis methods to identify potential reversal points. When they detect indications that the gap’s momentum is waning or that the price has reached extreme levels, they take contrarian positions with the expectation that the price will reverse and close the gap.

In conclusion, mastering these gap trading techniques—trading the gap fill, momentum trading, and gap reversal strategies—empowers Forex traders to approach gaps with diverse strategies that align with their trading objectives. Each technique offers distinct advantages and considerations, allowing traders to adapt to varying market conditions and seize opportunities presented by market gaps.

Forex Gap Analysis

Forex gap analysis is a critical aspect of effective gap trading. This analytical approach involves a comprehensive examination of gaps that occur in the Forex market. Traders employ gap analysis to gain valuable insights into market sentiment and to make informed decisions about potential future market movements. Here’s a closer look at how Forex gap analysis works:

Analyzing Gap Size

One of the key components of Forex gap analysis is evaluating gap size. Traders pay close attention to the magnitude of the gap, which is the difference between the closing price of one candlestick and the opening price of the next. Gap size often serves as an indicator of the gap’s significance.

- Large Gaps: A large gap signifies a substantial price difference between sessions. These gaps often result from major news events or significant market sentiment shifts. Traders regard large gaps as potentially more meaningful and may adjust their trading strategies accordingly.

- Small Gaps: Small gaps represent relatively minor price differences between sessions. They can occur during periods of lower volatility or when market sentiment is less pronounced. Traders may interpret small gaps as less significant but still consider their potential implications.

Volume Analysis

In addition to gap size, volume analysis is a vital component of Forex gap analysis. Traders examine the trading volume associated with a gap to gauge the level of market participation and enthusiasm surrounding the gap’s development.

- High Volume Gaps: Gaps accompanied by high trading volume suggest strong market participation and conviction. Traders often view high volume gaps as more reliable signals of potential trend continuation or reversal.

- Low Volume Gaps: Gaps with relatively low trading volume may indicate less enthusiasm from market participants. Traders approach low volume gaps with caution, as they may be less reliable indicators of future price movements.

Contextual Analysis

Forex gap analysis also places a strong emphasis on contextual analysis. Traders consider the broader market conditions and events surrounding the gap to understand its significance.

- News Events: Traders examine whether the gap coincides with major news releases or events that could have influenced market sentiment.

- Technical Levels: Analyzing gap in relation to key technical levels, such as support and resistance, can provide additional insights into potential price movements.

- Market Sentiment: Understanding the prevailing market sentiment and the sentiment at the time of the gap can help traders make more informed decisions.

In conclusion, Forex gap analysis is a multifaceted approach that involves evaluating gap size, volume, and contextual factors. By examining these elements, traders can gain a deeper understanding of market sentiment and the potential implications of gaps. This analysis empowers traders to make well-informed trading decisions, whether they choose to trade in the direction of the gap, anticipate gap fill, or employ other gap trading strategies.

Risk Management in Gap Trading

When it comes to trading Forex Market Gaps, effective risk management is paramount. Gap trading can be rewarding, but it also carries inherent risks. Traders must implement sound risk management strategies to protect their capital and ensure long-term success. Here are some essential risk management tips for gap trading:

1. Set Stop-Loss Orders

Setting stop-loss orders is a fundamental risk management practice in gap trading. These orders serve as predetermined exit points that limit potential losses. Traders establish stop-loss levels based on their risk tolerance and analysis of the gap’s context.

- Gap Fill Consideration: Traders often place stop-loss orders strategically with consideration of gap fills. If a gap is expected to fill, a stop-loss order may be set just beyond the anticipated gap-fill level to mitigate losses if the gap unexpectedly continues.

2. Diversify Your Portfolio

Diversification is a well-established risk management technique that applies to gap trading as well. By diversifying their trading portfolio, traders spread risk across various assets or currency pairs. Diversification can help mitigate the impact of a single gap trade gone wrong.

- Asset Allocation: Traders carefully allocate their capital to different assets, considering factors such as correlation, market conditions, and risk levels associated with each asset.

3. Avoid Over-Leveraging Positions

Over-leveraging is a common pitfall in gap trading and can lead to substantial losses. Traders should avoid excessively leveraging their positions, as it amplifies both potential gains and losses.

- Leverage Ratios: Traders adhere to reasonable leverage ratios, ensuring that their positions are adequately funded and not excessively leveraged. This approach helps maintain risk at manageable levels.

4. Stay Informed About News Events

Staying informed about upcoming news events that could impact gap trades is a proactive risk management strategy. Major news releases can trigger significant gaps, and being aware of the economic calendar is essential.

- News-Driven Gap Consideration: Traders anticipate the potential impact of news events on currency pairs and adjust their positions or risk exposure accordingly. Being prepared for news-driven gaps is crucial to managing risk effectively.

In conclusion, gap trading offers opportunities for profit, but it also carries inherent risks. Effective risk management is essential for protecting capital and achieving long-term success in gap trading. Traders should prioritize setting stop-loss orders, diversifying their portfolios, avoiding over-leveraging, and staying informed about news events. By implementing these risk management strategies, gap traders can navigate the market with greater confidence and resilience.

Common Pitfalls and Mistakes

Gap trading, while potentially rewarding, is not without its pitfalls and challenges. To achieve success in this trading strategy, it’s essential to be aware of common pitfalls and avoid making costly mistakes. Here are some of the most prevalent pitfalls and mistakes in gap trading:

1. Overtrading

Overtrading is a common pitfall in gap trading. It occurs when traders are tempted to trade every gap they encounter, regardless of the quality of the opportunity. Overtrading can lead to excessive exposure to market volatility and increased risk.

- Solution: Exercise discipline and select gap trading opportunities wisely. Focus on gaps that align with your trading strategy and show clear signs of potential profitability. Avoid the urge to overtrade, as it can deplete capital quickly.

2. Ignoring Risk Management

Neglecting risk management is a critical mistake that can have severe consequences in gap trading. Failing to set stop-loss orders or implement risk management strategies can expose traders to significant losses if gaps move against their positions.

- Solution: Prioritize risk management in your gap trading strategy. Always set stop-loss orders at appropriate levels to limit potential losses. Consider diversifying your portfolio and avoid over-leveraging positions.

3. Neglecting Market Context

Neglecting the broader market context is another mistake traders should avoid. Gaps do not occur in isolation, and their significance can be influenced by various market factors, including overall market sentiment and trends.

- Solution: Before trading a gap, consider the broader market context. Analyze the prevailing market sentiment, identify the trend, and assess the potential impact of news events or economic releases on the gap. Contextual analysis can help you make more informed trading decisions.

4. Lack of Patience

Impatience is a mistake that can lead to premature entries or exits in gap trading. Traders may become anxious to capitalize on a gap’s potential and fail to wait for confirmation or a favorable entry point.

- Solution: Exercise patience in gap trading. Wait for confirmation signals, such as price action or technical indicators, before entering a trade. Avoid rushing into positions based solely on the presence of a gap.

In conclusion, being aware of common pitfalls and mistakes in gap trading is essential for success. Traders should guard against overtrading, prioritize risk management, consider the broader market context, and exercise patience in their trading decisions. By avoiding these pitfalls and implementing sound trading practices, gap traders can increase their chances of achieving profitable outcomes in this dynamic trading strategy.

Conclusion

Mastering Forex Market Gaps is a valuable skill for traders seeking success in the Forex market. By understanding gap types, their causes, and effective trading strategies, you can harness the power of gaps to your advantage. Remember that gap trading involves risk, so always practice responsible risk management and continually refine your gap trading techniques. With dedication and skill, you can navigate the world of Forex Market Gaps and enhance your trading success.

Click here to read our latest article on Forex Grid Trading Strategy

FAQs

- What are Forex Market Gaps? Forex Market Gaps refer to abrupt price disparities between the closing price of one candlestick and the opening price of the next. These gaps occur when there is a significant difference in prices during market sessions.

- What causes Forex Market Gaps? Market gaps can have various causes. Weekend gaps occur due to market closure, while news-driven gaps result from significant news events that influence market sentiment and pricing.

- Are all gaps the same in Forex trading? No, there are different types of gaps in Forex trading, including common gaps, breakaway gaps, runaway gaps, and exhaustion gaps, each with its own characteristics and implications.

- How can I trade Forex Market Gaps effectively? To trade gaps effectively, consider gap trading techniques such as trading the gap fill, momentum trading, and gap reversal strategies. It’s also essential to practice risk management.

- What is the role of Forex Gap Analysis in trading? Forex Gap Analysis involves examining gaps’ size, volume, and contextual factors to gain insights into market sentiment and potential future price movements. It helps traders make informed decisions.

- What is the risk involved in gap trading? Gap trading carries risks, including potential losses. Risk management is crucial. Set stop-loss orders, diversify your portfolio, avoid over-leveraging, and stay informed about news events.

- Can I trade every gap I encounter? It’s not advisable to trade every gap. Overtrading can lead to losses. Choose gap trading opportunities wisely based on your strategy and analysis.

- Should I always set stop-loss orders when trading gaps? Yes, setting stop-loss orders is essential to limit potential losses in gap trading. It’s a fundamental risk management practice.

- How can I avoid common mistakes in gap trading? To avoid common pitfalls, exercise discipline, prioritize risk management, consider the broader market context, and be patient in your trading decisions.

- Is gap trading suitable for beginners? Gap trading can be challenging and may require experience. Beginners should start with thorough research, practice on demo accounts, and gradually gain expertise in this strategy.

Click here to learn more about Forex Market Gaps