Introduction to Gann Theory

In the dynamic world of Forex trading, the application of proven theories and strategies is crucial for success. Among these, Gann Theory has emerged as a powerful tool, offering unique insights into market trends and timing. This article delves into the use of Gann Theory in Forex trading, focusing on its components like Gann Angles and Time Cycles, and exploring how they can revolutionize your trading approach.

Understanding Gann Theory

Gann Theory, pioneered by W.D. Gann, a visionary finance trader in the early 20th century, stands as a testament to the fusion of various disciplines to predict financial market movements. This theory, deeply rooted in the principles of geometry, astrology, and ancient mathematics, offers a unique perspective in forecasting market trends, particularly in the volatile world of Forex trading.

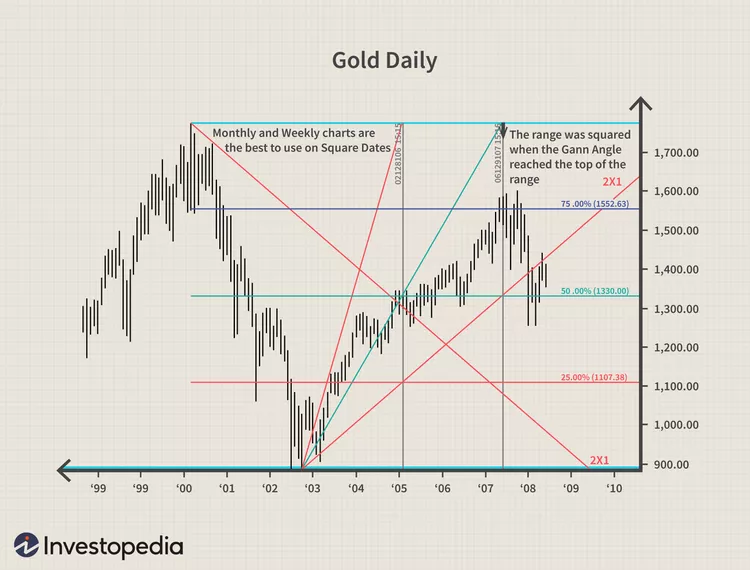

At the heart of Gann Theory lies the innovative concept of Gann Angles in Forex. These are not just simple diagonal lines on a chart; they represent a sophisticated method of identifying price movement directions and trends. Gann Angles are based on the principle that market movements are not random but follow geometric patterns and time cycles.

Gann’s approach was groundbreaking because it moved beyond the traditional methods of analysis. He believed that the market was geometric and cyclical in nature. By incorporating the principles of geometry, Gann was able to illustrate how certain angles, when drawn on a price chart, could indicate significant support and resistance levels. These Gann Angles in Forex trading are used to determine not just the direction of the market trends but also their strength and duration.

The use of astrology in Gann Theory might seem unconventional to modern traders, but Gann incorporated planetary movements and alignments as he believed they had a direct impact on the financial markets. He correlated major market movements with astrological events, adding another layer of analysis to his theory.

Ancient mathematics, particularly the concepts of sacred geometry and numerology, also play a crucial role in Gann Theory. Gann utilized these mathematical principles to identify potential price targets and turning points in the market. He believed that certain numbers and ratios had a significant influence on market behavior.

In essence, Gann Theory is a complex and multi-dimensional approach to market analysis. It’s not just about drawing lines on a chart; it’s about understanding the underlying geometric and temporal patterns that drive market movements. With its unique blend of disciplines, Gann Theory offers a holistic and deeply analytical approach to predicting market trends, making it a valuable tool for traders in the Forex market.

As traders delve deeper into the intricacies of Gann Angles in Forex and other aspects of Gann Theory, they unlock the potential to forecast market movements with a higher degree of accuracy, thereby transforming their approach to Forex trading.

Gann Angles in Forex Trading

Gann Angles, integral to Gann Theory, serve as a revolutionary tool in the realm of Forex trading, offering a unique and insightful way of charting and predicting market movements. These angles are not just mere lines on a chart; they represent a comprehensive system that identifies key support and resistance levels, crucial for any successful currency trading strategy.

In the intricate world of Forex, understanding and applying Gann Angles can be a game-changer for traders. These angles are drawn from significant price points, like highs and lows, and extend into the future to indicate potential areas of interest. The beauty of Gann Angles in Forex is their ability to offer a dual perspective – not only do they show price levels, but they also provide a temporal element, giving traders an understanding of the timing of future market movements.

The application of Gann Angles in Forex trading allows for the identification of potential breakout points. Breakouts occur when the price moves outside a defined support or resistance level with increased volume, indicating a potential continuation or reversal of the trend. By using Gann Angles, traders can anticipate these breakouts and position themselves accordingly.

Furthermore, Gann Angles are instrumental in spotting trend reversals. In Forex trading, catching a trend reversal at the right moment can be highly profitable. Gann Angles help in identifying these reversal points by providing a clear visual representation of where the market could potentially change direction.

Incorporating Gann Angles into a Forex trading strategy enhances market analysis by adding a layer of technical precision that is grounded in Gann’s principles. These angles are not static; they evolve with the market, offering dynamic support and resistance levels. This dynamic nature of Gann Angles makes them highly adaptable to the ever-changing Forex market conditions.

The key to successfully implementing Gann Angles in Forex lies in the understanding of their construction and interpretation. When combined with other analytical tools in Forex trading, such as Gann Square Analysis in Currency Trading or other Predictive Forex Trading Techniques, Gann Angles become even more powerful.

In summary, Gann Angles in Forex trading are a vital component of Gann Theory, offering a unique and effective way to analyze and predict market movements. Their ability to pinpoint support and resistance levels, identify potential breakout points, and anticipate trend reversals makes them an indispensable tool for traders looking to enhance their market analysis and trading strategies in the Forex market.

Using Gann Squares for Price and Time Analysis

Gann Squares are a pivotal component of Gann Theory, providing a sophisticated framework for price and time analysis in currency trading. This powerful tool goes beyond traditional charting methods by integrating the dimensions of price and time, offering traders a comprehensive view of the Forex market.

The essence of Gann Square Analysis in Currency Trading lies in its ability to forecast key price levels and critical timing for trades. Gann Squares are constructed by drawing a grid over a chart, where each square represents a specific price level and time interval. This grid aligns historical price points with time periods, allowing traders to anticipate future market movements with greater accuracy.

What sets Gann Square Analysis apart in Currency Trading is its holistic approach. Unlike some methods that focus solely on price movements or rely heavily on time-based predictions, Gann Squares consider both aspects equally. This dual focus is particularly beneficial in the Forex market, where volatility can be high, and price movements are often swift and unpredictable.

In practice, Gann Square Analysis in Currency Trading enables traders to identify potential turning points in the market. By aligning the price movements of a currency pair within the squares, traders can discern patterns and cycles that may not be immediately evident. This insight is crucial for making informed decisions, whether entering or exiting a trade.

Furthermore, the repeated application of Gann Square Analysis enriches a trader’s understanding of the market dynamics. It’s not just about identifying a single profitable trade; it’s about consistently recognizing patterns and trends over time. This repeated analysis contributes to a deeper, more nuanced understanding of how the Forex market operates, leading to more strategic and successful trading decisions.

Another key advantage of using Gann Squares is their adaptability. They can be applied to various time frames, from short-term day trading to long-term strategic planning. This flexibility makes Gann Square Analysis in Currency Trading an invaluable tool for a wide range of trading styles and objectives.

Incorporating Gann Square Analysis in Currency Trading into a broader trading strategy, especially when combined with other Predictive Forex Trading Techniques, can significantly enhance a trader’s ability to navigate the complex world of Forex. It provides an edge in understanding market movements, not just from a price perspective but also from a temporal viewpoint, offering a more rounded and informed approach to trading.

Gann Squares are an essential element of Gann Theory, offering a unique and effective method for price and time analysis in Forex trading. Their ability to provide a holistic view of the market, combining both price and time dimensions, makes them a valuable tool for any trader looking to deepen their market analysis and improve their trading outcomes in the dynamic world of Forex.

Time Cycles and Their Role in Forex Market Predictions

Forex Market Time Cycles are a fundamental aspect of Gann Theory, offering a unique perspective on the timing of market movements. These time cycles are not mere chronological measures; they represent the rhythmic patterns in the market that Gann identified as recurrent and predictable. Understanding and applying these Forex Market Time Cycles in trading strategies can significantly enhance a trader’s ability to forecast and capitalize on potential market turning points.

The concept of Time Cycles is based on the premise that the Forex market moves in predictable cycles over time. According to Gann Theory, these cycles are influenced by various factors, including economic, geopolitical, and even natural events. By studying past market trends and applying the principles of these cycles, traders can predict when the market is likely to experience a significant change in direction.

Incorporating Forex Market Time Cycles into trading strategies involves analyzing historical data to identify patterns and durations of past market cycles. This analysis allows traders to estimate the length and timing of future cycles. For instance, if a currency pair has shown a tendency to follow a particular cycle length repeatedly, a trader can anticipate when the next turn in the market might occur, and plan their trades accordingly.

The application of Forex Market Time Cycles is particularly useful in identifying potential entry and exit points. For example, if a trader knows that a particular currency pair tends to follow a 30-day cycle, they can watch for signs of a trend reversal around that time. This insight can help in making more informed decisions about when to open or close a position.

Moreover, the integration of Forex Market Time Cycles with other Predictive Forex Trading Techniques, such as Gann Angles and Gann Square Analysis in Currency Trading, can provide a more robust trading strategy. While Gann Angles offer insights into price movements, Time Cycles add the dimension of timing, allowing for a more comprehensive approach to market analysis.

It’s important to note, however, that while Forex Market Time Cycles can be incredibly insightful, they are not infallible. The Forex market is influenced by a myriad of factors, and while historical patterns can provide guidance, they do not guarantee future outcomes. Therefore, it’s crucial for traders to use Time Cycles as one part of a diversified trading strategy, always considering the broader market context and potential risks.

Forex Market Time Cycles play a vital role in the application of Gann Theory to Forex trading. They offer traders a deeper understanding of market timing, enhancing the ability to make well-timed trades. By mastering the use of Time Cycles in conjunction with other analytical tools, traders can develop more sophisticated and potentially more profitable trading strategies in the dynamic Forex market.

Integrating Gann Theory with Other Trading Tools

Integrating Gann Theory with other Predictive Forex Trading Techniques can significantly enhance its effectiveness in analyzing and predicting market movements. While Gann Theory, with its focus on Gann Angles, Gann Square Analysis in Currency Trading, and Forex Market Time Cycles, provides a unique and in-depth view of the market, combining it with other established trading tools can create a more robust and nuanced trading strategy.

One of the most effective ways to integrate Gann Theory in Forex trading is by using it alongside moving averages. Moving averages help smooth out price data over a specific period, providing a clearer view of the trend direction. When used in conjunction with Gann Angles, traders can gain a better understanding of both the direction and strength of the trend. For instance, if a Gann Angle indicates a potential upward trend and this is supported by a rising moving average, it can reinforce the trader’s confidence in the trend’s persistence.

Fibonacci retracements are another powerful tool that can complement Gann Theory. These retracements are based on the key numbers identified by the 13th-century mathematician Leonardo Fibonacci and are used to predict potential support and resistance levels. When these Fibonacci levels align with the levels indicated by Gann Square Analysis in Currency Trading, it can provide a strong indication of significant price levels to watch for.

Additionally, traders can enhance their application of Forex Market Time Cycles by integrating them with other timing indicators, such as oscillators or momentum indicators. These tools can help identify the best times to enter or exit trades based on market momentum, adding an extra layer of timing precision to the Gann Theory’s cyclical analysis.

It’s also beneficial to incorporate fundamental analysis with Gann Theory. While Gann Theory excels in technical analysis, understanding the economic and geopolitical factors that can influence currency values is crucial. By considering these alongside the technical predictions of Gann Theory, traders can gain a more comprehensive view of the market.

Integrating Gann Theory with other Predictive Forex Trading Techniques requires a balanced approach. While it’s important to use multiple tools for a well-rounded analysis, it’s equally crucial not to overcomplicate the trading strategy. The key is to find a synergy where these tools complement each other without causing analysis paralysis.

In summary, the integration of Gann Theory with other trading tools like moving averages, Fibonacci retracements, oscillators, and fundamental analysis can greatly enhance a trader’s ability to analyze and predict movements in the Forex market. This comprehensive approach, which combines the unique insights of Gann Theory with the strengths of other Predictive Forex Trading Techniques, can lead to more informed trading decisions and potentially more successful trading outcomes.

Challenges and Limitations

Challenges and Limitations

While the benefits of Gann Theory in enhancing Forex trading strategies are evident, there are notable challenges and limitations that traders should be aware of. The complexities inherent in Gann Theory, particularly in concepts like Gann Angles in Forex, Forex Market Time Cycles, and Gann Square Analysis in Currency Trading, can present a steep learning curve, especially for newcomers.

One of the primary challenges is the intricate nature of Gann Theory itself. Gann’s methods, which combine geometric patterns, astrological influences, and ancient mathematical principles, require a deep understanding and considerable practice to apply effectively. For instance, accurately drawing and interpreting Gann Angles in Forex trading demands not only a good grasp of the underlying theory but also the ability to apply it in the fast-paced and often unpredictable Forex market.

Similarly, mastering Forex Market Time Cycles involves more than just recognizing the patterns. Traders must be able to analyze historical data, understand the significance of different cycle lengths, and apply this knowledge to forecast future market movements. This can be daunting, as it requires both analytical skills and a nuanced understanding of the Forex market’s dynamics.

The use of Gann Square Analysis in Currency Trading also poses its challenges. It’s not just about placing a square over a chart; it involves understanding the relationships between time and price, and how these relationships can be used to predict future market behavior. This level of analysis requires a significant investment of time and effort to master.

Another important limitation to consider is that no single method, including Gann Theory and other Predictive Forex Trading Techniques, can guarantee success in the Forex market. The market’s volatility and susceptibility to a wide range of external factors—economic, political, and even psychological—mean that even the most well-thought-out strategies can face unexpected outcomes.

Additionally, there is the risk of over-reliance on Gann Theory to the exclusion of other important trading principles and techniques. While Gann Theory offers valuable insights, it should be used as part of a broader, more diversified trading strategy. Incorporating fundamental analysis, risk management, and other technical analysis tools can provide a more balanced and resilient approach to Forex trading.

While Gann Theory, including Gann Angles in Forex, Forex Market Time Cycles, and Gann Square Analysis in Currency Trading, can be a powerful addition to a trader’s toolkit, it is important to approach it with a clear understanding of its complexities and limitations. Success in Forex trading using Gann Theory requires patience, dedication to learning, and the ability to integrate it with other trading strategies and techniques.

Conclusion

Gann Theory, with its components like Gann Angles in Forex and Forex Market Time Cycles, offers valuable tools for traders. While there are challenges in mastering Gann Square Analysis in Currency Trading and other Predictive Forex Trading Techniques, the potential benefits in understanding and applying these methods are immense. As with any trading strategy, continuous learning and adaptation are key to success.

Click here to read our latest article on Mastering Denmark Indicators

FAQs

- What is Gann Theory in Forex Trading? Gann Theory is a method of technical analysis in Forex trading developed by W.D. Gann, which combines geometry, astrology, and ancient mathematics to predict market trends. It includes tools like Gann Angles, Gann Squares, and Time Cycles for analyzing currency movements.

- How do Gann Angles work in Forex trading? Gann Angles in Forex trading are diagonal lines drawn on charts that represent potential support and resistance levels. They help traders identify trend directions, potential breakouts, and trend reversals.

- What are Forex Market Time Cycles in Gann Theory? Forex Market Time Cycles are part of Gann Theory, indicating the rhythmic patterns in the market. They help traders predict timing for potential market fluctuations and turning points.

- Can Gann Square Analysis in Currency Trading improve trading decisions? Yes, Gann Square Analysis in Currency Trading can significantly improve trading decisions. It allows traders to forecast key price points and market timing by combining both price and time dimensions, offering a holistic market view.

- Is it necessary to use other Predictive Forex Trading Techniques with Gann Theory? While Gann Theory is powerful, integrating it with other Predictive Forex Trading Techniques, like moving averages or Fibonacci retracements, can enhance its effectiveness and offer a more comprehensive market analysis.

- How difficult is it to learn Gann Theory for Forex trading? Learning Gann Theory can be challenging due to its complexity and the integration of various disciplines. However, with dedication and practice, traders can effectively apply its principles in Forex trading.

- Are Gann Angles reliable indicators for Forex trading? Gann Angles are considered reliable indicators for identifying trends and potential price movements in Forex trading, but they should be used in conjunction with other analysis tools for the best results.

- How can I apply Forex Market Time Cycles in my trading strategy? To apply Forex Market Time Cycles, study historical market data to identify patterns and cycle durations. Use this information to anticipate future market movements and plan entry and exit points accordingly.

- What are the main limitations of using Gann Theory in Forex trading? The main limitations include its complexity, steep learning curve, and the fact that no method, including Gann Theory, can guarantee success due to the Forex market’s volatility and unpredictability.

- Can beginners in Forex trading use Gann Theory effectively? While beginners may find Gann Theory challenging, it’s possible to use it effectively with proper education, practice, and by combining it with simpler trading techniques initially until gaining more proficiency.

Click here to learn more about Gann Theory in Forex Trading