Introduction to the Forex Grid Impact

In the midst of today’s rapidly evolving landscape, the force of Forex Grid Impact stands undeniable. It is here, in this ever-changing world, that we witness global electric grid innovations reshaping the very foundations of the financial domain. These innovations, spanning the realms of smart grids, the seamless integration of renewable energy, and the bolstering of grid resilience, have forged a powerful nexus. At the heart of this convergence lies the forex market, a crucible where economic tides are now irrevocably influenced by the unfolding advancements.

Within this extensive guide, we embark on a journey to unravel the intricate bonds uniting the forex market with the transformative innovations coursing through the global electric grid. Our mission is to navigate this uncharted terrain where economic forces and technological wonders intertwine seamlessly.

Our expedition commences with a dissection of the profound impact of innovations like Renewables in Forex. These renewable energy sources, harnessed from the sun’s radiance and the relentless power of the wind, have transcended their role as mere energy generators. They have become architects of change within forex market dynamics, ushering in shifts in energy policies that, in turn, sculpt the dynamic landscape of currency exchange rates.

Furthermore, we dive into the realm of Grid Resilience Effects, a concept that demands unwavering attention. As the modern electric grid undergoes transformational evolution, it fortifies its foundations, emerging resilient in the face of disruptions. The forex market, however, is not indifferent to these shifts. It responds keenly to changes in energy supply reliability, giving birth to a nuanced interplay that exerts a profound influence on currency exchange rates.

Amidst the intricacies of this landscape, our gaze extends towards the horizon, where we catch a glimpse of the future. Emerging trends, most notably AI in Forex Trends, add additional layers of complexity to this already dynamic environment. The infusion of artificial intelligence into forex trading amplifies the dynamics, reshaping strategies and outcomes.

As we embark on this enlightening quest, we extend an invitation for you to accompany us. Together, we shall navigate the interwoven realms of finance and technology, illuminating the profound connections that bind forex markets and global electric grid innovations. Brace yourselves; this journey promises to be nothing short of electrifying.

Understanding Forex Market Dynamics

Before we explore the impact of electric grid innovations, it is essential to establish a solid understanding of the core dynamics driving the forex market. The forex market, often referred to as forex or FX, holds the distinction of being the largest and most liquid financial market globally. This bustling marketplace revolves around the exchange of currencies among a diverse set of participants, including banks, corporations, governments, and individual traders.

Remarkably, the forex market never sleeps, operating 24 hours a day, five days a week. Its movements are a result of a complex interplay of numerous factors. These factors encompass economic data releases that offer insights into a nation’s economic health, geopolitical events that wield influence over currency values, and, increasingly, the transformative innovations taking place within the global electric grid.

- Renewables in Forex: To truly grasp the profound Forex Grid Impact, one must recognize the pivotal role of renewable energy sources in this intricate equation. The adoption and integration of renewables, such as solar and wind power, hold significant sway over forex market dynamics. As countries transition towards embracing renewable energy sources, they often undergo substantial shifts in their energy policies. These policy shifts ripple through the forex market, leaving discernible marks on currency exchange rates.

- Grid Resilience Effects: Equally deserving of our attention is the concept of grid resilience. As modern electric grids evolve, fortified with advanced technologies and robust infrastructure, they enhance their capacity to withstand disruptions and ensure the reliability of energy supply. The forex market is attuned to shifts in energy supply reliability facilitated by these grid innovations. Understanding the intricate Grid Resilience Effects is paramount for forex traders navigating the multifaceted landscape where energy and currency intersect.

In the forthcoming sections of this comprehensive guide, we will delve deeper into the intricate interplay of these dynamics with innovations in the global electric grid. Our journey will illuminate the collective influence they wield over the forex market, where the currents of finance and technology converge.

Global Electric Grid Innovations

Electric grids worldwide are currently undergoing a transformative journey, driven by advanced technological innovations geared towards achieving enhanced efficiency, sustainability, and reliability. These innovations have a direct and multifaceted impact on forex markets, influencing various aspects of currency exchange rates.

- The Impact of Smart Grid Technologies: At the forefront of these electric grid innovations are smart grids, which represent a significant leap forward in grid management. These intelligent systems leverage digital communication and automation to revolutionize grid performance. Their impact on forex markets is substantial, primarily due to the real-time data they provide on energy consumption, supply, and distribution. This influx of data becomes a crucial factor for forex traders, empowering them to make informed decisions based on up-to-the-minute insights into energy-related variables. Consequently, the influence of smart grids on forex market efficiency becomes a pivotal consideration for traders.

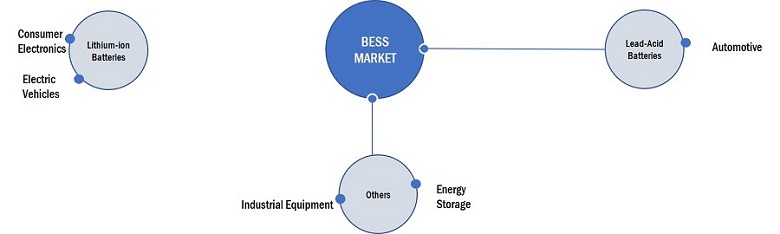

- Energy Storage Solutions and Forex Markets: Energy storage solutions, including advanced battery technologies, play a pivotal role in the transition towards sustainable energy sources. Beyond their function of storing excess energy, these innovations contribute significantly to grid stability. This interplay between energy storage solutions and grid resilience holds a direct connection to forex trends. Understanding this connection is paramount for forex traders, as it introduces a dynamic element that can impact currency exchange rates.

As we explore the profound effects of global electric grid innovations on forex markets, we uncover the intricate web of relationships between these developments and currency market dynamics. Within this dynamic landscape, the synergy between energy innovations and forex market fluctuations continues to evolve, offering both challenges and opportunities for market participants.

Energy-Dependent Economies and Forex Trends

In the midst of the ongoing global electric grid innovations, specific nations find themselves in a distinctive position due to their heavy reliance on energy exports. This distinct vantage point within the context of forex market dynamics adds a layer of complexity to the intricate relationship between energy dynamics and currency exchange rates.

Forex Market Trends in Oil-Dependent Nations: Prominently, we observe countries with significant dependence on oil exports. These economies, often categorized as oil-dependent, are deeply interconnected with the fortunes of the energy sector. In this intricate landscape, the dynamics of forex markets bear the profound influence of energy price fluctuations.

The interconnection between these economies and the forex market is acutely sensitive to variations in energy prices. As electric grids undergo transformational advancements and infrastructure enhancements, the stability and reliability of energy supply can undergo notable shifts. These fluctuations send ripples through the economies of oil-dependent nations, impacting their economic well-being and consequently leading to noticeable shifts in forex market trends.

It is of paramount importance for forex traders and market observers to discern the distinctive challenges and opportunities posed by these energy-dependent economies. As the global electric grid innovations continue to unfold, the dynamics of forex markets in these specific nations emerge as an increasingly significant area of focus and analysis. A comprehensive understanding of how energy price fluctuations directly influence currency exchange rates in these contexts becomes an invaluable insight for individuals navigating the ever-evolving landscape of forex trading.

Strategies for Forex Traders in a Changing Grid Landscape

In a dynamic landscape marked by the continuous evolution of electric grids and shifting energy dynamics, forex traders are compelled to adapt their strategies for not just survival but thriving in this ever-changing environment.

Forex Risk Management: Amidst the unfolding global electric grid innovations, the role of robust risk management strategies takes center stage. As the forex market adjusts to the transformative effects of these innovations, traders must proactively safeguard their investments and capitalize on emerging opportunities.

Understanding the Grid Resilience Effects emerges as a critical element of effective risk management. Grid resilience encompasses multifaceted dimensions, and a comprehensive grasp of its intricacies is essential for traders. A resilient grid can withstand disruptions, ensuring a steady energy supply, while grid vulnerabilities can trigger supply fluctuations that, in turn, lead to currency exchange rate volatility.

Energy-related factors are increasingly becoming linchpins in shaping forex market behavior. Traders who navigate this evolving landscape with a keen awareness of the repercussions of energy supply and grid stability on currency values are better positioned to make well-informed decisions.

In this ever-evolving grid landscape, effective risk management necessitates a proactive approach. Traders must stay vigilant, staying abreast of grid innovations, monitoring energy-related developments, and continuously adapting their trading strategies to the fluid market conditions. Through such diligent efforts, they can not only mitigate risks but also seize opportunities that arise as the forex market continues to respond to the transformative influences of the electric grid revolution.

Conclusion and Future Outlook

In summary, the impact of the Forex Grid in response to the ongoing global electric grid innovations is a multifaceted and intricate phenomenon. Within this complex relationship, the integration of renewable energy sources, the bolstering of grid resilience, and the integration of AI in forex trading represent just a few facets.

As we progress into the future, it becomes increasingly evident that vigilance towards emerging trends, especially those encompassed by AI in Forex Trends, will prove paramount. Traders and investors alike must acknowledge the importance of these trends to navigate the ever-evolving landscape successfully.

As the world continues its transformative journey towards sustainable and efficient electric grids, the forex market is poised to be a reflective mirror of these paradigm shifts. Understanding the dynamic forces at play is no longer just an advantage but an essential requirement for anyone participating in forex trading. It also holds intrinsic value for those seeking profound insights into the broader economic consequences of electric grid innovations.

The concept of Grid Resilience Effects, among other relevant keywords, will undoubtedly remain at the forefront of discussions in the foreseeable future. As we anticipate further advancements in both forex markets and global electric grid technologies, it becomes clear that this landscape teems with opportunities for those adept at navigating its intricacies with precision and foresight.

Click here to read our latest article on The Potential of Global Labor Forex

FAQs

- What defines the concept of Forex Grid Impact? The term “Forex Grid Impact” signifies the intricate connection between global electric grid innovations and their influence on currency exchange rates within the forex market.

- How do renewable energy sources exert their influence on forex market dynamics? Renewable energy sources, like solar and wind power, wield their impact by catalyzing shifts in energy policies, subsequently molding currency exchange rates in the forex market.

- Could you explain the significance of Grid Resilience Effects in forex trading? Grid Resilience Effects pertain to the consequences of grid stability and dependability on forex market trends, particularly in regions reliant on energy exports.

- What is the relationship between smart grid technologies and forex market efficiency? Smart grid technologies enhance forex market efficiency by furnishing real-time data on energy metrics, such as consumption, supply, and distribution, which inform traders’ decision-making processes.

- How do energy storage solutions play a role in forex market dynamics? Energy storage solutions, including advanced battery technologies, impact forex trends by contributing to grid stability, which in turn influences the reliability of energy supply.

- Why are economies heavily reliant on oil exports sensitive to forex market fluctuations? Economies dependent on oil exports are intricately linked to energy price fluctuations, resulting in significant repercussions on their economic stability and consequential shifts in forex market trends.

- What strategies can forex traders employ for effective risk management in the evolving grid landscape? To manage risk successfully, forex traders must comprehend the intricacies of Grid Resilience Effects and vigilantly monitor energy-related factors affecting currency exchange rates.

- Are there specific emerging trends like AI in Forex Trends that traders should be attentive to? Yes, traders should be watchful of emerging trends such as AI in Forex Trends, as these trends can substantially shape forex market dynamics.

- What are the recommended methods for staying well-informed about global electric grid innovations and their impact on forex markets? Staying informed necessitates consistent tracking of developments in both electric grid and forex market sectors, enabling a comprehensive understanding of their interrelation.

- What potential opportunities await individuals navigating the intricate relationship between electric grid innovations and forex markets? Profound opportunities exist for those adept at skillfully navigating this relationship. Understanding these dynamics can empower traders to capitalize on market trends and economic transformations effectively.