Introduction to the EUR/USD

The global financial markets have been witnessing significant movements and fluctuations in recent times, with the EUR/USD exchange rate taking center stage. In this comprehensive EUR/USD forecast article, we will delve into the factors driving this currency pair, analyze the impact of key events such as US inflation data and the Dollar selloff, and explore the broader context of currency exchange rate analysis and Federal Reserve interest rate expectations.

Factors Behind the Surge in the EUR/USD Forecast

At the heart of the recent financial market drama is the remarkable surge of the EUR/USD exchange rate. Traders and investors have been closely monitoring this currency pair as it continues to exhibit remarkable strength. The EUR/USD forecast has become a topic of great interest due to several critical factors.

One of the primary drivers of this surge has been the sharp decline of the US Dollar. This decline was precipitated by the release of crucial US inflation data, which took the markets by surprise. The Dollar selloff that followed this data release had a profound impact on the EUR/USD exchange rate, causing it to experience a significant surge of around 200 pips. This surge marked the pair’s largest daily gain in months, setting the stage for a potentially prolonged upward movement.

US Inflation Data and Its Influence

To understand the dynamics at play, it’s essential to dig deeper into the US inflation data that triggered the Dollar selloff. In October, the US Consumer Price Index (CPI) remained unchanged, defying expectations of a 0.1% increase. Furthermore, the annual inflation rate rose by 3.2%, albeit below the previous month’s 3.7%. Core inflation, which excludes volatile food and energy prices, also slowed more than anticipated.

The reaction to this unexpected inflation data was swift and significant. Treasury bonds rallied as investors sought safe-haven assets, and stocks on Wall Street recorded gains. However, the most notable consequence was the Greenback’s tumble to monthly lows. The Dollar selloff, which followed the weaker-than-expected inflation figures, further fueled the bullish momentum of the EUR/USD pair.

Currency Exchange Rate Analysis: EUR vs. USD

To gain a deeper understanding of this exchange rate surge, it’s crucial to engage in currency exchange rate analysis. This analysis involves evaluating various economic factors that influence the value of a currency relative to another. In the case of the EUR/USD forecast, we are comparing the Euro (EUR) to the US Dollar (USD).

One of the key factors driving this currency pair is the divergence in economic performance between the United States and the Eurozone. While the US economy continued to grow above trend, the Eurozone experienced a contraction of 0.1% during the third quarter. This divergence has played a pivotal role in supporting the strength of the Dollar in recent months.

However, the EUR/USD forecast isn’t solely dependent on past economic performance. Market sentiment and expectations are equally influential. The recent US inflation data, which came in below expectations, has reinforced market expectations that the Federal Reserve is unlikely to raise interest rates further in the near term. This dovish stance has contributed to the Dollar’s weakness and the Euro’s strength.

Fed Interest Rate Expectations and Market Dynamics

Federal Reserve interest rate expectations are a crucial aspect of the EUR/USD forecast. The central bank’s monetary policy decisions have a profound impact on currency markets. As of now, the market sentiment is leaning towards a belief that the Fed will maintain its accommodative stance in light of the subdued inflation figures. This expectation has led to a reassessment of the Dollar’s outlook, further bolstering the Euro’s position.

Looking ahead, it’s essential to consider the upcoming economic data releases that could shape the EUR/USD exchange rate. Specifically, market participants will closely watch the release of the Producer Price Index (PPI) and the October Retail Sales report. Continued signs of easing inflation, coupled with a softer consumer sentiment, could keep the US Dollar vulnerable in the short term. However, the narrative could shift if US economic outperformance reemerges as a dominant theme.

Technical Analysis: The Bullish Momentum

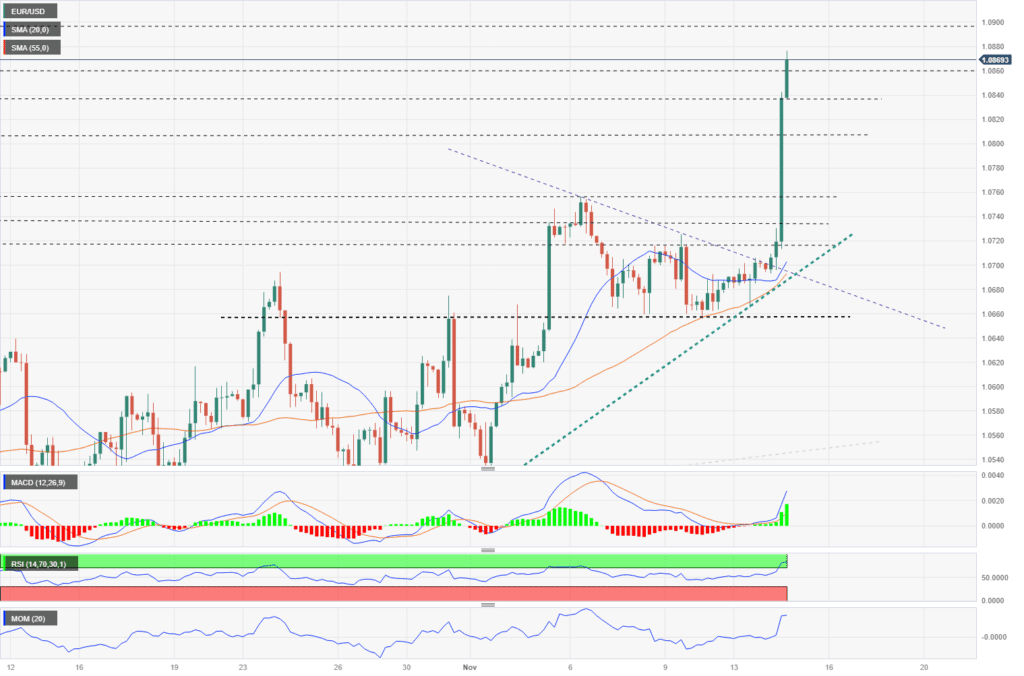

Turning our attention to technical analysis, the charts provide valuable insights into the EUR/USD pair’s recent performance and future outlook. On the daily chart, we observe a significant development—the EUR/USD pair has surged above both the 100-day and 200-day Simple Moving Averages (SMA) for the first time since August. Additionally, the 20-day SMA has crossed above the 55-day SMA, reinforcing the bullish outlook.

Source:FXS

The Relative Strength Index (RSI), a commonly used momentum indicator, is in overbought territory on the daily chart. However, it’s important to note that there are no signs of exhaustion in the current trend. This suggests that the bullish momentum may have room to run, although prudent risk management remains crucial.

Key Resistance Levels and Potential Correction Points

On the 4-hour chart, we can see that the price of the EUR/USD pair is seeking the next resistance level, disregarding the overbought readings on the RSI. The next significant resistance levels to watch are at 1.0900 and 1.0930. These levels may serve as key milestones in the EUR/USD’s ascent.

It’s worth noting that, in the context of the current bullish cycle, a correction to 1.0850 could occur without jeopardizing the overall upward bias. However, it’s crucial for traders and investors to remain vigilant and monitor key support levels to assess the sustainability of the positive outlook.

Conclusion: A Positive Outlook for EUR/USD

In conclusion, the EUR/USD forecast presents a positive outlook for the Euro against the US Dollar. The recent surge in the currency pair, driven by the Dollar selloff following US inflation data, has captured the attention of market participants. While economic divergence between the US and Eurozone has been a factor in the Dollar’s strength, the recent US inflation data has shifted market expectations regarding the Federal Reserve’s interest rate policies.

Looking forward, the EUR/USD exchange rate will continue to be influenced by economic data releases and central bank actions. Market participants will closely monitor indicators like the Producer Price Index and Retail Sales reports to gauge the Dollar’s vulnerability and potential shifts in market sentiment.

From a technical analysis perspective, the bullish momentum in the EUR/USD pair is evident, with key resistance levels to watch. Traders and investors should remain alert and adapt their strategies to changing market conditions while keeping a keen eye on support and resistance levels.

In this dynamic environment, the EUR/USD forecast remains a critical topic for traders, investors, and anyone interested in the global financial markets. Stay informed and stay ahead of the curve as we continue to monitor the exciting developments in this currency pair.

Click here to read our latest article on Harnessing Behavioral Economics in Forex Trading