Introduction to Crude Oil Trading

Crude oil trading strategies are pivotal in navigating the volatile yet lucrative commodity market. In this comprehensive guide, we delve into proven tips and strategies that revolutionize success for traders seeking remarkable wins in crude oil markets. Understanding the complexities of supply and demand dynamics and mastering the ever-evolving oil market dynamics is crucial for a successful trading journey.

Fundamentals of Crude Oil Trading

Crude oil, often considered the lifeblood of the global economy, operates within the intricate web of supply and demand dynamics. Understanding these fundamental pillars is essential for any trader aiming for success in the crude oil market.

Supply and Demand Dynamics

The crude oil market operates within the intricate interplay of supply and demand dynamics, significantly influenced by multifaceted factors that orchestrate the global oil landscape.

Factors Influencing Global Supply:

- Geopolitical Tensions: Geopolitical unrest, conflicts, or diplomatic standoffs in major oil-producing regions have historically proven to disrupt the steady flow of crude oil. Instances such as geopolitical tensions in the Middle East or diplomatic negotiations impacting oil trade agreements can prompt supply disruptions.

- Natural Disasters and Infrastructural Challenges: Natural calamities like hurricanes, earthquakes, or wildfires can ravage crucial oil-producing infrastructures, leading to production halts or delays in extraction and transportation, thereby affecting the overall supply chain.

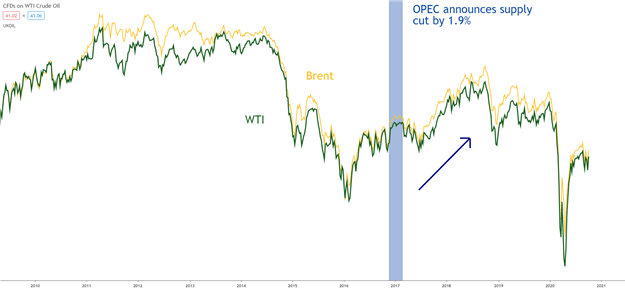

- Decisions by Oil-Producing Nations and Organizations: The strategic decisions made by major oil-producing countries or entities like OPEC wield substantial influence over global oil supply. Production quotas, output adjustments, or decisions related to market stabilization often alter the volume of crude oil available for trade on the global market.

Source:dfx

Impact on Supply Chain:

Disruptions in pivotal refineries stand as critical inflection points within the crude oil supply chain, wielding substantial influence on the market’s stability and trader sentiments. Instances of maintenance issues or unanticipated breakdowns in these key refining facilities can instigate ripples across the global oil landscape. These interruptions, irrespective of whether they occur locally or internationally, possess the potential to swiftly trigger tumultuous price fluctuations and acute shortages in the supply of crude oil.

The aftermath reverberates through trading strategies, compelling swift recalibrations to navigate the altered market conditions. Moreover, such disruptions imprint a palpable impact on market sentiments, sparking uncertainties and volatility as traders grapple with the sudden shifts in supply, thus necessitating agile adaptations in trading approaches and risk management strategies to mitigate potential losses amidst the turbulent market dynamics.

Fluctuations in Demand Dynamics:

- Economic Indicators and Industrial Activity: Economic growth or recessionary periods within major global economies dictate the demand for crude oil. During economic upswings, heightened industrial activities and increased consumer spending propel the demand for oil-based products, augmenting the overall demand for crude oil.

- Seasonal Variations and Weather Patterns: Seasonal shifts, especially in colder or warmer climates, influence energy consumption patterns. Winter months typically witness an upsurge in demand for heating oil, while summers witness higher consumption of gasoline due to increased travel and transportation activities.

- Industrial Output and Technological Advances: Industrial expansions, innovations, or technological shifts in energy sources also impact crude oil demand. The adoption of alternative energy sources or advancements in renewable energy technologies can alter the consumption patterns of fossil fuels like crude oil.

Source:dfx

Impact on Global Demand:

Transformations in industrial outputs wield a direct influence over the global demand for crude oil, particularly within sectors deeply entrenched in oil-derived products. Variations in industrial activities and shifts in manufacturing, transportation, and energy-intensive sectors significantly dictate the demand curve for crude oil. Moreover, the evolving global landscape, characterized by concerted efforts toward sustainable practices and the embrace of cleaner energy sources, plays a pivotal role in reshaping the long-term trajectory of crude oil demand.

Endeavors aimed at reducing carbon footprints and fostering environmental sustainability, coupled with the escalating adoption of renewable energy alternatives, serve as catalysts driving substantial alterations in the traditional consumption patterns of crude oil. These global initiatives, steering industries and economies towards eco-friendly practices, perpetuate a paradigm shift in the long-range prospects for crude oil demand, underlining the imperative for diversified energy strategies and adaptive market approaches in the ever-evolving oil trade.

Oil Market Dynamics within Commodity Markets

The oil market operates as a cornerstone within the intricate tapestry of commodity markets, encapsulating a myriad of complexities and distinctive traits. Commodity markets, encompassing a diverse spectrum of assets, are marked by their inherent volatility, subject to the ebbs and flows of global demand, geopolitical events, and macroeconomic factors. Within this expansive realm, energy commodities, particularly crude oil, emerge as linchpins, exerting substantial influence and occupying a pivotal position. The significance of crude oil within these markets extends beyond its inherent value as a vital energy source; it encapsulates a spectrum of industrial, geopolitical, and economic significance.

The dynamics governing the oil market within the broader commodity landscape are multifaceted. The global demand for energy, deeply entwined with economic growth trajectories, geopolitical shifts, and evolving consumer behaviors, profoundly influences the oil market’s ebbs and flows. Geopolitical tensions, conflicts, and diplomatic negotiations in major oil-producing regions intricately interlace with the supply chain dynamics, amplifying market uncertainties and impacting global oil prices. Additionally, macroeconomic factors such as interest rates, inflation, and currency valuations intertwine with the oil market, shaping investor sentiment and influencing trading patterns.

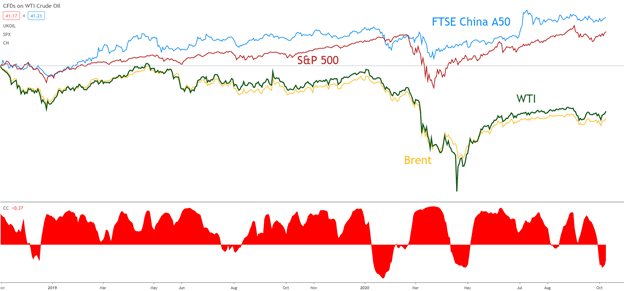

Moreover, the interconnectedness between various commodities within these markets creates intricate relationships and interdependencies. Crude oil’s association with other commodities, such as gold, metals, and agricultural products, highlights the interwoven nature of commodity markets. Price fluctuations in one commodity often reverberate across related markets, propagating waves of impact that transcend individual asset classes.

Navigating the complexities of the oil market within commodity markets requires astute insights, adaptive strategies, and a comprehensive understanding of the multifaceted influences at play. Traders and investors in these markets must remain vigilant, equipped with the ability to swiftly adapt to changing geopolitical landscapes, evolving consumer behaviors, and macroeconomic shifts that shape the intricate tapestry of commodity markets, with crude oil at its core.

Effective Crude Oil Trading Strategies

Effective strategies for navigating the volatile landscape of crude oil trading demand a sophisticated amalgamation of meticulous analysis, robust risk management, and a profound comprehension of market intricacies. Successful traders in this domain adopt a multifaceted approach, harnessing a synergy between fundamental and technical analyses to decipher market movements and derive actionable insights.

Astute Analysis and Comprehensive Understanding

Crafting winning strategies in crude oil trading necessitates an acute understanding of global economic indicators, geopolitical developments, and the undercurrents of supply and demand dynamics. Astute analysis involves scrutinizing intricate facets like geopolitical tensions in oil-producing regions, pivotal economic reports, and geopolitical events that may disrupt the supply chain. Moreover, a nuanced comprehension of the oil market’s sensitivity to global economic growth, industrial activities, and geopolitical shifts empowers traders to anticipate market movements effectively.

Integration of Fundamental and Technical Analyses

Employing a combination of fundamental analysis, delving into macroeconomic factors and geopolitical events influencing oil prices, and technical analysis, which involves scrutinizing price charts and employing indicators, provides traders with a multifaceted perspective. Fundamental analysis unveils the underlying drivers impacting supply and demand, while technical analysis identifies patterns and trends within price movements. This amalgamation fortifies traders with a comprehensive understanding of market dynamics, offering nuanced insights into entry and exit points, fostering informed decision-making.

Holistic Perspective and Risk Management

Fundamental and technical analyses serve as complementary tools, offering a holistic view of the market’s behavior. While fundamental analysis gauges the intrinsic value of crude oil based on supply-demand dynamics, geopolitical events, and economic indicators, technical analysis refines this understanding by deciphering market sentiment and price patterns. This holistic perspective equips traders with a nuanced understanding, enabling prudent risk management strategies like setting stop-loss orders, determining position sizes, and adhering to risk-reward ratios. It enables traders to navigate market uncertainties and potential volatilities with greater confidence and resilience.

In essence, effective strategies for crude oil trading transcend mere speculation; they are rooted in meticulous analysis, risk management, and the synergy between fundamental and technical approaches. Traders equipped with a deep understanding of market dynamics and a comprehensive analytical toolkit are poised to navigate the volatile landscape of crude oil trading with greater precision and resilience.

Advanced Tips and Techniques for Crude Oil Trading

Enhancing expertise in crude oil trading demands the adoption of advanced strategies and techniques that confer a competitive advantage within this dynamic market.

- Continuous Learning and Adaptation: Staying at the forefront of crude oil trading requires an unceasing commitment to learning and adaptation. The intricacies of this market demand a continuous pursuit of knowledge, including in-depth comprehension of geopolitical shifts, emerging economic trends, and global supply-demand dynamics. Traders who engage in perpetual learning adapt swiftly to evolving market conditions, positioning themselves to seize opportunities and navigate uncertainties proactively.

- Algorithmic and Quantitative Trading: Sophisticated traders leverage cutting-edge techniques like algorithmic and quantitative trading to harness data-driven insights and automate their strategies. Algorithms empower traders to execute trades based on predefined criteria, enabling rapid decision-making and precise market timing. Quantitative approaches, utilizing mathematical models and statistical analyses, allow for the identification of potential patterns and anomalies in market behavior, enhancing the precision of trading strategies.

- Sentiment Analysis and Artificial Intelligence: The integration of sentiment analysis and artificial intelligence (AI) technologies revolutionizes crude oil trading. Sentiment analysis, scrutinizing market sentiments, social media trends, and news sentiments, offers critical insights into prevailing market biases and potential price movements. AI-driven algorithms, capable of processing vast datasets and detecting intricate patterns, empower traders with predictive insights and informed decision-making capabilities, elevating the precision and agility of trading strategies.

- High-Frequency Trading (HFT) and Market Access: High-frequency trading techniques, driven by powerful algorithms and lightning-fast execution speeds, enable traders to capitalize on fleeting market inefficiencies. Acquiring direct market access (DMA) facilitates rapid trade executions, circumventing intermediaries, and providing traders with the agility to swiftly respond to market fluctuations, gaining a competitive edge in executing trades.

- Risk Management and Diversification: Advanced risk management strategies and portfolio diversification play a pivotal role in mitigating risks associated with crude oil trading. Implementing dynamic risk mitigation techniques, such as adaptive stop-loss orders and precise position sizing, bolsters resilience against potential losses. Diversifying portfolios across multiple asset classes, beyond just crude oil, helps cushion against market volatilities and unforeseen disruptions, ensuring a more robust risk management approach.

Key Reports and Indicators for Oil Traders

For traders immersed in crude oil markets, staying abreast of essential reports and indicators holds pivotal importance in enabling informed decision-making and capitalizing on market movements.

- Weekly Inventory Updates: Regular updates on crude oil inventories stand as vital indicators of market dynamics within the oil trading landscape. These weekly reports provide crucial insights into the current stockpile of crude oil held in reserve. Fluctuations in inventory levels often signal shifts in supply and demand dynamics, influencing market sentiments and triggering price movements. A notable increase in inventories might indicate an oversupply, potentially exerting downward pressure on prices. Conversely, a decrease might imply robust demand or supply constraints, potentially leading to price hikes.

- American Petroleum Institute (API) and Department of Energy (DoE/EIA) Reports: Both the API and DoE/EIA reports serve as comprehensive repositories of data crucial for understanding the intricate facets of the oil market. These reports offer detailed insights into various aspects, including oil supply, refinery production, inventory levels, and crucial statistical analyses. The API report, released on a weekly basis, furnishes extensive information encompassing petroleum products that constitute a significant portion of refinery production. Similarly, the DoE/EIA report, announced weekly as well, offers comprehensive data on crude oil supplies, inventory levels, and refined product production. Traders heavily rely on these reports to gauge supply-demand imbalances, anticipate market movements, and formulate their trading strategies.

Leveraging Social Media and Emerging Trends

In today’s digital age, social media platforms serve as valuable sources of real-time information and insights for traders navigating the crude oil market.

#OOTT on Twitter: A Hub for Oil Traders

The hashtag #OOTT, signifying the Organization of Oil Traders, has evolved into a pivotal platform on Twitter, fostering a vibrant community where traders and industry leaders congregate to exchange invaluable information, share critical updates, and engage in discussions pertinent to the oil market.

The #OOTT hashtag serves as a dynamic conduit, bringing together a diverse spectrum of oil traders, analysts, industry experts, and market enthusiasts. It acts as a virtual forum, facilitating real-time interactions and enabling the dissemination of timely insights regarding oil market trends, geopolitical developments, and impactful news events. This platform fosters a collaborative environment where participants share firsthand experiences, analyses, and forecasts, enriching the collective knowledge base of the oil trading community.

Traders leveraging #OOTT gain access to a trove of real-time information, breaking news, and key reports that significantly influence oil market sentiments and price movements. Moreover, the hashtag’s prominence extends beyond a mere information-sharing platform; it serves as a catalyst for thought-provoking discussions, enabling participants to dissect market intricacies, deliberate on emerging trends, and offer diverse perspectives on trading strategies and risk management.

The interactive nature of #OOTT on Twitter transcends geographical boundaries, providing a global platform for traders to stay updated, collaborate, and capitalize on shared insights. Traders tapping into this resourceful hub harness a wealth of knowledge, enabling them to make more informed decisions, adapt swiftly to market shifts, and navigate the complexities of the oil market with greater acumen and agility.

In essence, the #OOTT hashtag on Twitter stands as a bustling nexus, fostering a vibrant community where oil traders and industry leaders converge, exchange invaluable insights, and collectively contribute to a deeper understanding of the ever-evolving dynamics within the oil trading landscape.

The #OOTT hashtag on Twitter acts as a conduit for information exchange, collaboration, and knowledge-sharing among oil traders and industry experts, fostering a robust community centered around the nuances of the oil market.

Absolutely, let’s delve further into the significance of utilizing social platforms like LinkedIn, forums, and specialized groups as pivotal resources for gaining insights and fostering community-driven approaches in crude oil trading:

Harnessing Social Platforms for Market Insights

In the realm of crude oil trading, the utilization of social platforms such as LinkedIn, specialized forums, and industry-specific groups has emerged as a transformative avenue for acquiring diverse perspectives, fostering insightful discussions, and cultivating a community-driven approach to trading.

LinkedIn: Networking and Insights

LinkedIn, a prominent professional networking platform, serves as an invaluable resource for traders seeking to expand their network and glean insights from industry experts. The platform offers a multifaceted environment where traders, analysts, and industry professionals engage in discussions, share articles, and offer insights on the latest trends shaping the crude oil market. By leveraging LinkedIn, traders gain access to a vast repository of industry-specific content, including articles, posts, and discussions that provide nuanced insights into market dynamics, geopolitical influences, and emerging trends.

Forums and Specialized Groups: Collaborative Communities

Specialized forums and dedicated groups centered around crude oil trading act as collaborative communities, uniting traders with varied backgrounds and expertise. These platforms facilitate vibrant discussions, enabling participants to share experiences, analyses, and trading strategies. Whether it’s commodity trading forums, energy-focused groups, or dedicated platforms for oil market enthusiasts, these spaces foster an exchange of diverse perspectives, cutting-edge insights, and in-depth analyses. Participants engage in discussions on market trends, macroeconomic factors impacting oil prices, geopolitical shifts, and effective trading methodologies, thereby enriching their understanding of the complex interplay of factors influencing the oil market.

Community-Driven Approach to Trading: Collective Wisdom

The utilization of social platforms in crude oil trading promotes a community-driven approach, wherein traders collaboratively contribute to a pool of collective wisdom. This amalgamation of diverse viewpoints, experiences, and analytical approaches empowers traders to refine their strategies, gain new perspectives, and adapt to market changes more effectively. The interactive nature of these platforms cultivates an environment where shared knowledge, experiential insights, and collaborative problem-solving elevate the collective expertise of traders.

In essence, harnessing social platforms like LinkedIn, forums, and specialized groups transcends mere networking; it fosters a collaborative ecosystem where traders converge to share insights, engage in discussions, and collectively contribute to a more informed, agile, and community-driven approach to navigating the intricacies of crude oil trading.

Conclusion

Navigating the complex landscape of crude oil trading demands a blend of astute strategies, in-depth analysis, and adaptability to emerging trends. The strategies outlined in this comprehensive guide aim to empower traders with the tools and knowledge necessary for success in the volatile crude oil market.

By understanding the fundamental dynamics of supply and demand, mastering technical and fundamental analyses, and leveraging advanced strategies like futures curve analysis and options utilization, traders can fortify their positions in this ever-evolving market. Staying updated with key reports, indicators, and leveraging the power of social media platforms ensures that traders are equipped with timely information, allowing them to make informed decisions and capitalize on market movements.

In the dynamic world of crude oil trading, continuous learning, adaptation to market shifts, and prudent risk management are the cornerstones of sustained success.

Click here to read our latest article on the Gold Price Forecast

FAQs

- How do supply and demand dynamics affect crude oil trading? Supply and demand dynamics play a pivotal role in crude oil trading. Supply disruptions due to geopolitical tensions or refinery outages impact supply levels, affecting prices. Conversely, shifts in global economic growth, seasonal variations, and industrial output directly influence demand for crude oil, thus impacting its trading value. Traders closely monitor these dynamics to anticipate market movements.

- What role do reports like the API and DoE/EIA play in oil trading? Reports from the American Petroleum Institute (API) and Department of Energy (DoE/EIA) are crucial for oil traders. They provide comprehensive data on oil supplies, refinery production, and inventory levels. Traders analyze these reports to gauge supply-demand imbalances, anticipate market movements, and formulate effective trading strategies.

- How can social media platforms like Twitter aid crude oil traders? Platforms like Twitter, especially using hashtags like #OOTT (Organization of Oil Traders), offer real-time updates, breaking news, and key reports related to the oil market. Traders leverage these platforms to stay informed about market trends, geopolitical developments, and crucial news events, influencing their trading decisions.

- What significance do continuous learning and adaptation hold in crude oil trading? Continuous learning is vital in crude oil trading. Staying updated with geopolitical shifts, economic trends, and supply-demand dynamics allows traders to adapt swiftly to market changes, seizing opportunities and navigating uncertainties effectively.

- How do high-frequency trading (HFT) and market access impact crude oil trading? High-frequency trading, powered by algorithms, enables rapid trade executions, helping traders capitalize on market inefficiencies. Direct market access (DMA) facilitates quicker trade executions, providing traders agility to respond promptly to market fluctuations, gaining a competitive edge in execution.

- What role does sentiment analysis and AI play in oil trading? Sentiment analysis helps gauge market sentiments, social media trends, and news sentiment, providing critical insights into market biases and potential price movements. AI-driven algorithms aid in processing vast datasets, offering predictive insights and informed decision-making capabilities.

- How do forums and specialized groups benefit crude oil traders? Forums and specialized groups create collaborative communities where traders exchange experiences, analyses, and trading strategies. These platforms foster a diverse range of perspectives, enriching traders’ understanding of market intricacies and aiding in refining strategies.

- Why are weekly inventory updates essential for crude oil traders? Weekly inventory updates offer crucial insights into the current stockpile of crude oil, signaling shifts in supply and demand dynamics. Traders analyze these updates to anticipate market movements and make informed trading decisions.

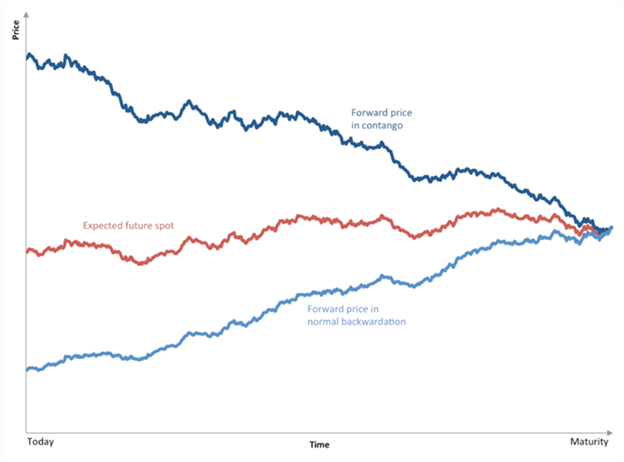

- How does the futures curve analysis impact trading strategies? Understanding the futures curve, distinguishing between contango and backwardation, helps predict future demand and market sentiment. Traders leverage this analysis to adjust their strategies according to prevailing market structures.

- What is the significance of risk management in crude oil trading? Robust risk management techniques, such as adaptive stop-loss orders and portfolio diversification, mitigate potential losses and safeguard against market volatilities, ensuring a more resilient trading approach.

Click here to learn more about Crude Oil Trading